The dollar did not receive any support from the results of the recent important US economic data, nor from the Federal Reserve announcing its monetary policy and the statements of its Governor, Jerome Powell. Therefore, the price of the US dollar pair against the Japanese yen remained under a downward pressure that pushed it towards the 106.35 support, the lowest level in more than a month, before settling around 106.70 at the time of writing, awaiting for any developments. US economic activity experienced a significant contraction in the first quarter of 2020, according to a report released by the US Department of Commerce yesterday. The report stated that the real GDP of the United States decreased at an annual rate of - 4.8 percent in the first quarter after a jump of 2.1 percent in the fourth quarter of 2019.

The decrease in real GDP in the first quarter reflected the negative contributions from consumer spending, fixed non-residential investment, exports and private stock investments. Meanwhile, positive contributions from fixed residential investment, federal government spending, and local government spending helped reduce the downside. Consumer spending fell 7.6 percent in the first quarter amid a sharp drop in service spending, led by health care and goods, and by auto and parts. The decline in non-residential fixed investment primarily reflected lower equipment, led by transportation equipment, while the decrease in exports primarily reflected lower services, led by travel.

On the other hand. The US Federal Reserve Board indicated that it will keep its key short-term interest rate close to zero in the foreseeable future as part of its extraordinary efforts to support the economy plunging into its worst crisis since the 1930s. Chairman Jerome Powell noted the seriousness of the downturn caused by coronavirus outbreak and made clear that the Federal Reserve will continue to do everything in its power to provide support.

Speaking at a virtual news conference, Powell said he believed the deadly Corona epidemic as would endanger the US economy for a year or more, especially if a vaccine or an effective treatment had not been developed before then. He warned that a deep and prolonged recession could cause devastating damage by forcing companies to go bankrupt, keeping unemployment high and undermining the skills of unemployed workers. It is likely that it will take some time until we return to a more normal level of employment and, ultimately, maximum employment.

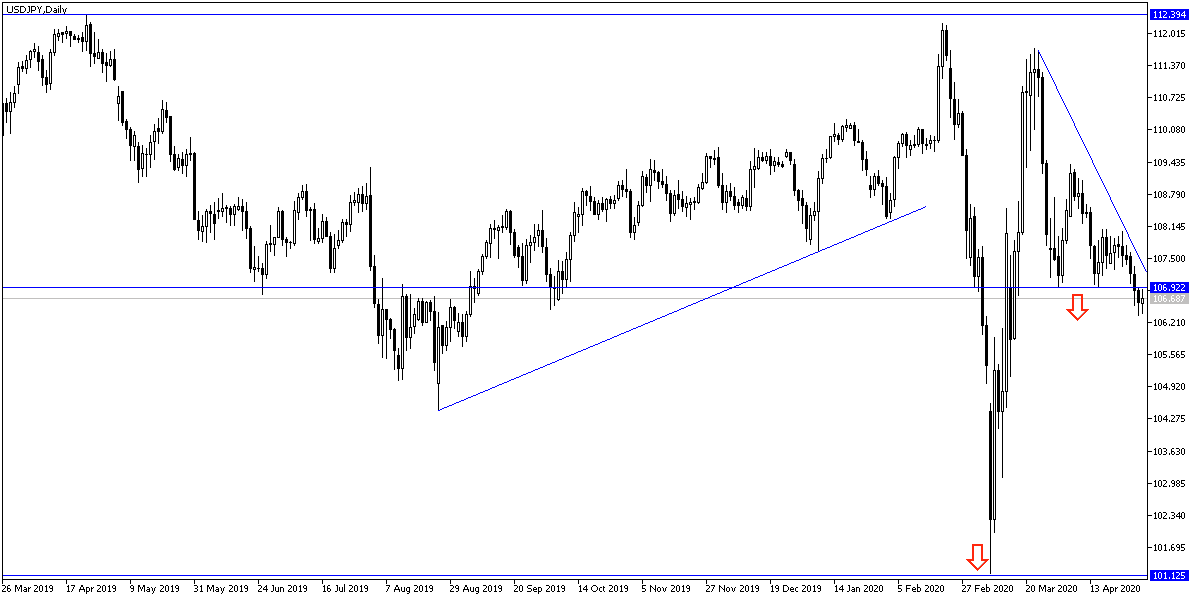

According to technical analysis of the pair: The general trend of the USD/JPY pair will remain bearish as long as it remains stable below the 108.00 support, which we have warned a lot that breaching it will lead to a stronger bearish slide, especially with stability in the narrow ranges of several trading sessions. Reaching the 106.00 support will confirm strong technical indicators’ reaching strong oversold areas, thus returning to buying the pair. The 110.00 psychological resistance remains a target for the bulls in the event of increased optimism, and from there, the current bearish outlook shifts for a while.

Today, the pair will react to the announcement of the US unemployment claims, along with a reading of the Federal Reserve’s preferred index to measure the US inflation, the personal CPI, along with the average income and spending of the American citizen, and the Chicago PMI.