For three consecutive trading sessions, the USD/JPY pair is moving in an upward correction range, but with limited gains out of the 107.45 support, towards the 108.67 resistance, before stopping after the announcement of disappointing results for the March US jobs, whose details were announced at the end of last week’s trading. The pair is stable around the 108.50 level in the beginning of this week’s trading. The JPY/USD pair continues to trade under great downward pressure after retreating from a two-month high of 111.900 late last month.

In the US, nonfarm payroll data came in worse than expected with more than 700,000 jobs lost in March, compared to expectations of only 100,000 jobs. The downturn pushed the US unemployment rate to a multi-year high of 4.4%, against expectations of 3.8%. However, average hourly wage growth exceeded economists' estimates of 3.0% with a reading of 3.1%. On the other hand, the ISM non-manufacturing PMI for March exceeded expectations of a reading of 44, as it came at 52.5, but the non-manufacturing employment index reading came at 47, while expectations were for an improvement to 53.7 points.

Economists hope that an extraordinary series of bailout measures by the US Congress and the Federal Reserve will help stabilize the US economy in the coming months. The main goals of a recent 2.2-trillion-dollar congressional relief package are to quickly put money in the hands of people and motivate companies to avoid job cuts or summon laid-off employees quickly.

The package includes an additional $600 a week of unemployment benefits in addition to the usual state payments that will enable millions of newly unemployed to pay their rent and other bills. But it will not make up for the usual level of spending by the Americans in the past. Accordingly, Oxford Economics forecasts that for the April-June quarter, this decline is likely to cause the largest quarterly drop in consumer spending ever.

For a series of pessimistic expectations, including those of Joel Bracken, chief US economist at IHS Markit, who forecasts that the US economy will contract sharply in the April-June quarter - at an annual rate of 26.5%, the worst in records dating back to just after the World War. II. In the same contxt, many economists say that additional government support will be needed, especially if the virus continues until late summer.

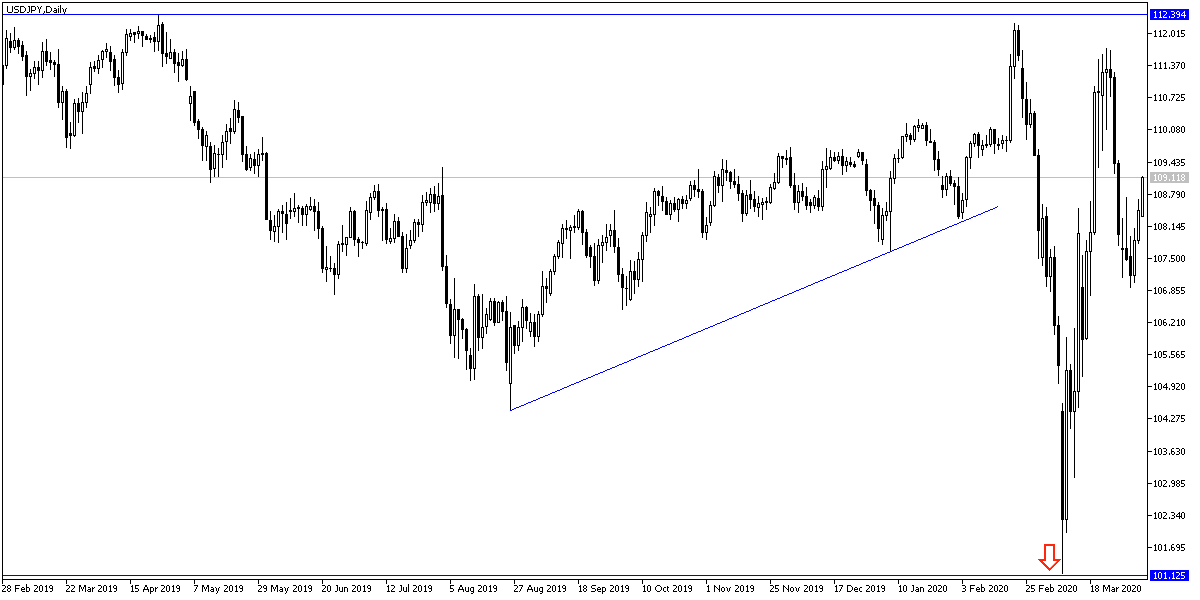

According to technical analysis of the pair: On the daily chart, it appears that the USD/JPY has made a sharp rebound recently. This comes on the heels of a sharp decline in the first third of March. This confirms the strength of the pair's fluctuations in recent times. Therefore, bulls will target long-term profits around 109.74 or 112.28 or higher at 114.11 respectively. On the other hand, bears look for gains with a move towards support levels at around 105.76 or 103.56 or less at 101.18.

Today, the pair is not expecting any important economic releases from Japan or the United States of America.