Nigeria is home to Africa’s most populous country, and the economy has overtaken South Africa as the biggest as measured by GDP. It also caters to the world’s third-largest population. The global Covid-19 pandemic has forced a partial lockdown of Nigeria, placing a significant strain on small-scale entrepreneurs, responsible for providing their families with day-to-day income. The economy depends on self-employment, which accounts for over 40% of the labor market. While a national response has not been announced, at least one state announced plans for a stipend to the self-employed, without providing more details. The USD/NGN ascended into its resistance zone on thin trading volume.

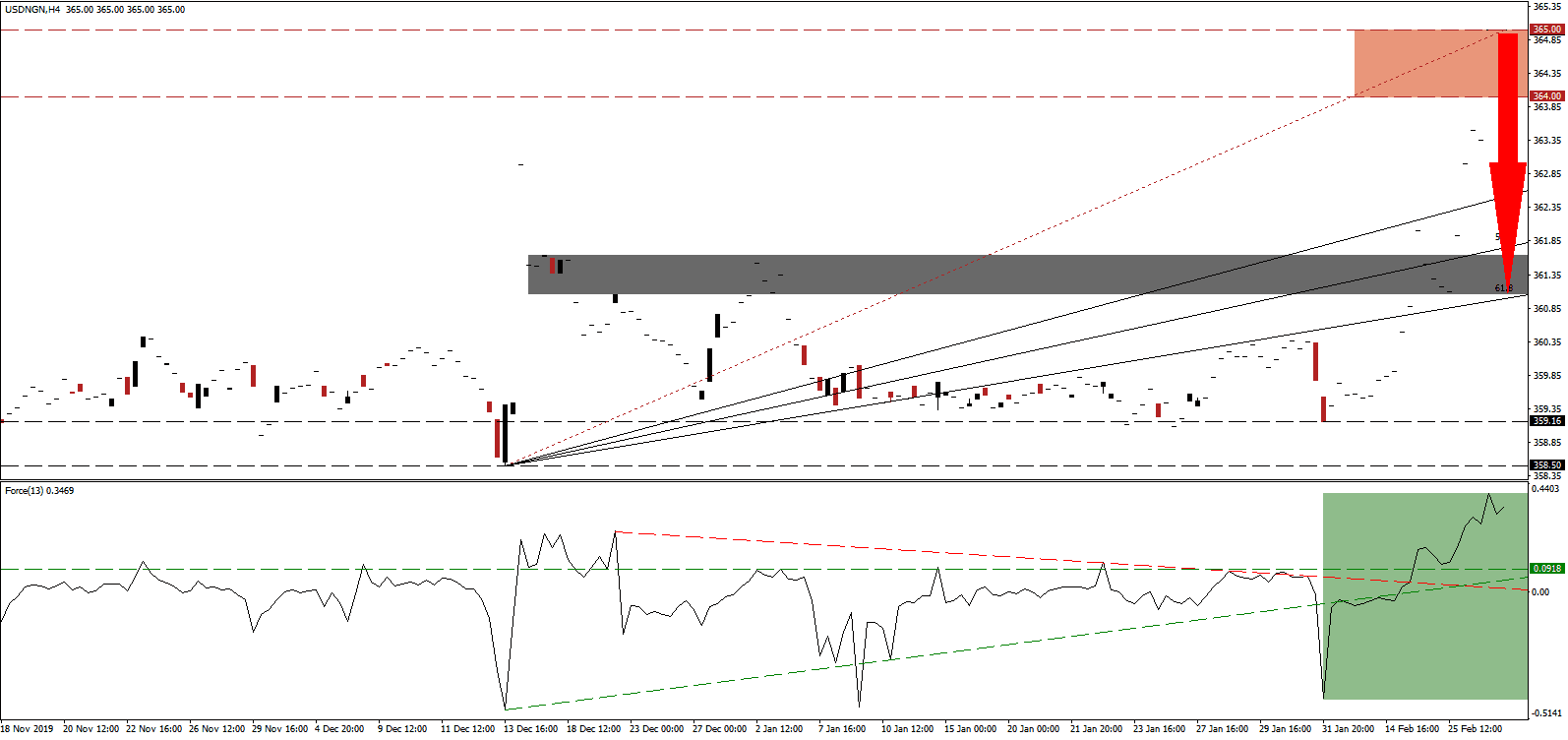

The Force Index, a next-generation technical indicator, spiked to a new 2020 peak, as marked by the green rectangle. Upside exhaustion, in combination with the lack of volume, is favored to pressure for a reversal into its horizontal support level. While the ascending support level is closing in, a breakdown extension into its descending resistance level cannot be excluded. Bulls are in control of the USD/NGN, but it is essential to consider that not all days witness trading activity in this currency pair. The last recorded trade was on April 6th.

Nigeria’s finance minister stressed the importance of a stimulus to avoid an economic recession. She added that creditors considered suspending debt repayments, assisting the country to bridge the period until activities can resume. The collapse in oil prices adds economic difficulties and forced a revision for the 2020 budget, which was established with a base price of $57 per barrel and a USD/NGN exchange rate of 305.00. Estimates for the 2020 debt-to-GDP ratio call for an increase to 55.0%, less than half of the one the US expands. The USD/NGN remains inside of its resistance zone located between 364.00 and 365.00, as marked by the red rectangle, pending a breakdown to lead a price action reversal.

This sporadically traded currency pair is exposed to a sudden contraction into its ascending 38.2 Fibonacci Retracement Fan Support Level. The most recent advance was initiated by a flight to liquid assets, likely to be reversed as markets get an opportunity to properly price the new record-debt level of the US stimulus and bailouts. A move in the USD/NGN into its short-term support zone located between 361.05 and 361.64, as identified by the grey rectangle, is possible. You can learn more about the Fibonacci Retracement Fan here.

USD/NGN Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 365.00

Take Profit @ 361.00

Stop Loss @ 366.00

Downside Potential: 400 pips

Upside Risk: 100 pips

Risk/Reward Ratio: 4.00

In the event the Force Index retreats into its ascending support level and bounces higher, the USD/NGN could feel limited upside pressure. With the exchange rate at all-time highs and a US economy facing potentially the most severe challenge in its modern history, any acceleration to the upside may offer Forex traders a selling opportunity. Extreme caution and patience are advised on the back of severe short-term challenges, combined with a long-term bullish outlook for the Nigerian economy.

USD/NGN Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 367.50

Take Profit @ 370.00

Stop Loss @ 366.50

Upside Potential: 250 pips

Downside Risk: 100 pips

Risk/Reward Ratio: 2.50