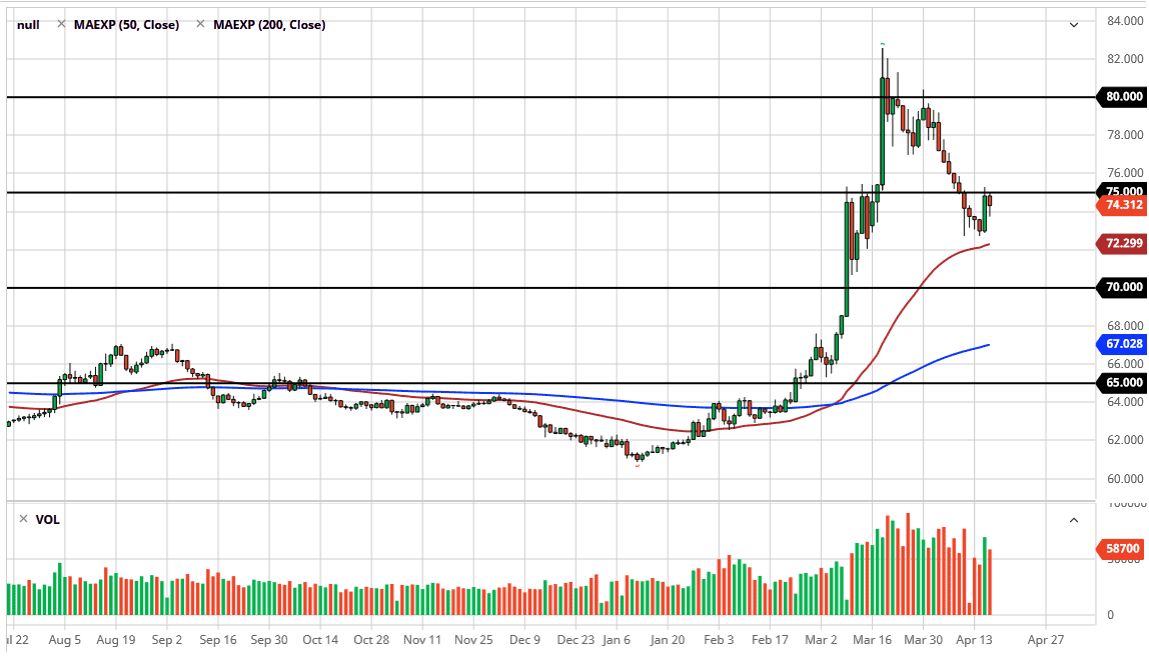

The US dollar to pull back just a bit against the Russian ruble during trading on Thursday, as oil markets got a bit of a reprieve. Remember, the Russian ruble is highly levered to the crude oil markets, as it is without a doubt one of the largest components of the Russian economy. However, I would direct your attention to the candlestick from the Wednesday session which was a massive engulfing and positive candlestick. From a technical analysis standpoint the only thing that kept this market from breaking out to the upside was the fact that it slammed into the psychologically and structurally important 75 ruble handle.

Underneath the massive engulfing candlestick from the previous session, there is the 50 day EMA which is currently hugging the 72.301 RUB level, an area that had seen some buying pressure previously. Furthermore, the 50 day EMA is starting to slope higher, and of course as the market has pulled back a bit only to find buyers later in the day on Thursday. At this point, it’s obvious to me that the 75 ruble level is going to continue to be crucial, so if we get a move above there, I think it’s very likely that we continue to grind much higher.

It is possible that this will coincide with some type of break down and crude oil, but it doesn’t necessarily have to be that situation. After all, the US dollar is highly sought after in terms of safety anyway, and clearly the Russian ruble isn’t necessarily were people hide from economic noise. However, if crude oil does break down again during the day on Friday, the ruble will certainly be punished as a result. Furthermore, the US dollar will gain becomes the crude oil market is priced in those very same US dollars, and money tends to run into the treasury market in these times, which of course required US dollars to be involved with.

If we did break down below the 50 day EMA on this chart, it’s very likely that we will find a bit of support at the 71 ruble level, followed by the 70 ruble level. However, that seems to be very unlikely at the moment due to the overall “risk off” attitude that most market participants have at the moment, and of course the massive oversupply of crude oil in general. With this, I remain bullish of the greenback against the ruble.