South African finance minister Mboweni outlined one possible labor market reform for the post-Covid-19 economy, targeting restaurants. His proposal calls for a higher proportion of South African employees than non-South African to be approved for reopening. He notes after his return from exile in 1990, eight out of ten were South African. It compares with almost 100% of today’s restaurant business hiring non-South Africans. Due to the coronavirus, the government is forced to address permanent positive adjustments, which extend to the tax code. Therefore, the long-term prospects for the economy are bright if proper steps are implemented. The USD/ZAR completed a breakdown below its resistance zone, where renewed selling pressure is expanding.

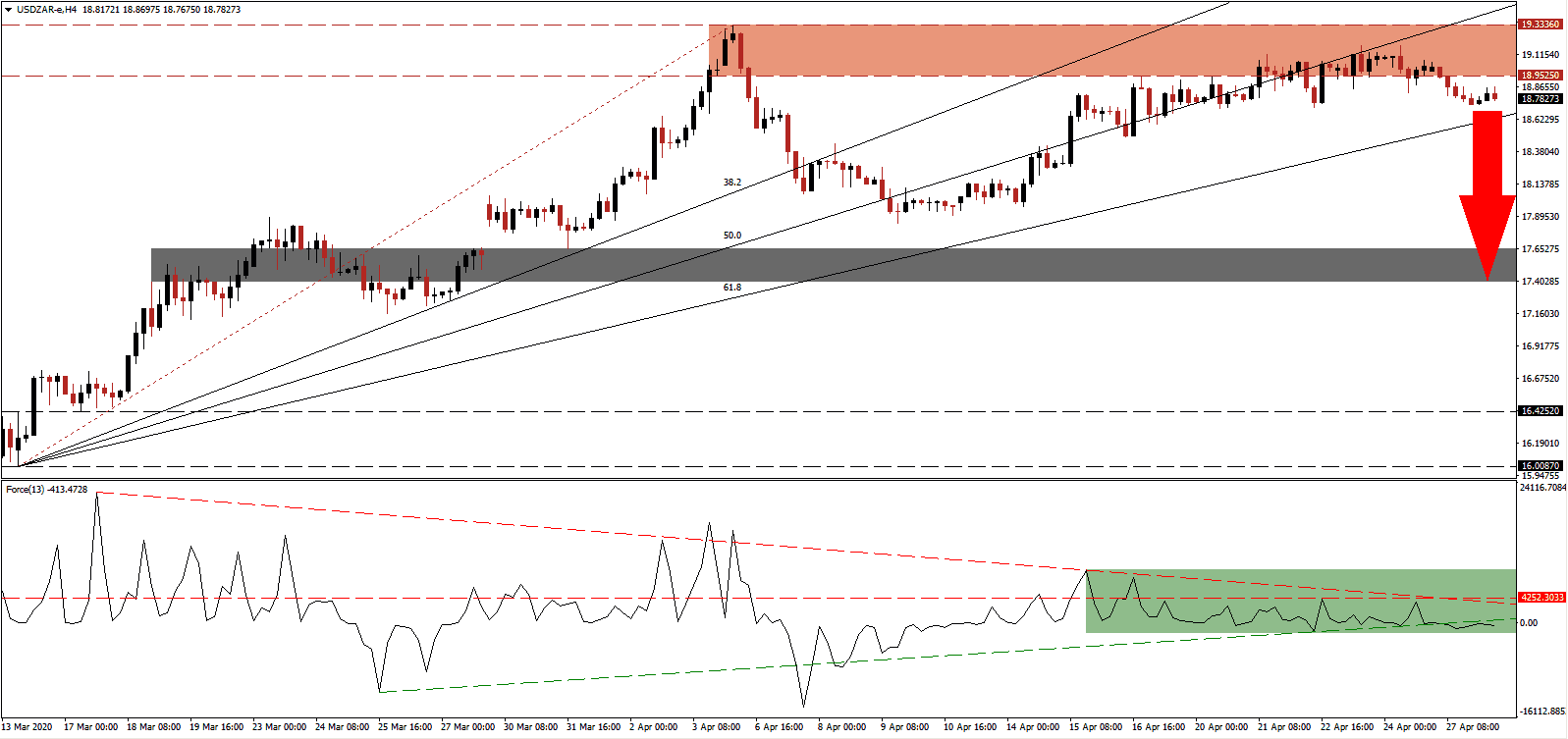

The Force Index, a next-generation technical indicator, remains below its horizontal resistance level in negative territory, as marked by the green rectangle. An increase in bearish momentum is exercised by the descending resistance level and further enhanced by the contraction in the Force Index below its ascending support level. Bears are in control of the USD/ZAR, and this technical indicator is positioned to challenge its April low, leading price action into a breakdown extension.

Mboweni added the social grants are temporary and be lifted in October, before stressing the new South African economy will have growth opportunities for domestic companies. Countries that will take the Covid-19 pandemic as an opportunity to implement reforms are positioned to grow out of the recession as a more efficient economy. By contrast, the US continues its debt-driven support of financial markets, failing to realize the pressing need to adjust to a new reality. Following the correction in the USD/ZAR below its resistance zone located between 18.9525 and 19.3336, as marked by the red rectangle, a more significant profit-taking sell-off is favored to materialize.

One final support level is present in the form of the ascending 61.8 Fibonacci Retracement Fan Support Level. Price action is trapped between it and the bottom range of its resistance zone, with the remainder of the sequence above it. A breakdown is likely to initiate the next wave of sell-orders, allowing the USD/ZAR to accelerate down into its short-term support zone located between 17.3964 and 17.6478, as identified by the grey rectangle. A continuation of negative surprises in US economic data could extend the correction.

USD/ZAR Technical Trading Set-Up - Breakdown Extension Scenario

- Short Entry @ 18.7825

- Take Profit @ 17.3975

- Stop Loss @ 19.1000

- Downside Potential: 13,850 pips

- Upside Risk: 3,175 pips

- Risk/Reward Ratio: 4.36

In the event of a reversal in the Force Index above its descending resistance level, the USD/ZAR is expected to enter a temporary breakout. With US initial jobless claims this week anticipated to show the loss of more than 30 million jobs over the past two months, the upside potential continues to deteriorate. Forex traders are advised to consider any price spike from current levels as an improved entry opportunity for new sell orders. This currency pair will test its next resistance zone between 20.4061 and 20.6123.

USD/ZAR Technical Trading Set-Up - Limited Breakout Scenario

- Long Entry @ 19.5000

- Take Profit @ 20.4000

- Stop Loss @ 19.1000

- Upside Potential: 9,000 pips

- Downside Risk: 4,000 pips

- Risk/Reward Ratio: 2.25