US President Trump notes the economy will remain in lockdown until healthcare officials deem it safe to resume activities under a new set of protective measures. It is a step back from his initial push to force the economy to resume operations. Furthermore, he mentioned the potential of a second direct payment to citizens before the majority received their first one. It highlights the severity of disruptions and what may yet to materialize. While the majority hopes for a quick recovery, developing fundamental conditions suggest a lengthy rehabilitation process. The USD/ZAR established a new short-term resistance zone from where a further breakdown sequence is pending.

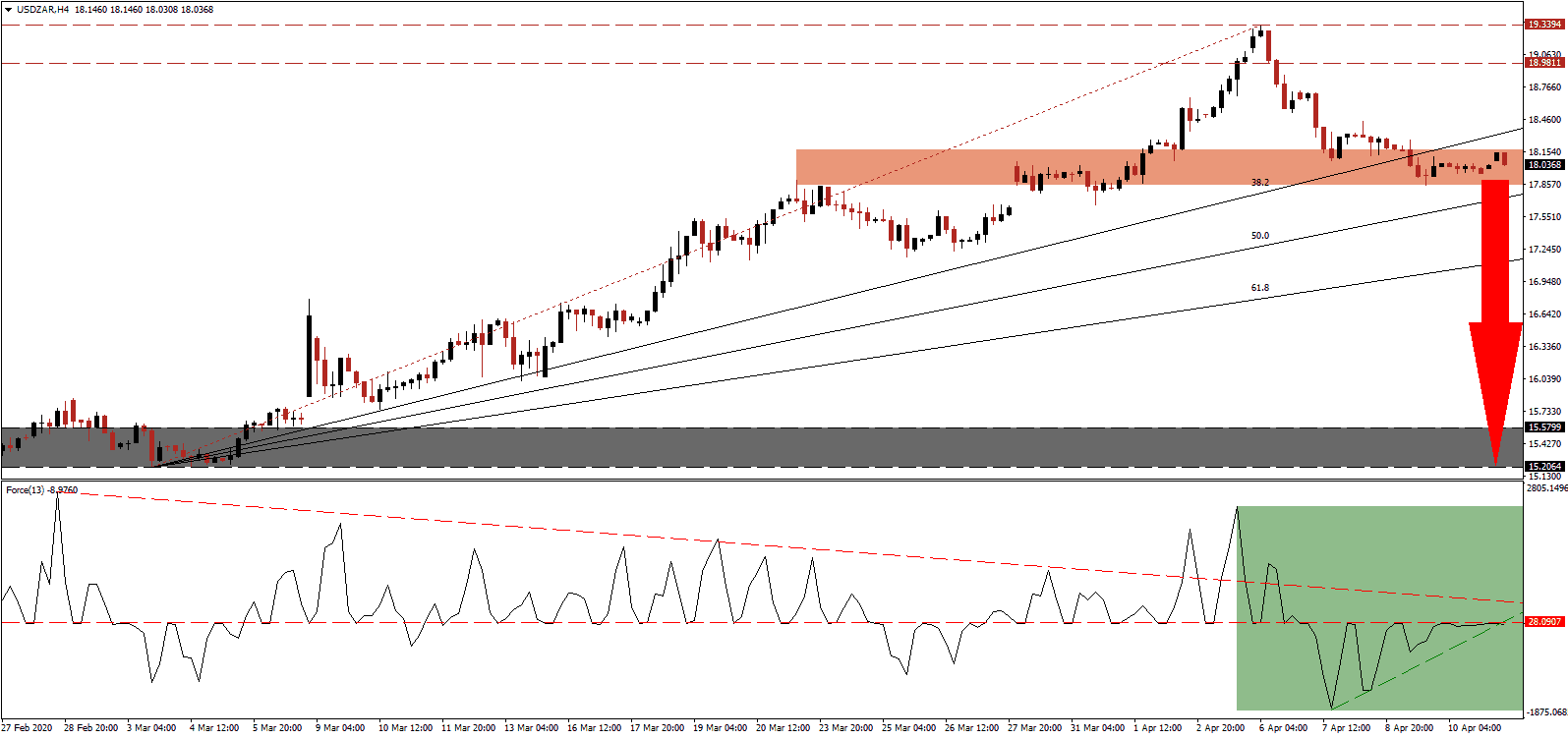

The Force Index, a next-generation technical indicator, retreated from a higher high to a lower low before recovering. It remains below its horizontal resistance level, and additional downside pressure is provided by its descending resistance level. The Force Index is also pushing below its ascending support level, as marked by the green rectangle, increasing breakdown pressures on price action. Bears remain in control of the USD/ZAR with this technical indicator below the 0 center-line.

While selling pressure eased following the initial breakdown, a short-term resistance zone formed. This zone is located between 17.8452 and 18.1779, as marked by the red rectangle. The ascending 38.2 Fibonacci Retracement Fan Resistance Level crossed above it, and the 50.0 Fibonacci Retracement Fan Support Level is closing in on the bottom range of it. South Africa is in a unique position, forced by the global Covid-19 pandemic, to implement a substantial tax overhaul and labor market reforms, allowing the economy to enter a sustained path to recovery. It will result in a strengthening of long-term fundamentals in the USD/ZAR, granting this currency pair a bearish bias.

A breakdown below the 50.0 Fibonacci Retracement Fan Support Level is anticipated to rekindle selling pressure in the USD/ZAR. Downside momentum is expected to convert the 61.8 Fibonacci Retracement Fan Support Level into resistance, clearing the path for a more massive correction. The next support zone is located between 15.2064 and 15.5799, as identified by the grey rectangle. US economic data disappointments may provide the next catalyst. You can learn more about a breakdown here.

USD/ZAR Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 18.0350

Take Profit @ 15.5350

Stop Loss @ 18.5350

Downside Potential: 25,000 pips

Upside Risk: 5,000 pips

Risk/Reward Ratio: 5.00

In the event the Force Index elevates above its descending resistance level, the USD/ZAR is likely to revisit its long-term resistance zone. This zone is located between 18.9811 and 19.3394, the origin of the original breakdown in this currency pair. A sustained advance remains unlikely, given the deterioration of US economic fundamentals, a staggering debt-to-GDP ratio above 100%, and the potential of more monetary easing by the US Federal Reserve.

USD/ZAR Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 18.7000

Take Profit @ 19.2500

Stop Loss @ 18.5000

Upside Potential: 5,500 pips

Downside Risk: 2,000 pips

Risk/Reward Ratio: 2.75