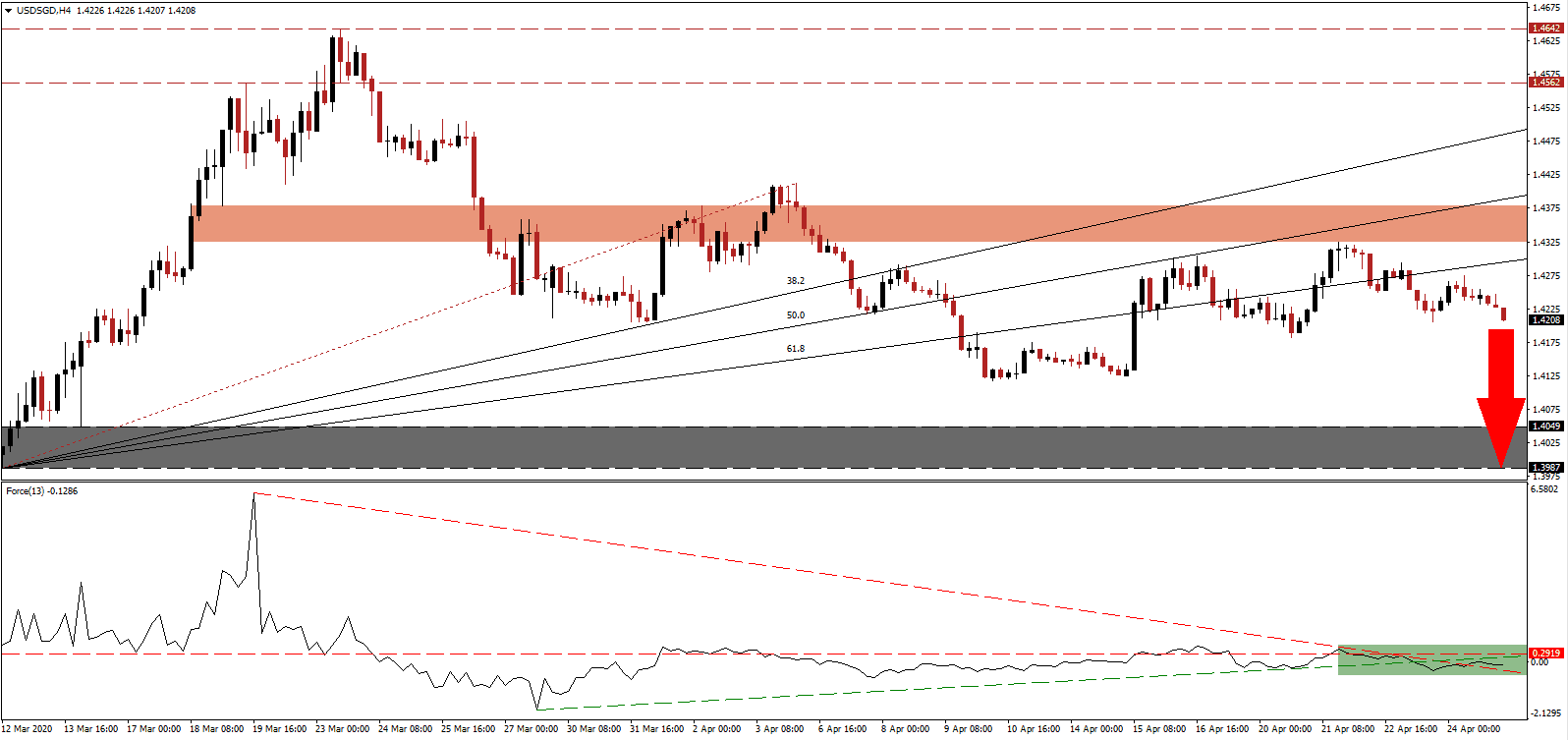

Singapore’s Trade and Industry Minister Chan Chun Sing confirmed that the city-state is bracing for a more significant economic contraction than the previously forecast 4.0% annualized GDP slump. He added the global outlook deteriorated massively over the past month, as the global Covid-19 pandemic disrupts supply chains. The first-quarter GDP posted a contraction of 10.6%, and the rise in infections caused Singapore to extend implemented circuit breakers until June 1st, the fourth extension. The USD/SGD completed a breakdown below its ascending 61.8 Fibonacci Retracement Fan Support Level, from were more downside is favored.

The Force Index, a next-generation technical indicator, remains below its horizontal resistance level in negative territory. Adding to bearish developments, is the conversion of its ascending support level into resistance, as marked by the green rectangle. Bears are in control of the USD/SGD. While the Force Index eclipsed its descending resistance level, a renewed collapse in this technical indicator is anticipated to accelerate the sell-off in price action.

US initial jobless claims are expected to clock in above 30 million this week, and the virus already erased more jobs than the economy created since the Great Recession of 2008. Complacency over the long-term impacts dominate, preventing accurate measures to be fully implemented. The US added to its debt last week by almost $500 billion, after the initial stimulus to support small and medium-sized companies was awarded mostly to public-listed large companies. The latest sign of US misappropriation is adding to downside momentum in the USD/SGD, after being rejected by its short-term resistance zone located between 1.4324 and 1.4379, as marked by the red rectangle.

Forex traders are advised to monitor the intra-day low of 1.4182, the base of the previous breakdown below its 61.8 Fibonacci Retracement Fan Support Level. A push lower is expected to attract the next wave of net sell orders in the USD/SGD, providing the required volume for an accelerated contraction in this currency pair. The next support zone awaits price action between 1.3987 and 1.4049, as identified by the grey rectangle.

USD/SGD Technical Trading Set-Up - Breakdown Extension Scenario

- Short Entry @ 1.4200

- Take Profit @ 1.3990

- Stop Loss @ 1.4270

- Downside Potential: 210 pips

- Upside Risk: 70 pips

- Risk/Reward Ratio: 3.00

In case of a sustained advance in the Force Index above its ascending support level, serving as temporary resistance, the USD/SGD may attempt a reversal. Due to dominant bearish pressures on this currency pair, resulting from a combination of fundamental and technical factors, the upside remains limited to its intra-day high of 1.4412. It marks the peak of the redrawn Fibonacci Retracement Fan sequence, and represents Forex traders with a second short-selling opportunity.

USD/SGD Technical Trading Set-Up - Limited Reversal Scenario

- Long Entry @ 1.4310

- Take Profit @ 1.4410

- Stop Loss @ 1.4270

- Upside Potential: 100 pips

- Downside Risk: 40 pips

- Risk/Reward Ratio: 2.50