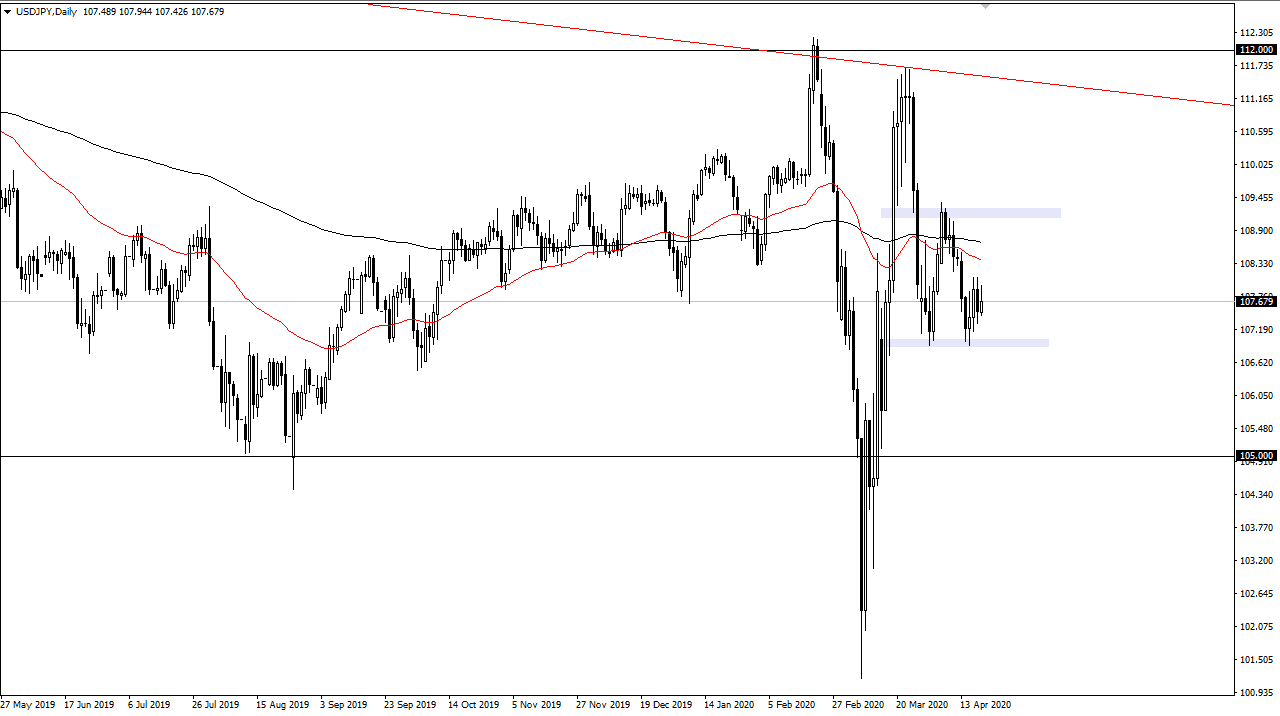

The US dollar has been relatively quiet during the trading session on Monday to kick off the week, as we continue to see a lot of ranging action. At this point, the market looks to be stuck between the ¥107 level on the bottom, and the ¥109 level on the top. At this point, the market is very unlikely to break out of this range, at least in the short term considering that the market is likely to continue to see a lot of noisy behavior. Ultimately, the market will eventually break out of this range, which is roughly 200 points.

If we break down below the ¥107 level, it’s likely that the market goes looking towards the ¥105 level after that. Granted, we need a little bit of a “push” in order to see this happen, but it certainly looks as if it is the most likely outcome of what we have seen recently. Yes, the ¥107 level has offered significant support, but the market is not able to hang on to gains for any significant amount of time. At this point, if the market does break above the range of the last couple of sessions, then we may go looking towards the ¥109 level above which is the top of the short-term range. Again, this is a 200 point range so typical technical analysis would tell you that a move towards the ¥111 level could be very possible.

The 50 and the 200 day EMA indicators are essentially flat, hanging about the ¥109 level. If we can break above there, then it is a very bullish sign but again, I believe that we only have an upside to about the ¥111 level, due to the fact that we have seen massive selling in that area, and of course this pair is highly sensitive to risk appetite. Beyond all of that, there is a downtrend line that cuts through that general vicinity as well, so I think we continue to chop around between these 200 point ranges. I would not expect easy trading, because I think at best this is going to end up being very noisy as traders try to figure out whether or not the economy is going to muddle through with the recent closing of major markets, as the coronavirus has ravaged the planet. Ultimately, we have 200 point ranges that we are trading back and forth from.