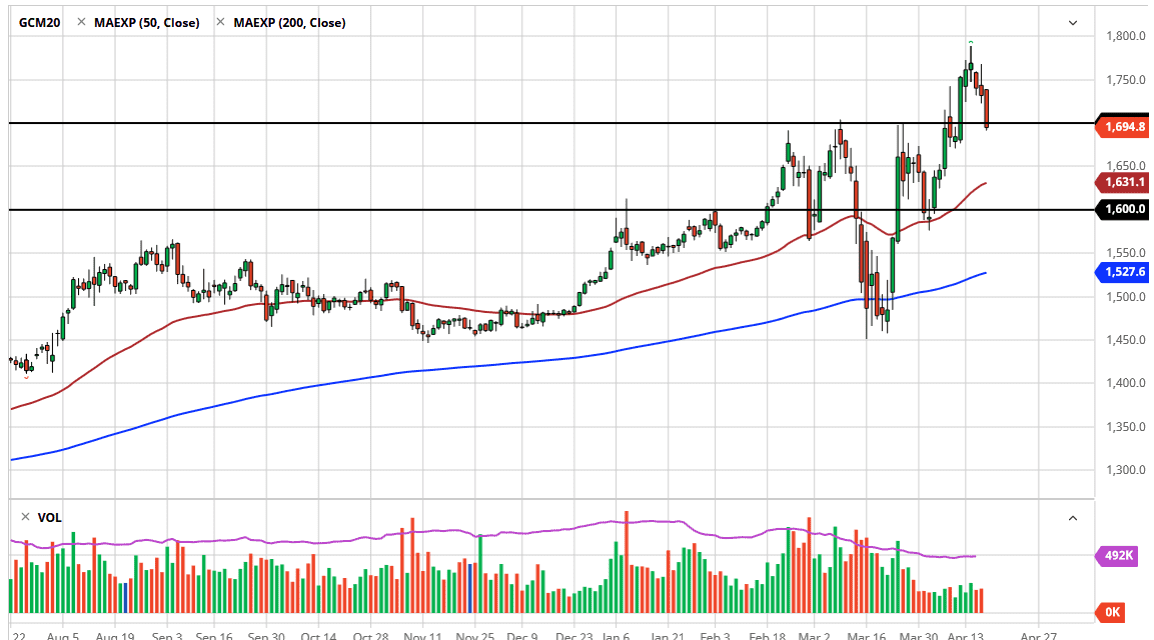

Gold markets have fallen significantly during the trading session on Friday, reaching down below the $1700 level. That being said, I see a significant amount of support down to at least the $1675 region, so I think that we are going to see a certain amount of buying pressure in this area, so if we get any type of negative news over the weekend, I imagine gold will open to the upside. I am bullish regardless, so even if we continue to slip from here, I think then you have to look at gold is being “on sale.”

I like the idea of finding value, because gold has been in such a strong uptrend. All things being equal, it’s very likely that we test the highs again, now that we have seen so much in the way of economic damage. Part of the issues that we have seen with the gold market as of late is that there has been an actual shortage when it comes to gold supply. After all, those who work to make gold bars are all sitting at home as well. Nonetheless, the futures market still continues to show signs of trouble, and therefore I think that the gold market will eventually get a bit of a bid.

A breakdown to the downside has the $1650 level offered support, and by the time we get down there it’s possible that the 50 day EMA catches up as well. That is a technical signal that a lot of traders pay attention to, so I think that it’s possible that we may get a bounce from that area. Further down from there, the $1600 level could offer a significant amount of support as well, so I would like to buy their as well. I just don’t have a scenario right now that suggests to me that we should be shorting gold. Sure, we can be down another $20 on Monday, but do you really want to fight this type of trend when clearly a lot of traders out there are looking for safety? Granted, there are things that could change my entire outlook on gold, but right now I think we are light years away from gold pulling back for anything more than the usual giveback on an uptrend. The rate of change and declines of the economy has been brutal, and gold of course is one of the best ways to edge that.