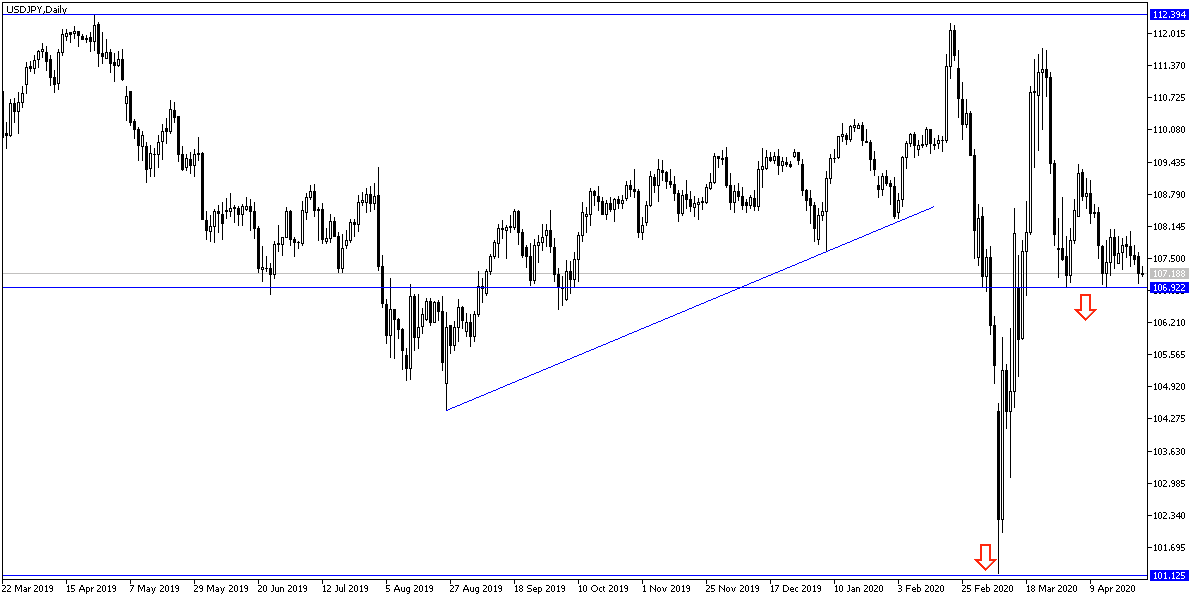

At the beginning of this week's trading, the Japanese Central Bank cut short the time and quickly announced its monetary policy. This announcement was scheduled for today, Tuesday, and the bank explained that the action was to prevent the spread of the virus. The USD/JPY currency pair plunged to the 106.99 support before stabilizing around the 107.25 level at the time of writing. The Japanese central bank kept the negative interest rate -0.10% unchanged as expected, but it increased the stimulus plans to face the devastating economic effects of the coronavirus. The pair did not complete the collapse in light of global economies desire to re-open and gradually get rid of the restrictions imposed to prevent the spread of the disease. This trend, despite fears, increased investor risk appetite, and they give up, even temporarily, safe haven assets, the biggest gainer from that crisis.

The number of global cases infected with COVID-19 coronavirus exceeded the barrier of 3 million, according to data collected from Johns Hopkins University. The death toll rose to 206,803. At least 869,935 people have recovered. The United States of America still has the highest number of cases in the world, at 965,933,000 infected people, and the highest number of deaths at 54,877,000.

Although the United States issues alarming figures, the US administration intends to reopen the US economy and gradually relinquish some of the restrictions imposed to prevent the rapid spread of the epidemic. The global economies moving towards reopening the economy supported the global stock markets a lot in the beginning of this week's trading and increased the opportunity for risk appetite.

This week represents a state of suffocation with many possible market moving events, including meetings of many of the largest central banks in the world. Besides nearly a third of the companies in S&P500 will announce their profitability for Q1 of 2020, and most importantly, may talk about their vision of future conditions, especially as the epidemic continues and no vaccine is reached to eliminate it. Global central banks and governments, despite what they have done to cope with the severe global economic recession, still make promises to provide massive amounts of assistance to markets, and some investors look beyond the economic devastation that is currently sweeping the world. Instead, they focus on the potential return to growth as outbreaks in some areas stop.

According to technical analysis of the pair: Going back to what I mentioned in the recent technical analyzes of the USD/JPY, it was technically confirmed that stability in a limited path for several sessions in limited ranges foreshadows a strong movement downwards, which is what happened at the beginning of the week's trading. Investors will wait for stronger support levels to return to buying the pair, and the closest ones are currently at 106.85, 106.10 and 105.45 respectively. I still think that the 110.00 psychological resistance is still the key to the strength of a bullish correction, otherwise the bears will continue to control the performance.

As for the economic calendar data today: From Japan the unemployment rate and consumer price index will be announced. From the United States, Commodity Trade Balance, Consumer Confidence and the Richmond Industrial Index data will be released.