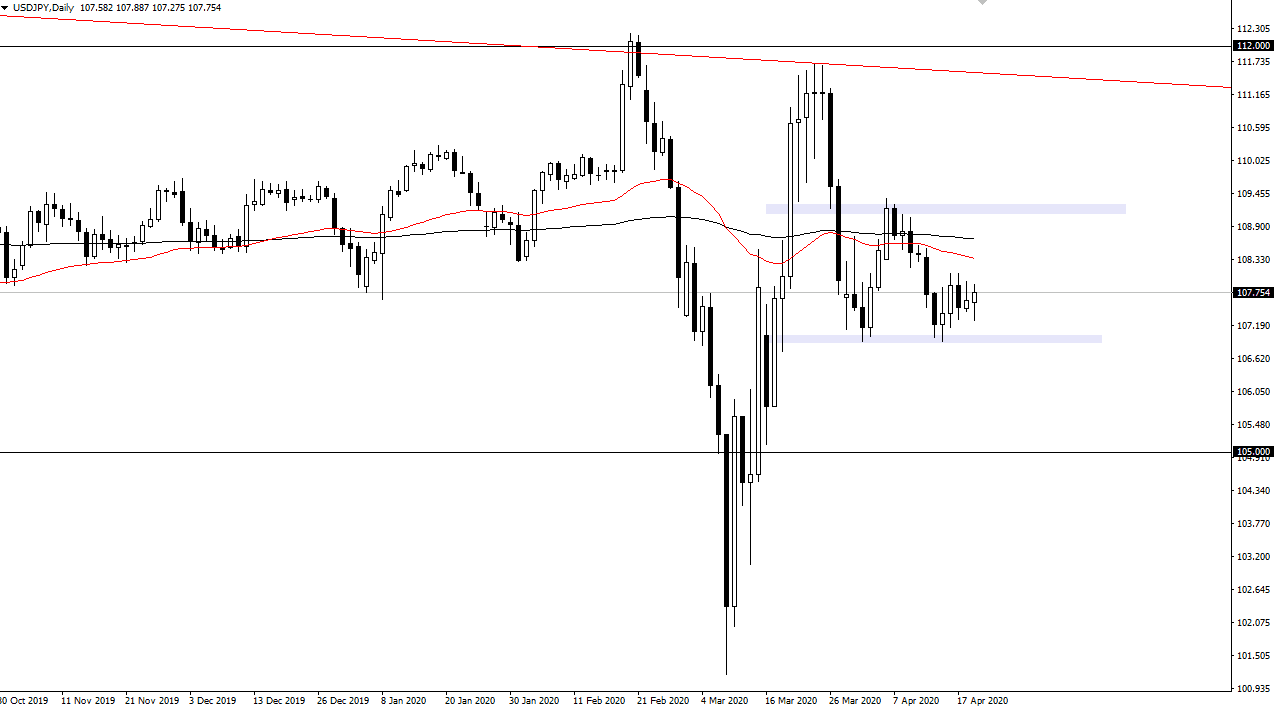

The US dollar initially fell during the trading session on Tuesday but bounced enough to turn around and form a little bit of a hammer. That being said, the previous candlestick was an inverted hammer, or perhaps a shooting star, so with this tells me is that we still have plenty of noise ahead of us going forward.

When you look at the chart it is easy to see that the ¥107 level is significant support, while the ¥109 level is significant resistance. I believe at this point the market is likely to continue to bang around in this 200 point range, and it is difficult to see a scenario where we get a huge move without something major happening. After all, both of these currencies are known as safety currencies, so it does keep a little bit more neutral than other currency pairs. For me, I believe this is a great indicator of Japanese yen strength or weakness, and to use this chart more or less as an economic indicator.

For example, if this pair is starting to fall to reach towards the lower levels, then it shows Japanese yen strength. That means that you should probably be looking to short much more sensitive currencies against the Japanese yen. For example, the AUD/JPY pair, or maybe the GBP/JPY pair. On the other hand, the Japanese yen is losing a lot of value, and this pair start reaching towards the ¥109 level, it’s possible that we could see the other pairs such as the AUD/JPY pair rallied, assuming that it’s not a major “risk off” move out there when it comes to the US dollar.

When looking directly at this pair, you can see that we are simply grinding back and forth, and it is likely that the market will continue to see a lot of back-and-forth type of range bound trading. I do not expect much, but if we were to break out of this 200 point range it would more than likely go 200 points either higher or lower, depending on whichever direction we head. In other words, a break down sends this market towards the ¥105 level, while a breakout to the upside sensitive to the ¥111 level. All things being equal, this is not an overly exciting place to be right now as these are two of the stronger currencies around the world, and therefore tend to cancel each other out.