Yesterday’s first-quarter GDP data out of the US showed a steeper contraction together with a rise in inflation, representing the most unfavorable combination for the US Federal Reserve to address. It also indicates the recession will be more excessive than initially hoped for, increasing the likelihood it may remain in place longer than financial markets, politicians, and policymakers are willing to recognize. Today’s US initial jobless claims data is likely to display more than 30 million lost jobs over the past two months, nearly 50% more than the total generated since the Great Recession of 2008. The USD/ZAR is positioned to extend its breakdown sequence after the readjustment of its support and resistance zones to reflect weakness in the US Dollar.

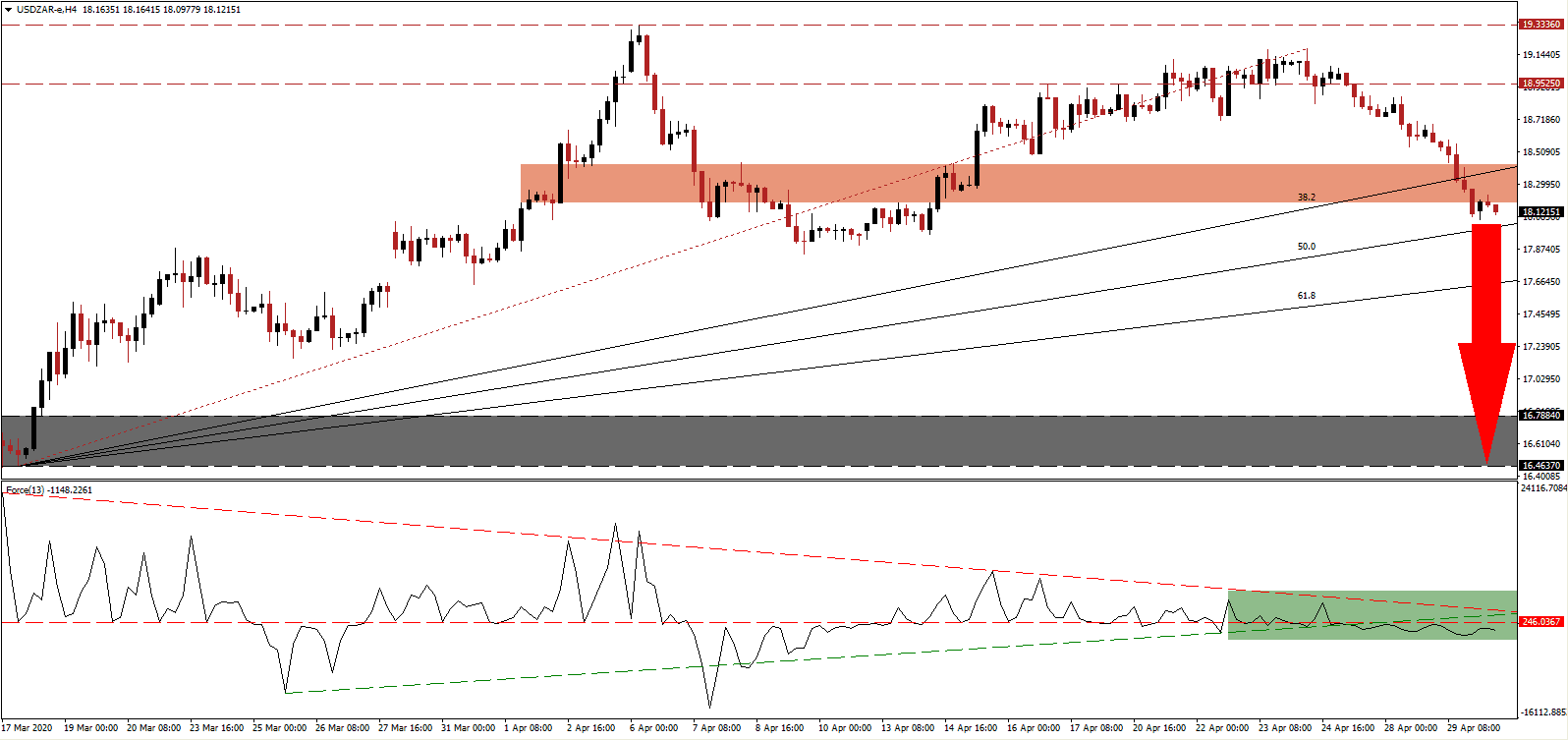

The Force Index, a next-generation technical indicator, shows the dominance of bearish pressures, expanded following the contraction below its ascending support level. Adding to breakdown momentum is the descending resistance level, on track to cross below its horizontal resistance level, as marked by the green rectangle. This technical indicator maintains its position in negative territory, confirming bears are in control of the USD/ZAR. You can learn more about the Force Index here.

Following the breakdown in this currency pair below its long-term resistance zone located between 18.9525 and 19.3336, the USD/ZAR converted its short-term support zone into new resistance, reflecting the expanding weakness in price action. It is positioned between 18.1787 and 18.4283, as marked by the red rectangle. Breakdown pressures are further enhanced by the ascending 38.2 Fibonacci Retracement Fan Resistance Level, which is on the verge of crossing above the top range of this zone.

Where South Africa is willing to address essential issues in its economic model, ranging from tax to labor reforms, the US favors remaining on its preferred approach of debt-funded consumerism. Nearly $3 trillion in stimulus and corporate bailouts were announced in response to the Covid-19 pandemic, including direct cash payments to consumers with more rumored. It adds to an unsustainable mountain of debt and weakening economic outlook. The USD/ZAR is anticipated to accelerate into its adjusted support zone located between 16.4637 and 16.7884, as identified by the grey rectangle.

USD/ZAR Technical Trading Set-Up - Breakdown Extension Scenario

- Short Entry @ 18.1250

- Take Profit @ 16.4650

- Stop Loss @ 18.5600

- Downside Potential: 16,600 pips

- Upside Risk: 4,350 pips

- Risk/Reward Ratio: 3.82

A triple breakout in the Force Index, taking it above its descending resistance level, could pressure the USD/ZAR into its long-term resistance zone. Developing fundamental conditions point towards a critically weaker than price US economy. The misappropriation of stimulus and bailout money adds to growing concerns about primary policy mistakes. Forex traders are recommended to consider any reversal as a selling opportunity.

USD/ZAR Technical Trading Set-Up - Limited Reversal Scenario

- Long Entry @ 18.7200

- Take Profit @ 19.1700

- Stop Loss @ 18.5600

- Upside Potential: 4,500 pips

- Downside Risk: 1,600 pips

- Risk/Reward Ratio: 2.81