For two weeks in a row, the USD/JPY pair is moving in a limited range, amid a stable downward trend, below the 108.00 support, amid a balanced demand by investors for both safe haven currencies in this pair. At the beginning of this week’s trading, the pair was around the 107.65 support, Coronavirus remains the strongest influencer on investor sentiments and global financial markets. The global economy entered into a severe recession due to the epidemic, which exceeded the 2008-2009 global financial crisis. Global economies are opening up amid fears, instead of a policy of closure to contain the rapid spread of the disease. The shutdown caused millions of jobs, and the companies’ results were disastrous.

Spain, the country with the second largest number of confirmed Coronavirus cases after the United States, allowed children to leave their homes briefly for the first time in six weeks. At the same time, Italy is preparing to exit the first and largest closure to protect against the Coronavirus in the West, and fears still exist that a second wave will be more violent, which Italy will not be able to deal with if occurred.

Billions of dollars of relief may not prevent from the coronavirus, which target small companies, many of which will eventually go bankrupt. The epidemic continues to confuse the US economy even more than economists have feared. Almost one in six American workers has applied for unemployment benefits in the past five weeks. The damage is so severe that the deeply divided Congress has reached an agreement between the two parties on massive support for the economy. On Friday, US President Donald Trump signed a bill to provide nearly another 500 billion dollars, including loans to small businesses and hospital aid.

This week will be one of the busiest seasons, with more than 150 companies in the S&P500 reporting how much they achieved in the first three months of 2020. Many companies have withdrawn their full earnings forecasts for 2020 due to the uncertainty caused by the Corona virus, so Wall Street has lowered its own estimates.

US stocks have generally risen since late March on promises of massive help from Congress and the Federal Reserve, along with more recent hopes that parts of the economy may be close to reopening. In Georgia, some companies began welcoming customers again on Friday after the governor eased their month-long closure. But many professional investors are skeptical of the recent rally in the market. They say there is still a lot of uncertainty about how long the recession will last and that attempts to reopen the economy could lead to more waves of infection if they are premature.

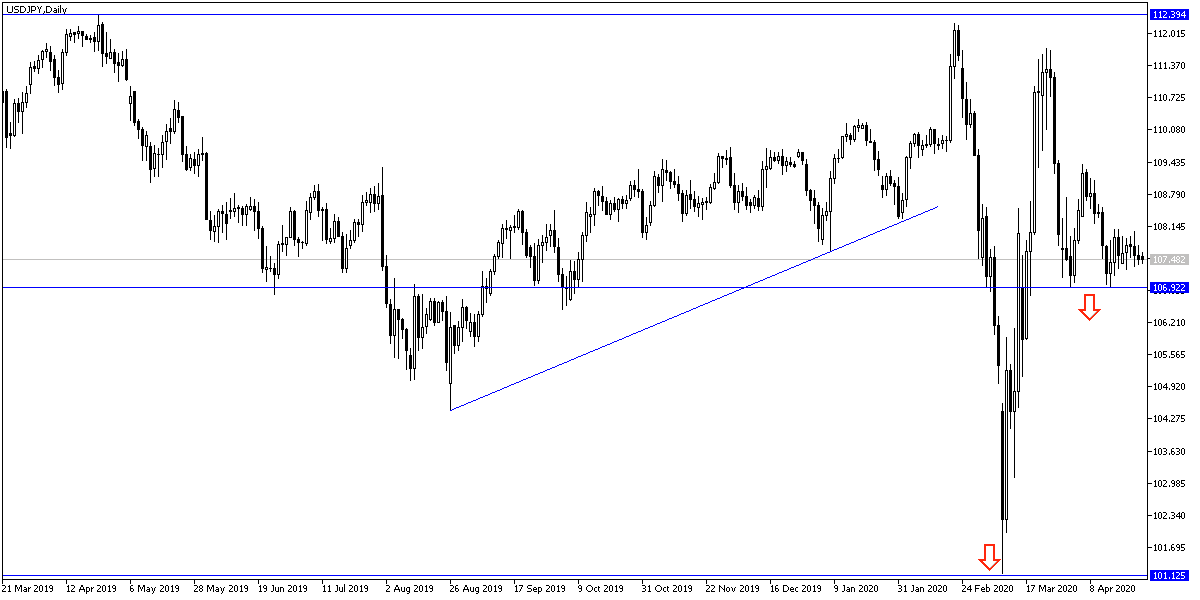

According to technical analysis of the pair: Expectation are as is without change. The downward trajectory for the USD/JPY is still the stronger, and stability below 108.00 support increases losses to move towards stronger support levels, the closest of them are currently 107.25, 106.85 and 106.00, respectively. There will be no chance for an upward correction without the pair surpassing the 110.00 psychological resistance.

We may witness a quieter movement for the pair today in light absence of any important economic data from the United States of America and Japan.