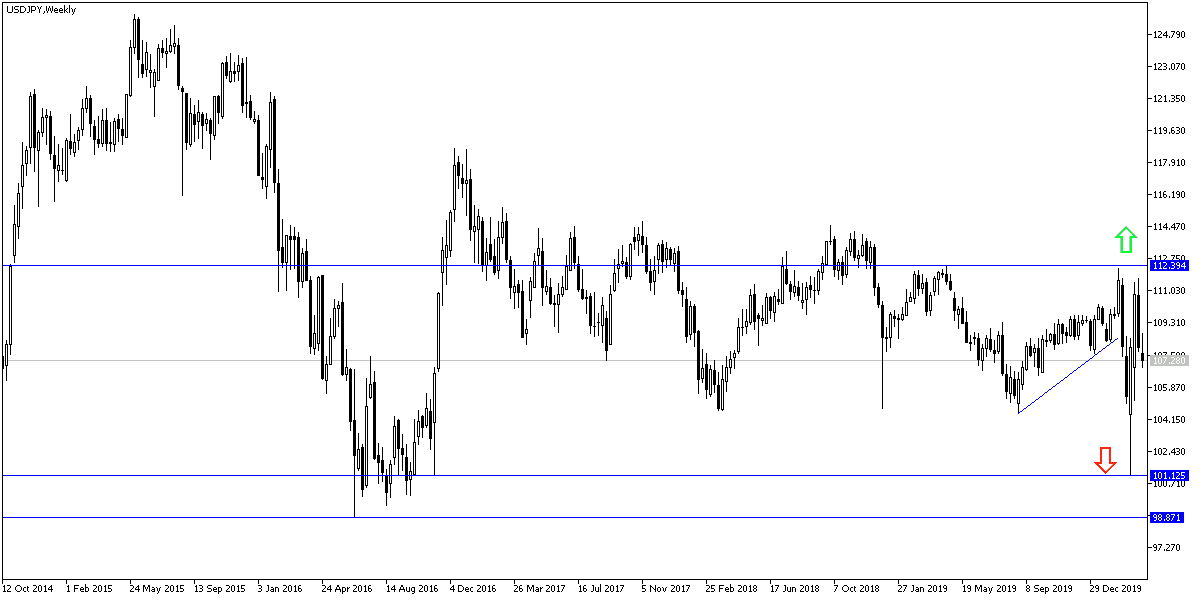

As I expected at the beginning of this week’s transactions that the US dollar pairs will remain in a state of waiting and limited movement until the announcement of updated American job numbers and amid expectations of sudden surprises, as in the last report of jobless claims that exceeded 3 million claims, which was the largest increase in the history of the modern United States of America. Since the beginning of trading this week, the USD/JPY has been moving in a range between the 108.72 resistance and the 106.91 support and is settling around the 107.15 level in the beginning of trading on Thursday. US private sector jobs fell by 27,000 in March, after jumping by 179,000 jobs in the adjusted February report.

Economists had expected private sector jobs to drop by 150,000 jobs, compared to the addition of the 183,000 jobs that were originally announced for the previous month. The decline was much smaller than expected but still reflects the first drop in private sector employment since September 2017.

The decline in US employment in the private sector came with small companies cutting 90,000 jobs, offset by an increase of 7,000 jobs in mid-sized companies and the addition of 56,000 jobs in large companies.

On the other hand, manufacturing shrank in the United States and around the world last month, affected by the economic implications of the coronavirus outbreak. Accordingly, ISM Manufacturing PMI fell to 49.1 in March after recording 50.1 in February. According to the index, any reading below the 50 level indicates contraction. The index had announced growth in January and February.

GB Morgan also mentioned that global manufacturing contracted in March. The Global Manufacturing Index recorded a reading of 47.6 in March. This was a slight improvement from 47.1 in February - but only because Chinese factories began to rise again last month after closing in February to counter COVID-19. With the exception of China, GB Morgan found that global manufacturing fell last month to its lowest level since May 2009, during the depths of the Great Recession.

Economists had expected a further drop in the US index. Timothy Fury, chair of the ISM Manufacturing Index Committee, said “things got worse” and predicted that the index would indicate further weakness in April. New orders and factory employment declined last month to the lowest level since 2009. Production and export orders also dropped.

According to the technical analysis of the pair: Bears control of the USD/JPY performance is still the strongest since the pair gave up at the 110.00 psychological resistance, and sales may increase on the pair if it settled below the 107.00 support as is the performance currently, as expectations are still indicating pessimistic US economy numbers amid of the United States' lead in numbers of coronavirus cases and deaths. The pair will turn upward without moving towards the 110.00 psychological resistance again, and this will depend on the return of confidence and optimism in the markets.

As for the economic calendar data today: All focus will be on the US economic data, which includes unemployed claims, the trade balance, and factory orders.