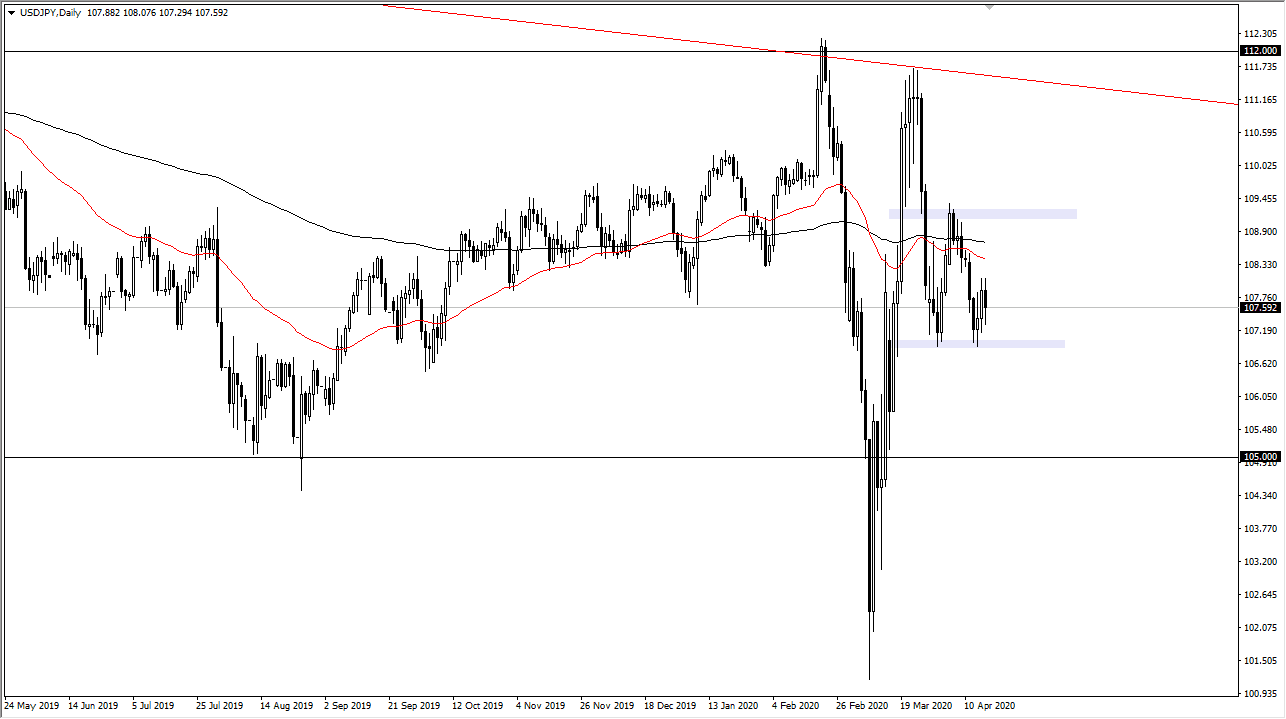

The US dollar has gone back and forth during the trading session on Friday, as we continue to see a lot of choppiness in this market. I believe that the 50 day EMA and the 200 day EMA both flattening out makes quite a bit of sense, considering that we simply have no real clear cut idea when it comes to what the risk parameters going to be, mainly because both of these currencies are considered to be safety currencies. In other words, both of these will be sought out in times of distress, although I would be the first person to admit that the Japanese yen tends to do a little bit better. In this environment, I think this explains why we have been grinding lower, not necessarily breaking down.

I believe that the ¥107 level underneath offers plenty of support, and if we were to break down below there it does open up a larger move. To the upside, I see the ¥109 level as offering significant resistance, as it had offered quite a bit of support previously. This is a market that I think is trying to carve out a range that is more acceptable for markets instead of whatever had been going on a couple of weeks ago. Those swings were way too wild for the market to sustain, so it makes sense that the energy is being sucked out of the room so to speak.

I believe that you can trade this range between ¥107 and ¥109 as a bit of a rectangle. In other words, once we break out it’s likely that we take the same measured move, meaning that the 200 point range then translates to a 200 point move on whichever direction we break. That being said, you can see that the 50 day EMA is starting to curl a little bit lower, and that suggests that we are probably more likely to see selling rather than buying. I don’t necessarily think that we break down below the ¥105 level, at least not in the near term. I do believe that we are more likely to break down towards that level than not, and this could be led by the stock market. However, I have to keep all possibilities in the back my mind as markets tend to be very noisy as of late, and although the range may have shrunk a bit, the reality is we still have plenty of short-term volatility.