The pressures on the USD pushed the USD/JPY to retreat to the 108.20 support before closing the week's trading around the 108.45 level and complete the pace of decline at the beginning of this week's trading down to the 107.80 support at the time of writing. Results of the recent US economic releases confirmed the vulnerability of the largest economy in the world to the rapid spread of the Corona epidemic, which caused a total and strict closure of many major US states. The US CPI for the month of March fell strongly to -0.4%, against expectations of -0.3%, and on an annual basis, inflation came 1.5% below expectations at 1.6%. On the other hand, the core consumer price index, which excludes energy and food, fell below expectations, recording -0.1% against expectations of 0.1%. On an annual basis, core inflation recorded 2.1%, compared to expectations of 2.3%.

The United States of America still has the most confirmed cases and deaths of any other country around the world, with more than 530,000 cases reported and at least 20,600 deaths, according to Johns Hopkins University figures. New York State got the hardest hit, where number of deaths exceeded 700 deaths for six consecutive days, but the increase in people entering the hospital is slowing down, in a sign that gives hope to contain the disease.

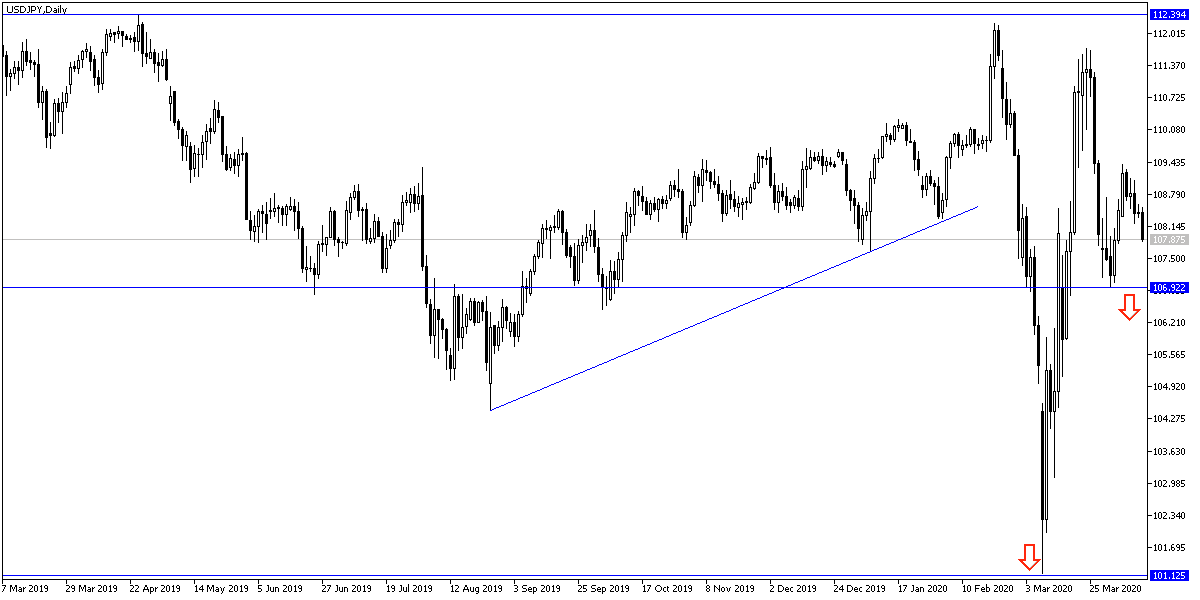

According to the technical analysis: A very quiet start is expected for the USD/JPY performance due to the Easter celebrations. On the daily chart, the pair appears to have made a sharp rebound recently from fresh lows for several years. It appears to have stopped rebound just before full recovery. It has since fallen from the middle ascending channel amid increasing volatility in the markets. Bulls will target another bounce at around 110.44, 112.06 or higher at 114.11. On the other hand, bears will look to bounce lower at support levels of 105.97 or 104.42 or less at 103.05.

On the short term, the pair is trading within a bullish channel on the 60-minute chart. The pair has recently retreated after touching the support trend line at 108.36. This could lead to the next bounce, as bulls will target short term retracements at 108.91, 109.51 or higher at 109.99. On the other hand, bear will look for profits at the support levels of 107.84 or 107.22 or less at 106.70.

As for the economic calendar data today: The agenda has no important economic data, whether from Japan or the United States due to the Easter holiday.