For the seventh consecutive day, the USD/JPY pair stabilizes in a limited movement range that threatens a strong movement coming in one of two directions, and the downward trend remains the closest opportunity to get support from the next move. The world is still facing a severe recession and will continue to support more investor appetite for safe havens. Global economic stimulus to counter the devastating effects of the Coronavirus does not stop. The US House of Representatives meets again to vote on a fourth bill before it is sent to President Trump to help companies paralyzed by the coronavirus, a measure of nearly $500 billion that many lawmakers are already looking for. According to the Congressional Budget Office, Thursday's House of Representatives vote will raise the total cost of the two parties’ four bills to respond to the various impacts to about $ 2.5 trillion.

The global number of cases and deaths caused by the deadly coronavirus (COVID-19) has increased to 2.61 million, according to data collected by Johns Hopkins University. The death toll has risen to 181,235, and at least 703,502 have recovered. The United States of America has the highest number of cases in the world with 834,858 infected and more than 45,894 dead.

The American stimulus increases at the time that the American administration seeks to reopen the American economy, even if gradually, to avoid a total collapse of the largest economy in the world if the policy of closure continues longer. This policy was intended to contain the spread of the disease, but it caused factories and companies to close and to fire 22 million Americans from their jobs. Since the start of the epidemic, the US Federal Reserve, under the leadership of Jerome Powell, and the US government, while avoiding political discord, have launched massive stimulus plans to urge factories and companies to face the consequences of the crisis and keep employees as much as possible. As the Coronavirus caused the loss of all historical positive figures for the American labor market, before the epidemic, American unemployment was at its lowest level in 50 years.

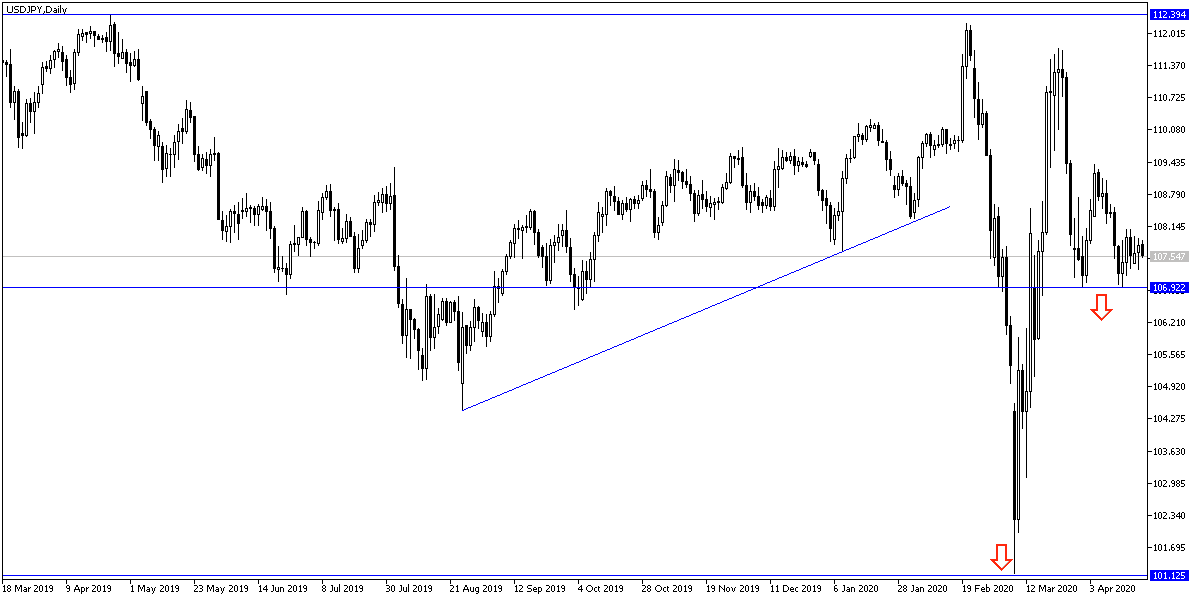

According to technical analysis of the pair: I do not see any change in the technical view of the USD/JPY pair, as it remains stable below the 108.00 support amid stronger control of the bears on performance, and risk aversion will remain supportive of this trend and foreshadow a downward movement towards support levels at 107.55 and 106.90 And 106.00, respectively. There will be no control of the bulls on performance without moving above the 110.00 psychological resistance. US jobless claims readings, the US Manufacturing and Services PMI and new home sales will have a strong affect to the pair's performance.