Five stages of the South African nationwide lockdown protocol are implemented, and the government plans to downgrade to stage four starting May 1st. The re-opening process will be slow and permanent changes to social life, and therefore the economy should be taken into consideration. Many governments continue to believe a swift recovery will follow the global Covid-19 pandemic, with a return to the old normal. Vaccine development remains complex, and treatment has not been identified. Accepting permanent adjustments is paramount to a sustainable path forward. South Africa is ahead in this essential regard, adding a bearish catalyst to the USD/ZAR. This currency pair completed a double breakdown from where an accelerated corrective phase is likely to materialize.

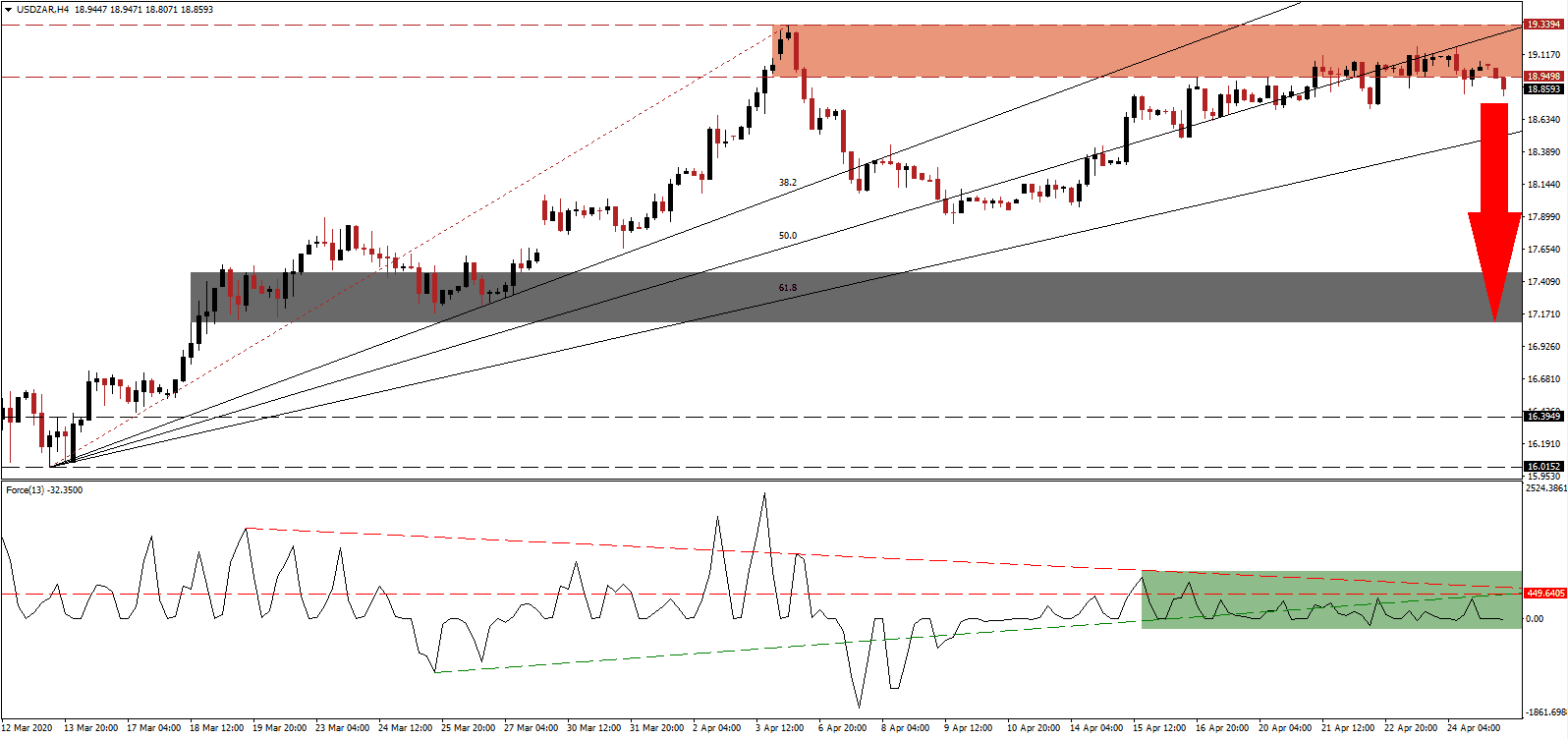

The Force Index, a next-generation technical indicator, maintains its position below the 0 center-line. Following the rejection by its ascending support level, serving as temporary resistance, bearish pressures expanded. The descending resistance level is adding to downside momentum, and this technical indicator is expected to slide deeper into negative territory. Bears are in full control of the USD/ZAR since the presence of a negative divergence was confirmed.

Following the double breakdown in the USD/ZAR, below its ascending 50.0 Fibonacci Retracement Fan Support Level and its resistance zone located between 18.9498 and 19.3394, as marked by the red rectangle, a more massive correction is anticipated. South Africa is determined to turn the crisis into an economic opportunity with new long-lasting positive changes. The US favors debt fuel consumption and artificially elevated asset prices to create a wealth effect, sponsored by the US Federal Reserve. You can learn more about a resistance zone here.

One essential level to monitor is the 61.8 Fibonacci Retracement Fan Support Level. A breakdown is favored to initiate the next wave of sell orders in this currency pair. It will allow the USD/ZAR to correct into its short-term support zone is located between 17.1024 and 17.4770, as identified by the grey rectangle. Once financial markets shift their focus on the costs of the stimuli implemented due to the virus, unsustainable debt levels in conjunction with weaker than priced economic growth out of the US may lead to an extension of the breakdown sequence.

USD/ZAR Technical Trading Set-Up - Breakdown Extension Scenario

- Short Entry @ 18.8500

- Take Profit @ 17.1500

- Stop Loss @ 19.3000

- Downside Potential: 17,000 pips

- Upside Risk: 4,500 pips

- Risk/Reward Ratio: 3.78

In the event the Force Index eclipses its descending resistance level, the USD/ZAR is likely to challenge its resistance zone once again. Given the accumulation of negative economic circumstances out of the US, with a bearish long-term outlook, Forex traders are advised to consider any breakout from current levels as a second short-selling opportunity. The next resistance zone awaits this currency pair between 20.4061 and 20.6123.

USD/ZAR Technical Trading Set-Up - Limited Breakout Scenario

- Long Entry @ 19.7500

- Take Profit @ 20.4500

- Stop Loss @ 19.4500

- Upside Potential: 7,000 pips

- Downside Risk: 3,000 pips

- Risk/Reward Ratio: 2.33