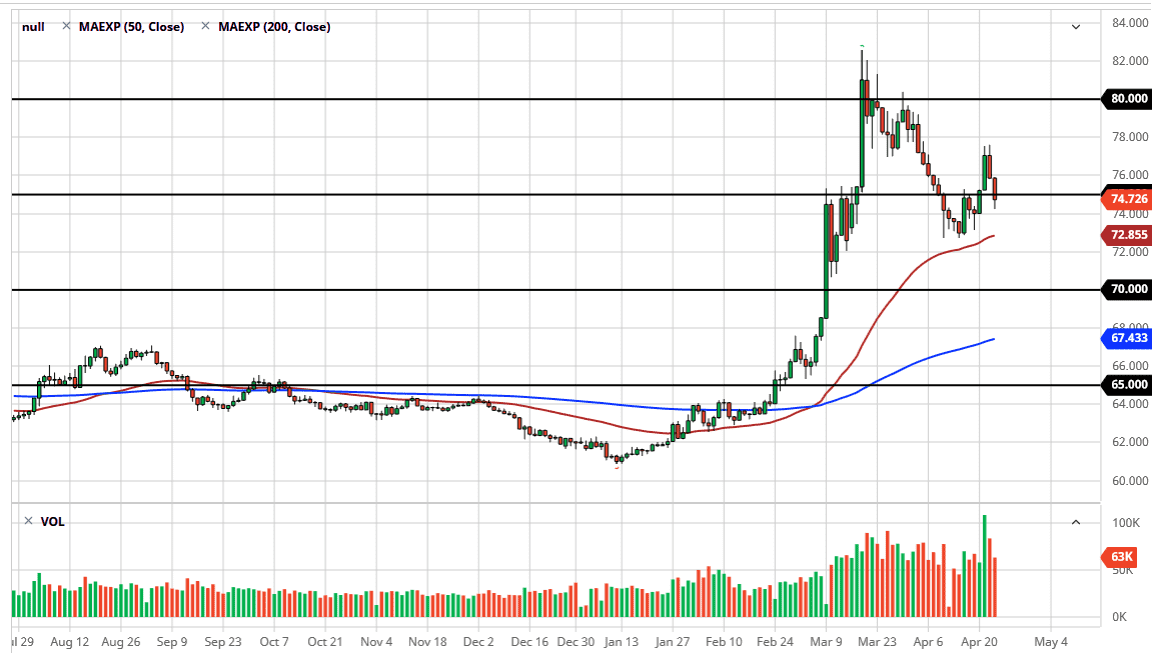

During the trading session on Thursday, the US dollar dropped below the 75 ruble level during trading, but also found enough support underneath to turn things around and show signs of support. That being said, one of the biggest drivers of the value of the Russian ruble is of course the oil market as Russia is so heavily dependent on exports. That being said, the trading session for Thursday was particularly good for crude oil but it is simply a technical bounce and therefore I would anticipate that the US dollar should climb against the Russian ruble if the oil market rolls over again.

At this point in time, it is likely that the market will look for technical support in this general vicinity as well, as the 74 ruble level will attract a certain amount of attention, and of course the 50 day EMA underneath would show technical support as well. That being said, if the market breaks down below the 50 day EMA, then I think the market could go down to the 72 ruble level, and then possibly even the 70 ruble level. However, to the upside it is likely that if we break above the 76 ruble level, then take on the resistance from the previous couple of sessions. If we can break that, then it is likely we could go to reach towards the 80 rubles level.

I do believe that there are going to be plenty of issues around the world and therefore it’s likely that the US dollar needs to be picked up by a lot of emerging markets and economies, so it’s very likely that we will see the US dollar strengthen against various emerging market currencies such as the Russian ruble, South African Rand, and many others. The Russian ruble is simply far too one-dimensional to be considered a viable opportunity for the US dollar, so therefore it has a natural proclivity to lose value. When you look at this chart, you can see that although we have had a significant pullback, it pales in comparison to where we started just a couple of months ago. With that, I do believe it is only a matter of time before we break to the upside, so therefore I look at these pullbacks as potential value plays. All things being equal, I do believe that the 50 day EMA should hold as a bit of a floor.