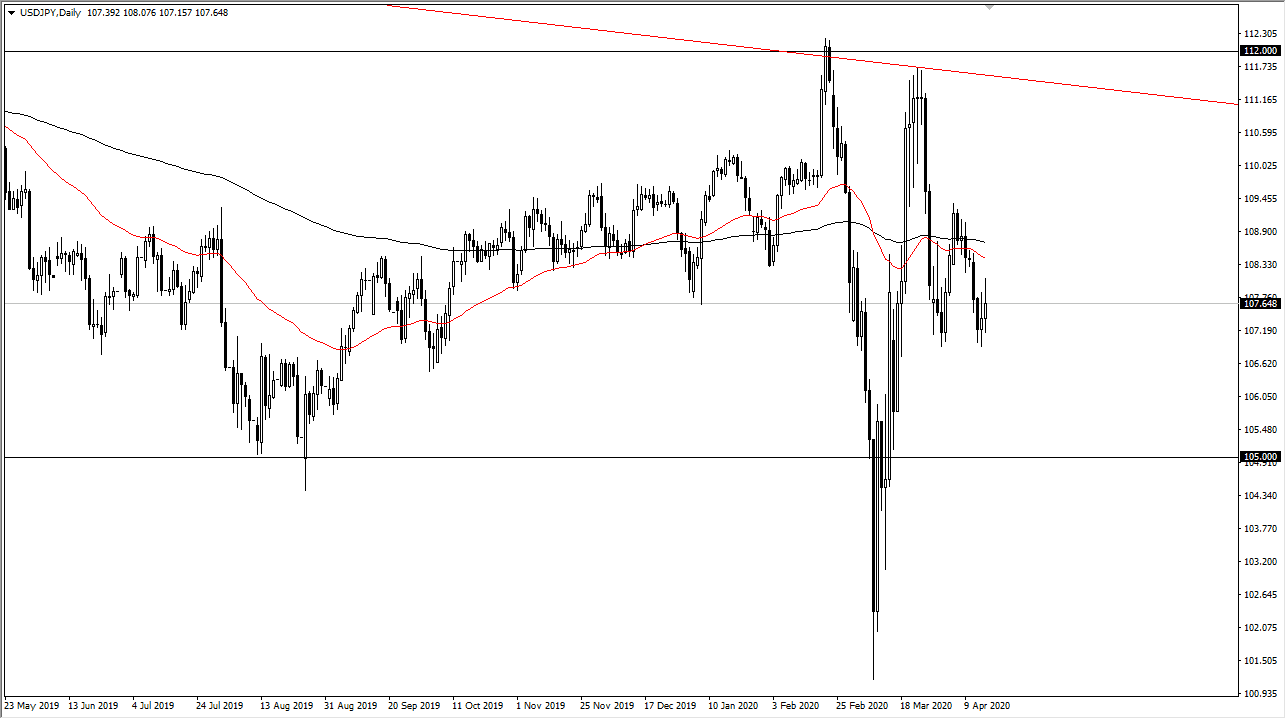

The US dollar initially pulled back a bit during the trading session on Thursday, but then shot much higher as the volatility continues. Keep in mind that the ¥107 level underneath is massive support and has now trying to form a bit of a” double bottom.” That being said, we rally from there and found a lot of trouble at the ¥108 level. Looking at this chart, it’s obvious that the market is still struggling with the idea of finding some type of support.

If the market were to break down below the lows of the trading session on Wednesday, then it opens up a move much lower. When I look at this chart, I can clearly see that we have 200 PIP range is that we have been dealing with. Between the ¥107 and ¥109 level is where we have been bouncing around lately and is the current range. However, and much like a rectangle technical analysis pattern, if we break above the top of the range, then it’s very likely that we go looking towards the ¥111 level. On the other hand, if we break down below the ¥107 level, then it’s likely that we go to the ¥105 level. In the meantime, it’s simply a matter of bouncing around and going back and forth in this general vicinity.

Keep in mind that the US dollar/Japanese yen pair is very sensitive to risk appetite overall. Typically, this pair will rally right along with the stock market, and then fall if there is a bigger “risk off” scenario. This is because the Japanese yen is considered to be one of the ultimate safety currencies out there, although the US dollar can be thought of much in the same way against most other currencies. This causes a bit of a “push/pull” dynamic in this market, and therefore I think you will continue to see choppiness regardless of what happens next. That being said, I have clear 200 point range that I can look to in order to layout the next move. The 50 day EMA and the 200 day EMA are both towards the top of the range and a relatively flat, showing that we just don’t have any momentum at the moment, but that will probably pick up relatively soon, considering that the market can’t sit forever in the same general vicinity.