South African cabinet ministers resumed their meeting to craft a way forward once the Covid-19 related lockdown is lifted. The government invited experts across the country to propose an economic recovery plan. Immediate steps are favored to include reappropriation of funds in the 2020 budget, but this serves as a short-term solution. A widening of the budget deficit cannot be avoided in Africa’s second-largest economy as measured by GDP. Cautious optimism remains that necessary long-term adjustments to the labor code and tax reforms will be implemented. The USD/ZAR lost bullish momentum as it drifted into the bottom range of its resistance zone, and breakdown pressures are accumulating.

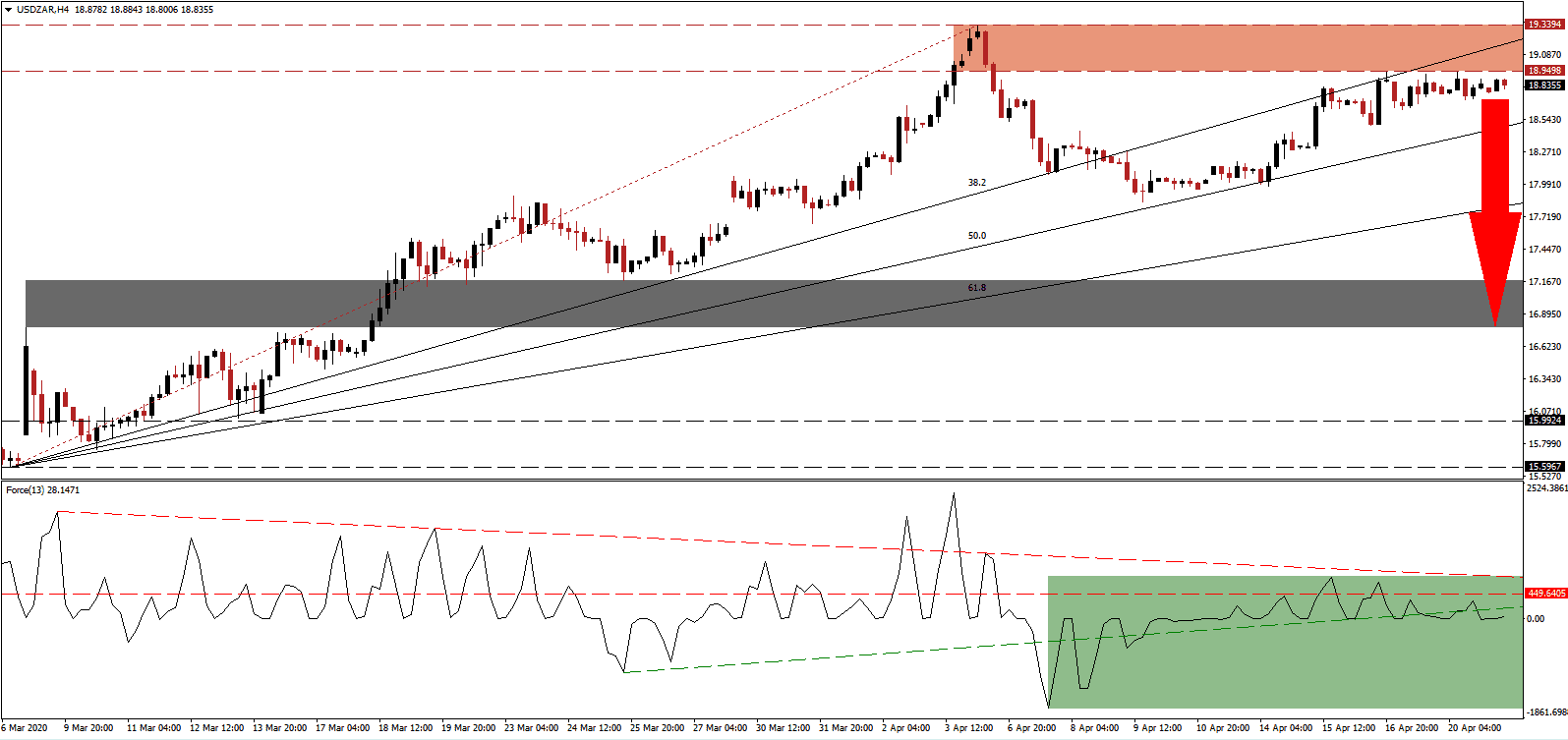

The Force Index, a next-generation technical indicator, maintains its position below the horizontal resistance level with the descending resistance level adding to bearish momentum. While the Force Index crossed above the 0 center-line, it remains below the ascending support level, as marked by the green rectangle. This technical indicator is favored to accelerate to the downside, testing the April low, on the back of fundamental negative progress out of the US, initiating a corrective phase in the USD/ZAR. You can learn more about the Force Index here.

Where the US is confident in raising debt to fuel the existing disastrous economic model, South Africa will be required to make changes. It will allow the government to identify lasting positive adjustments, placing it in a position to grow more powerful out of the global Covid-19 pandemic. The US administration maintains the concept of a swift recovery, leaving it vulnerable to ongoing negative surprises. After the ascending 38.2 Fibonacci Retracement Fan Resistance Level moved into its resistance zone, the risks of a profit-taking sell-off in the USD/ZAR rose. This zone is located between 18.9498 and 19.3394, as identified by the red rectangle.

Forex traders are recommended to monitor the approaching 50.0 Fibonacci Retracement Fan Support Level. A breakdown is favored to attract the next wave of net sell orders in the USD/ZAR, providing the necessary downside momentum for an accelerated corrective phase. US initial jobless claims are expected to confirm the mounting job losses resulting from the virus, adding to bearish catalysts for the USD/ZAR. The next short-term support zone awaits this currency pair between 15.5967 and 15.9924, as marked by the grey rectangle.

USD/ZAR Technical Trading Set-Up - Profit-Taking Scenario

Short Entry @ 18.8500

Take Profit @ 16.8000

Stop Loss @ 19.3500

Downside Potential: 20,500 pips

Upside Risk: 5,000 pips

Risk/Reward Ratio: 4.10

In the event The Force Index spikes above its descending resistance level, the USD/ZAR could face a temporary price spike. The next resistance zone is located between 20.4061 and 20.6123. An unrealistic stance by the US leadership, in combination with the US Federal Reserve oversupplying the market with its currency, presents a long-term bearish bias to price action. Forex traders are recommended to consider a breakout from current levels as a selling opportunity.

USD/ZAR Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 19.5000

Take Profit @ 20.5000

Stop Loss @ 19.0000

Upside Potential: 10,000 pips

Downside Risk: 5,000 pips

Risk/Reward Ratio: 2.00