Despite the strength of the US dollar against most other major currencies in the last trading sessions, the attempts to bounce higher for the USD/JPY pair did not exceed the 108.08 level, and for both sessions, the pair failed to overcome that level, and then closed last week's trading around the 107.55 level. Bears continue to control the performance. Especially with failure to reach the 110.00 psychological resistance. The pair is still interacting with the world awaiting the COVID-19 to reach its peak, especially in global economies. The Corona pandemic has forced the world economy to close down, and thus the global economic activity has stopped, setting the stage for a more severe global economic recession than the recent global financial crisis of 2008-2009. The dollar fell against the yen for the second week in a row.

As for the US economic data, US imports and exports came in better than expected with a change of -1.6% and -2.3%, respectively, compared to -1.9% and -3.2%. March Core retail sales exceeded forecasts on a monthly basis at -4.5% with expectations for -4.8% and major retail sales posted a sharp decline to -8%. On the other hand, industrial production on a monthly basis came in worse than expected with a change of -5.4% compared to expectations for a reading of -4%. The readings of the claims of the, along with building permits, were higher than expected.

From Japan, February industrial production exceeded expectations of a weak reading -0.3% and expectations for production to remain around 0.4% unchanged. The triple index of industrial activity declined to -0.5% from a reading of 0.8% with expectations for a reading of -0.2%.

The Trump administration and Congress are close to reaching agreement on a $450 billion aid package to boost the small business loan program and add hospital funds and the COVID-19 epidemic testing. Especially at a time when owners of small companies were reeling with the outbreak of the coronavirus that led to the closure of much economic activity, Treasury Secretary Stephen Mnuchin said he hoped to reach an agreement that could quickly pass Congress and restore the Small Business Administration program by midweek.

“I think we are very close to today's deal,” he said, adding "I hope we can do this." But Senate Minority Leader Chuck Schumer said he believed an agreement could be reached late Sunday or early Monday. He said: "We still have some additional details to deal with."

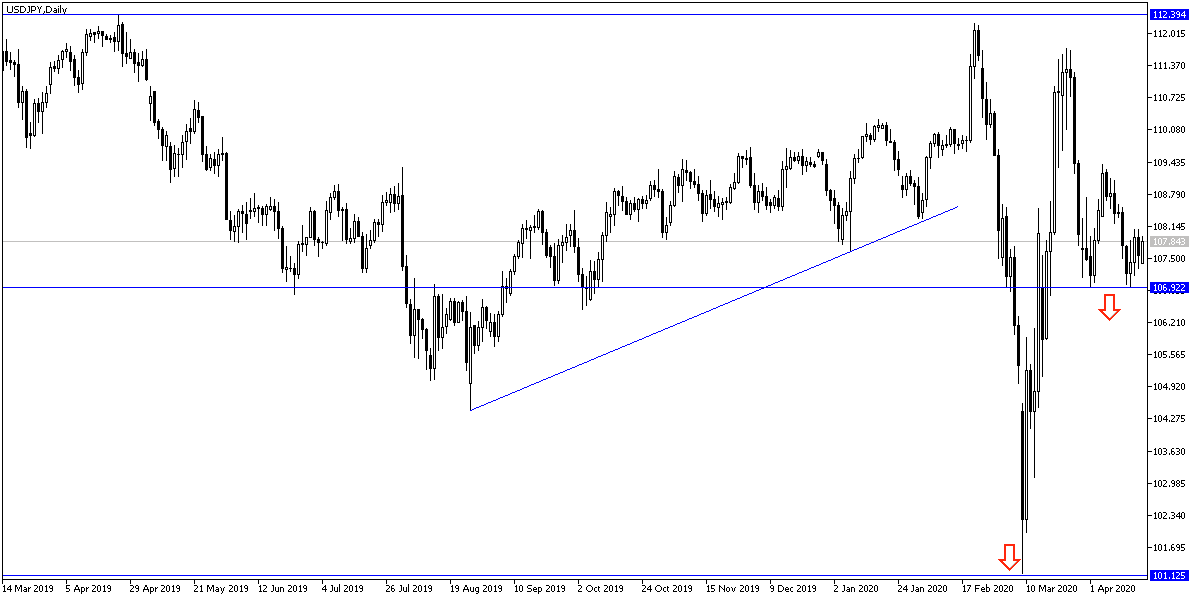

According to technical analysis of the pair: On the daily chart, it appears that the USD/JPY has recently rebounded from its multi-year low at around 101.16. The pair has not yet returned to the short-term bullish channel, amid increasing downward pressure. Therefore bulls will target long-term profits at 109.79 or higher at 111.69. On the other hand, bears will look for more profits at around 105.24 or less at 103.41. I still prefer buying the pair from every downtrend.

As for the economic calendar data today: The Japanese Trade Balance will be announced. There are no significant US economic releases today.