OPEC+ agreed to an unprecedented production cut of 9.7 million barrels per day or roughly 10% of capacity, ending a multi-week price war between the consortium and Russia. The US intervened to smooth out differences between Saudi Arabia and Mexico, but the deal failed to elevate markets. It may be too little too late, with the attention shifting back to the global recession, and the Covid-19 pandemic. OPEC has long lost control of prices, especially with the emergence of oil shale producers in the US. Speculation was high that the oil war was intended to harm the emerging US sector, but failed to materialize. While WTI crude oil initially rallied, price action quickly reversed into its support zone.

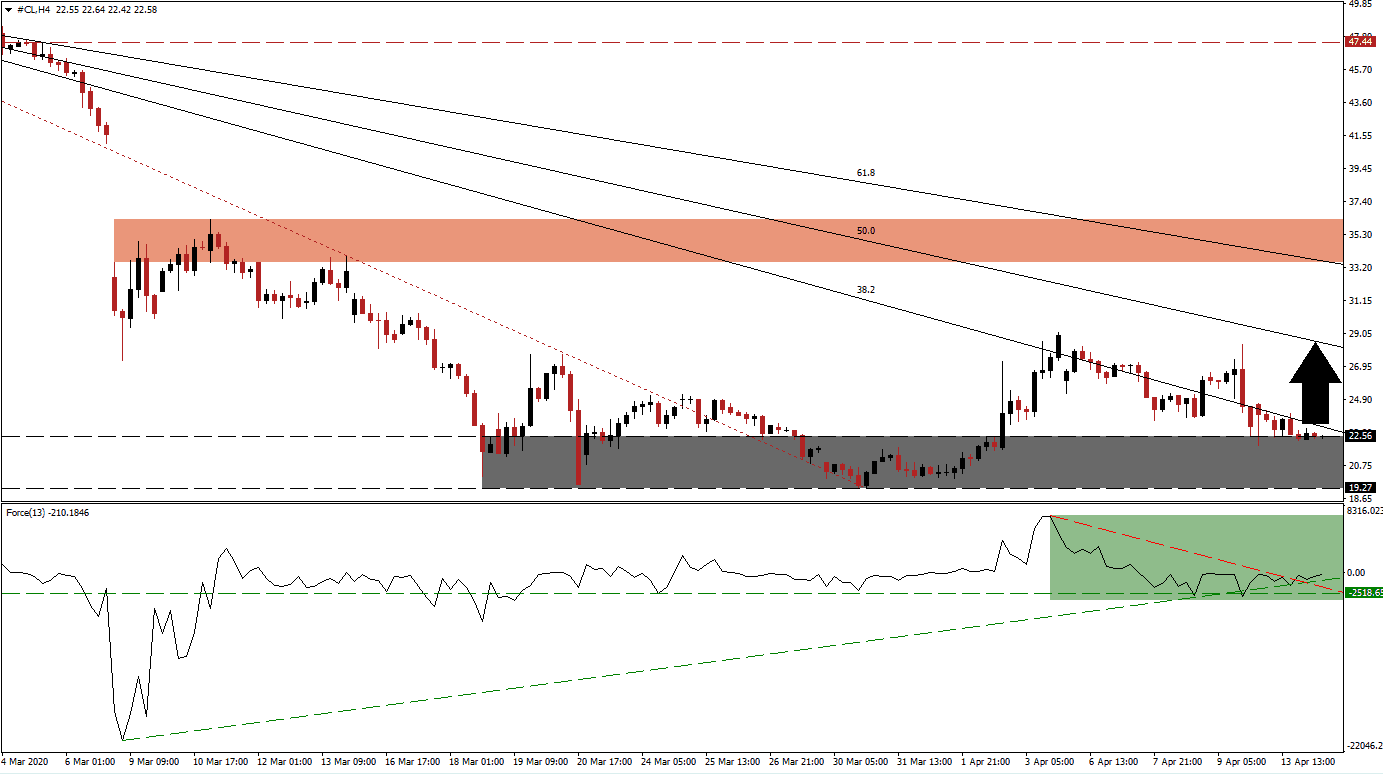

The Force Index, a next-generation technical indicator, points towards a build-up in bullish momentum after reversing off of its horizontal support level. Its ascending support level is adding to upside pressure, which expanded following the breakout in the Force Index above its descending resistance level, as marked by the green rectangle. This technical indicator is favored to cross above the 0 center-line, ceding control of WTI crude oil to bulls.

Price action was unable to sustain a push higher, but given the depressed levels in WTI crude oil, another attempt at recovery is anticipated. With the bearish global economic outlook, uncertainty over the length of the recession, and mispriced long-term economic impacts due to Covid-19, this commodity is expected to establish a trading range. Any breakdown below the support zone located between 19.27 and 22.56, as identified by the grey rectangle, is unsustainable. Significant upside potential is equally absent.

This commodity is ripe for a short-covering rally, but the descending 61.8 Fibonacci Retracement Fan Resistance Level is limiting the magnitude of any advance. It just crossed below the short-term resistance zone located between 33.55 and 36.28, as marked by the red rectangle, which will be lowered as the trading range is confirmed. The 50.0 Fibonacci Retracement Fan Resistance Level may suffice to end any reversal in WTI crude oil. It is positioned where the next downward adjustment to the resistance zone is located.

WTI Crude Oil Technical Trading Set-Up - Short-Covering Scenario

- Long Entry @ 22.55

- Take Profit @ 29.00

- Stop Loss @ 20.85

- Upside Potential: 645 pips

- Downside Risk: 170 pips

- Risk/Reward Ratio: 3.79

Should the Force Index correct below its descending resistance level, acting as temporary support, WTI crude oil may attempt a breakdown below its support zone. Prices at current levels are likely to force smaller US shale producers out of business, taking supply off the market. It provides a minor fundamental boost to this commodity, countering the negative impacts of the recession. Traders are advised to view any sell-off as a temporary event and sound buying opportunity.

WTI Crude Oil Technical Trading Set-Up - Limited Breakdown Scenario

- Short Entry @ 19.35

- Take Profit @ 15.60

- Stop Loss @ 20.85

- Downside Potential: 375 pips

- Upside Risk: 150 pips

- Risk/Reward Ratio: 2.50