South Africa entered the global Covid-19 pandemic with a battered economy troubled by blackouts due to the Eskom disaster. The lockdown, impacting billions of people across the world, is now adding strain to the fragile system. Unlike developed countries where massive debt-funded stimulus packages have been announced, Africa’s second-biggest economy by GDP has a unique opportunity for permanent positive adjustments. They include a substantial tax overhaul and labor market reforms. South Africa can grow out of the crisis if the government implements proper improvements. Volatility is favored to remain elevated, but the USD/ZAR is anticipated to extend its breakdown sequence.

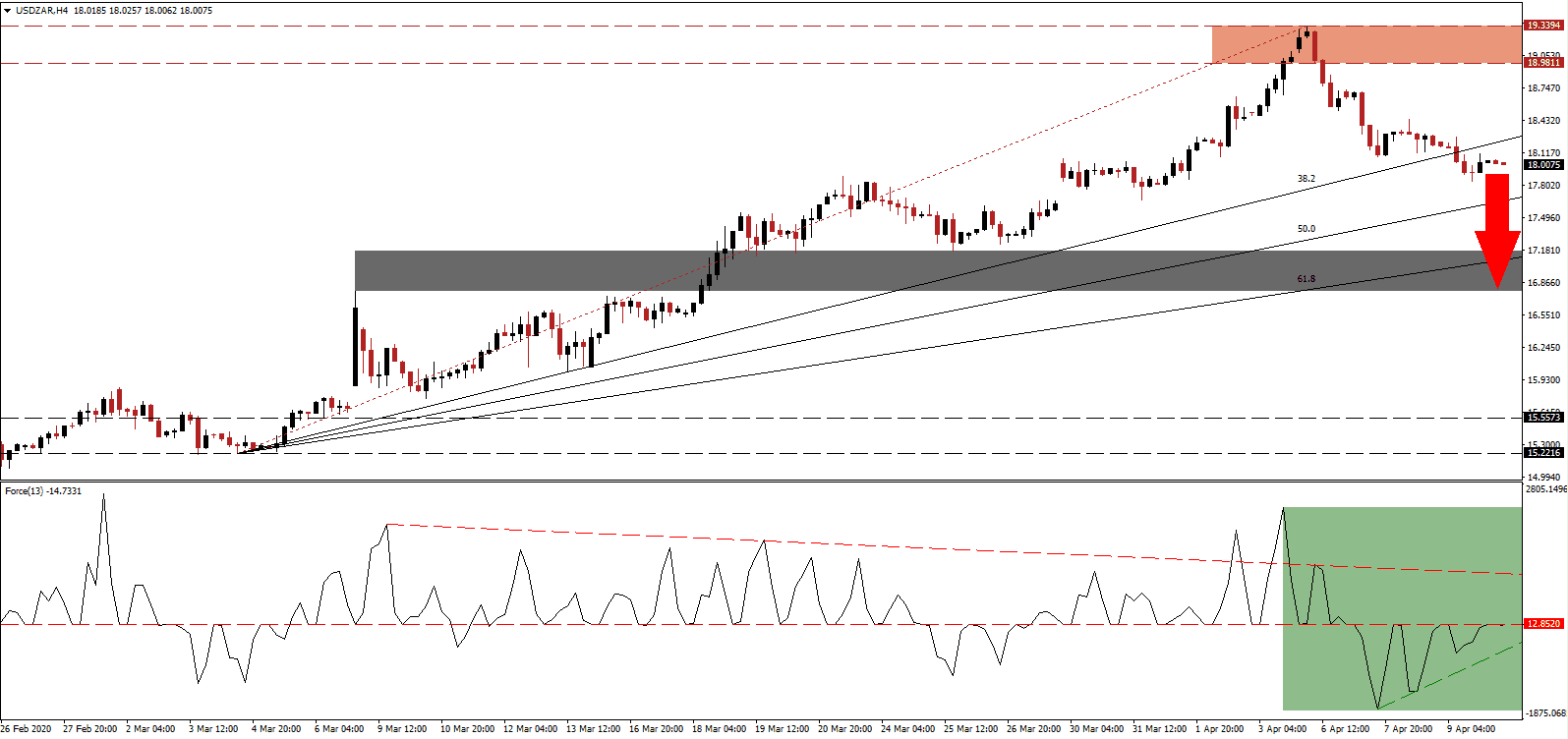

The Force Index, a next-generation technical indicator, collapsed to a new 2020 low before reversing. It was rejected two times by its horizontal resistance level, each instance resulting in a higher low. An ascending support level materialized, and the Force Index has now reached its horizontal resistance for a third time, as marked by the green rectangle. While a short-term breakout may occur, its descending resistance level is expected to keep downside pressures intact. With this technical indicator in negative territory, bears are in control of the USD/ZAR.

Following the rejection in this currency pair by its horizontal resistance level located between 18.9811 and 19.3394, as marked by the red rectangle, the uptrend was violated. Adding to bearish developments was the contraction in the USD/ZAR below its ascending 38.2 Fibonacci Retracement Fan Support Level, converting it into resistance. South Africa’s economy is projected to collapse by 23.5% in the second quarter, but US data is clocking in at record contractions. Besides the labor market, which lost over 10% of its workforce in the past three weeks with more to come, consumer confidence plunged to all-time lows.

A global economic recession will initially harm many countries, but it will also provide a much-needed catalyst to force necessary reforms. In this category, South Africa is in a better position to adjust than the US, driven by an urgent need and absence of choice. The USD/ZAR is on track to correct into its short-term support zone located between 16.7809 and 17.1742, as identified by the grey rectangle. More downside is possible, but a new catalyst is required. You can learn more about a support zone here.

USD/ZAR Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 18.0000

Take Profit @ 16.8000

Stop Loss @ 18.3500

Downside Potential: 12,000 pips

Upside Risk: 3,550 pips

Risk/Reward Ratio: 3.43

Should the Force Index accelerate above its descending resistance level, the USD/ZAR is likely to recovery into its horizontal resistance zone. With US economic losses bigger than priced into markets, any price spike from current levels will offer composed Forex traders a second short-selling opportunity. An extended breakout in this currency pair is questionable unless a meaningful change in prevailing bearish conditions develops.

USD/ZAR Technical Trading Set-Up - Limited Reversal Scenario

Long Entry @ 18.7000

Take Profit @ 19.2500

Stop Loss @ 18.4500

Upside Potential: 5,500 pips

Downside Risk: 2,500 pips

Risk/Reward Ratio: 2.20