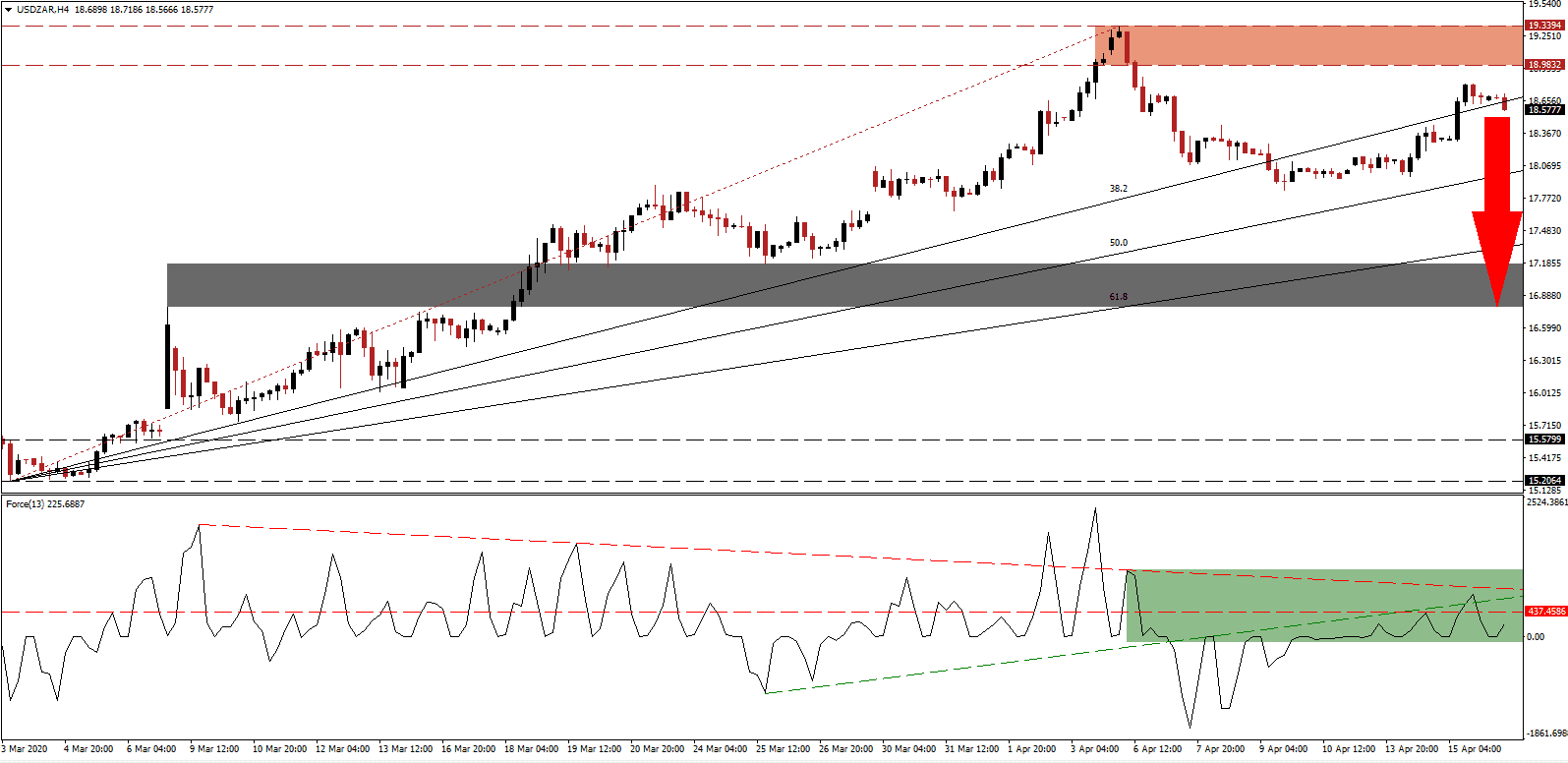

US economic data continues to clock in well below economists predictions, suggesting financial markets are mispriced, driven by hopes for a swift reversal of the deep recession. Many governments were quick to increase debt and roll-out economic aid packages far more massive than during the 2008 global financial crisis. The failure to accept the probability of long-term adjustments to existing economic operating models and the global supply chain, represents the most significant risk moving forward. Bearish pressures on the USD/ZAR rose after this currency pair contracted below its ascending 38.2 Fibonacci Retracement Fan Support Level.

The Force Index, a next-generation technical indicator, recovered from a new 2020 low. It remains in positive territory but below its horizontal resistance level and its ascending support level, as marked by the green rectangle. The descending resistance level is adding to breakdown pressures in the USD/ZAR, favored to force a crossover below the 0 center-line, ceding control of this currency pair to bears. Volatility is expected to increase once the descending resistance level moves below the ascending support level. You can learn more about the Force Index here.

Governments willing to accept the changing dynamics of present fundamentals are in a superior position to adapt and place their struggling economies back on a growth track. Where the US took a lead role in a global debt push to provide a fragile bridge past the peak-pandemic cycle, South Africa is unable to follow this long-term destructive practice. It is, therefore, forced to look at underlying fundamentals, allowing lasting positive changes, like a reduction in the tax code and labor market reforms. The breakdown in the USD/ZAR below its resistance zone located between 18.9832 and 19.3394, as marked by the red rectangle, ended the bullish advance in price action.

With the rise in global debt levels, a financial crisis cannot be ruled out. The current focus remains on daily Covid-19 infections, but once the peak has been confirmed, financial markets will assess the costs of individual responses to the pandemic. While essential issues remain ignored, the ripple effect and the virus itself may persist for longer than presently accepted. South Africa is battling economic issues on multiple fronts, but the US outlook continues its bearish trajectory. The USD/ZAR is anticipated to challenge its short-term support zone located between 16.7809 and 17.1742, as identified by the grey rectangle, from where the emergence of a dominant bearish chart pattern is favored.

USD/ZAR Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 18.6000

Take Profit @ 16.7800

Stop Loss @ 18.8800

Downside Potential: 18,200 pips

Upside Risk: 2,800 pips

Risk/Reward Ratio: 6.50

In case the Force Index spikes above its descending resistance level, the USD/ZAR is likely to test its resistance zone again once again. Given existing fundamental developments, a sustained breakout is not expected to materialize. The size of intensifying US weakness overshadows significant South African problems. Adding to bearish pressures is the likelihood of the US Federal Reserve to extend the supply of US Dollars. Forex traders are advised to cautiously consider a price action reversal as a second selling opportunity.

USD/ZAR Technical Trading Set-Up - Limited Reversal Scenario

Long Entry @ 19.0300

Take Profit @ 19.3300

Stop Loss @ 18.8800

Upside Potential: 3,000 pips

Downside Risk: 1,500 pips

Risk/Reward Ratio: 2.00