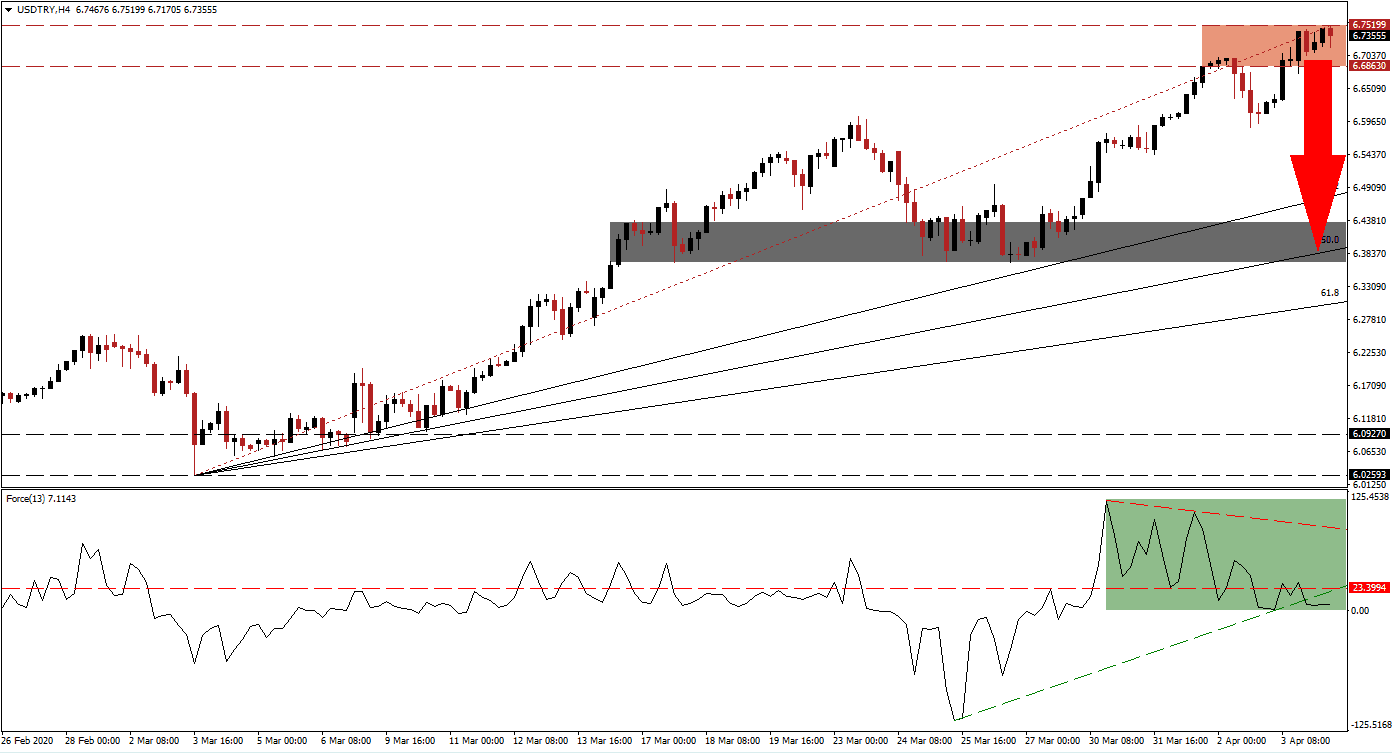

Turkey is facing increasing pressure from the Covid-19 outbreak, and President Erdogan’s government is under criticism after asking for public donations to assist in combating the virus. It raised questions about the fiscal stability of the country, which deployed resources to stem the economic contraction in 2018. The Turkish Lira collapsed during that period, sending the USD/TRY to all-time highs. Unorthodox policy moves by President Erdogan surprised markets but delivered unexpected positive results. Price action has no reached its resistance zone, but the loss in bullish momentum suggests another corrective phase could be imminent.

The Force Index, a next-generation technical indicator, shows the existence of a negative divergence after recording a lower high while this currency pair drifted higher. A descending resistance level formed, adding to downside pressure on the USD/TRY. The Force Index converted its horizontal support level into resistance, as marked by the green rectangle, and contracted below its ascending support level. Bears are awaiting a pending collapse in this technical indicator into negative territory to regain control of price action. You can learn more about the Force Index here.

After the Turkish economy expanded 6.0% in the fourth quarter of 2019 and 1.0% annualized, above consensus estimates in both instances, annualized GDP growth is anticipated to deteriorate in-line with a global recession. With economies set to recalibrate the fundamental set-up and reassess supply chains, Turkey is set to benefit from a new world order. It provided an essential long-term catalyst for its currency. The USD/TRY is under breakdown pressures inside of its resistance zone located between 6.68630 and 6.75199, as marked by the red rectangle.

One significant level to monitor is the intra-day low of 6.58789, the previous breakdown low, which was reversed to a marginally higher high. A collapse below this level will close the gap between this currency pair and its ascending 38.2 Fibonacci Retracement Fan Support Level. More downside is favored to take the USD/TRY into its short-term support zone located between 6.36969 and 6.43415, as identified by the grey rectangle. It is enforced by the 50.0 Fibonacci Retracement Fan Support Level.

USD/TRY Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 6.73500

Take Profit @ 6.38500

Stop Loss @ 6.83000

Downside Potential: 3,500 pips

Upside Risk: 950 pips

Risk/Reward Ratio: 3.68

In the event of an advance in the Force Index above its descending resistance level, the USD/TRY could be pressured into a breakout. With the global economic outlook depressed, and the US piling on debt, any price spike from current levels is likely to remain temporary. The next resistance zone is located between 7.05790 and 7.12440. Forex traders are recommended to consider this an excellent area to place new net short orders.

USD/TRY Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 6.95000

Take Profit @ 7.12000

Stop Loss @ 6.87000

Upside Potential: 1,700 pips

Downside Risk: 800 pips

Risk/Reward Ratio: 2.13