The bearish momentum for the USD/JPY still stands and is increasing with the investor’s rush again towards safe heavens amid increasing bleak expectations for the global economy with the ongoing world seafaring from the coronavirus. The Beige Book issued by the Fed Reserve suggested that the US economic activity contracted sharply and suddenly in all areas due to Covid-19.

The Beige Book, a group of specialized reports about the economic conditions in the 12 Fed Reserve states, suggested that the industries most affected includes entertainment, hospitality and retail due to social distancing and mandatory closure measures. With the epidemic effect on companies in many sectors, the Federal Reserve noticed the drop of employment in all areas, and sharply in many of them.

The drop of employment was the sharpest in the retail and entertainment and hospitality sectors, despite many areas reporting that the sharp employment cuts were widespread. For the coming expectations, the central bank said that the near term expectations will be for more job cuts in the coming months.

The report also mentioned the general trend towards higher inflation for selling prices and non-labor input prices, as areas reported either slow price growth, steady prices or moderate drops in prices. Economic expectations were described highly uncertain among commercial connections across all areas, with expectations for worsening conditions in the coming few months.

USD resume its rise amid a drop in investor’s risk appetite after the IMF expected a 3% drop in the global GDP for 2020 due to the coronavirus, the weakest global performance since 1929. These horrible shocking expectations came after president Donald Trump stopped funding the WHO in a protest to their management of the initial coronavirus outbreak in China, leading to its spread across the world.

The US retail sales dropped by a -8.7% in March, which is an unprecedented drop, as the coronavirus forced an almost complete closure on a national scale. Sales deterioration far exceeded the previous -3.9% drop, which happened during the great recession in 2008.

The US Commerce Department said car sales fell 25.6%, while clothing sales collapsed, falling 50.5%. Restaurants and bars recorded a revenue drop of nearly 27%.

Consumer confidence has diminished in the United States of America, with the vast majority of Americans remaining in their homes under closure orders. Consumer spending accounts for two-thirds of the US economy, and a record drop in retail sales is a symptom of a severe recession that most economists believe the United States has already entered. Economists at JPMorgan Chase now expect the US economy to shrink by a record 40% in the April-June quarter.

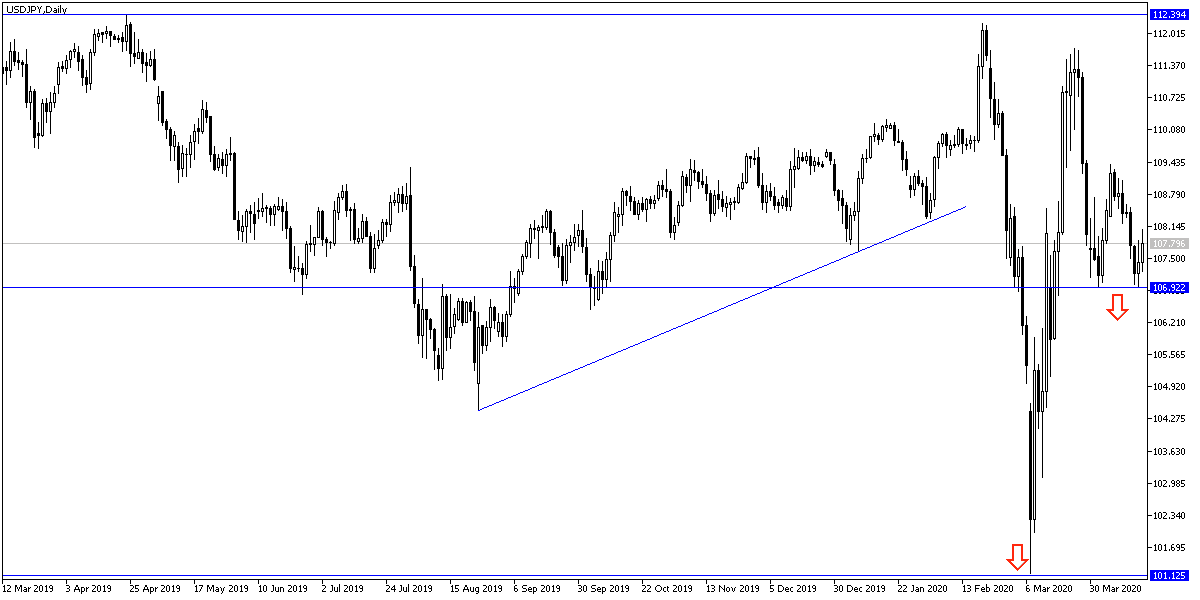

According to the technical analysis of the pair: Bears domination of the USD/JPY path is still the strongest, especially with its stability below the 108.00 psychological support. The increased risk of investors fleeing the risk will support stronger gains for the Japanese yen at the expense of the safe haven dollar as well. The next bear targets may be support levels 106.90, 106.00 and 105.10 respectively. And there will be no chance for a bullish correction without breaching the 110.00 psychological resistance and this depends on improving investor sentiment.

The pair will react to the release of the US, unemployment claims, the Philadelphia industrial index, and building permits data.