The USD/JPY rose by more than 100 points in the beginning of this week’s trading, reaching the 109.37 resistance before the pair stabilized around the 109.20 level at the time of writing. The x safe heavens 109.20 of this pair is still in favor of the US dollar. The US Federal Reserve does not stop providing ongoing support to the US economy in the face of the devastating effects of the spread of the Coronavirus. The last measure announced by the bank was that they would support the $349 billion small business lending program.

The Federal Reserve Board said yesterday that it would purchase banks' loans to small businesses as part of the program, which is implemented by banks and the Small Business Administration, and was created under the economic relief package of $ 2.2 trillion. Loans can be dropped if they are spent on payroll, to encourage companies to continue to pay their employees' salaries or to re-employ workers who may have recently been laid off.

By purchasing loans, the Fed will create an incentive for banks to participate in more lending. The purchase of loans should provide more cash for banks to lend. Otherwise, when banks provide a loan, they are usually required to keep some cash in reserve in case of default.

The Fed said in a two sentence statement: More details would be provided this week.

The US Federal Reserve is also expected to launch a program that helps states and cities purchase bonds. The rescue package, approved earlier this month, directed US Treasury Secretary Manuchin to support such an effort as part of the $454 billion legislation the Treasury Department has provided to support the Federal Reserve's efforts to support the banking system and the economy.

Amid recent optimism by investors due to the slow pace of coronavirus cases and deaths, US stocks rose by more than 7% during yesterday's session, as the S&P 500 rose by 175.03, or 7%, to 2,663.68, and almost all US stocks were on the rise. It recovered more than its losses last week, when the US government announced a record number of layoffs. The Dow Jones industrial average rose 1627.46 points, or 7.7%, to 22679.99, and the NASDAQ rose 540.15 or 7.3% to 7913.24.

From Japan, the prime minister said he is preparing to announce the 108 trillion yen ($ 1 trillion) package to boost the world's third largest economy. It will be the largest package ever for Japan’s economy, about twice as much as expected. The Japanese economy was already shrinking late last year before the Coronavirus paralyzed the global economy. The announcement pushed Japan's Nikkei 225 Index up 4.2%. As for other Asian stocks, the Kospi index in South Korea jumped 3.9%, and the Hang Seng index in Hong Kong increased by 2.2%.

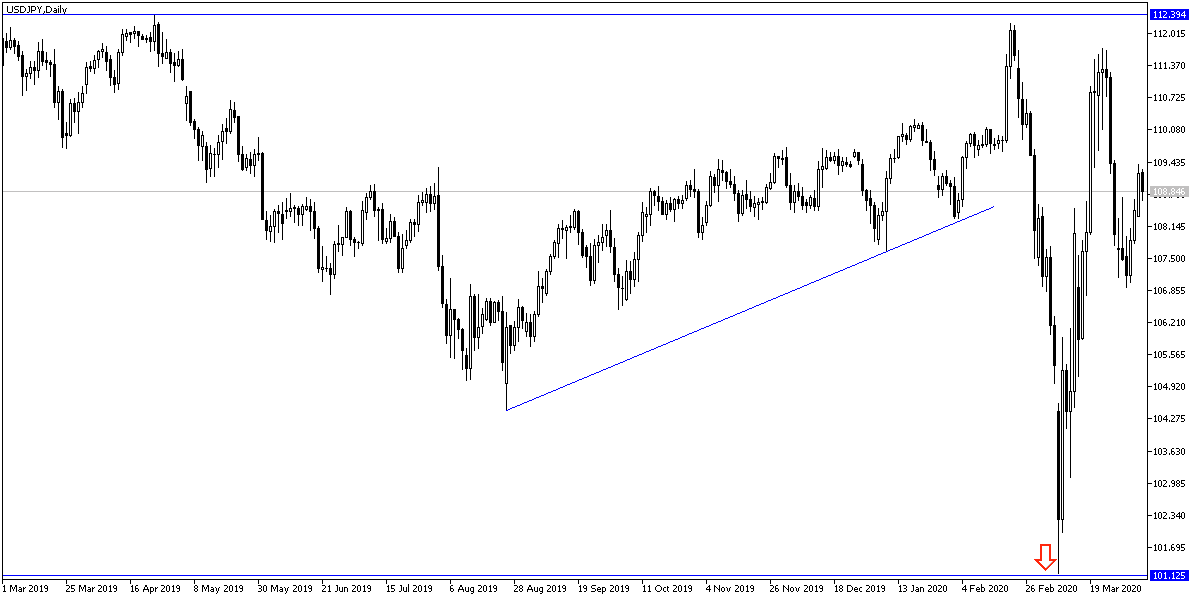

According to the technical analysis: On the daily chart, the USD/JPY is still moving inside a recently formed bullish channel, and the strength of the upward correction may increase if the pair succeeds in breaching the 110.00 psychological resistance, where it is closest to currently. Without the stability below 108.00, there will be no bear control again. US figures regarding the Corona pandemic and its global economic effects will have more impact on investor sentiment, hence, the performance of the pair.

As for the economic calendar data today: From Japan, average wages and household spending will be announced. From the United States, the job opportunity rate will be announced.