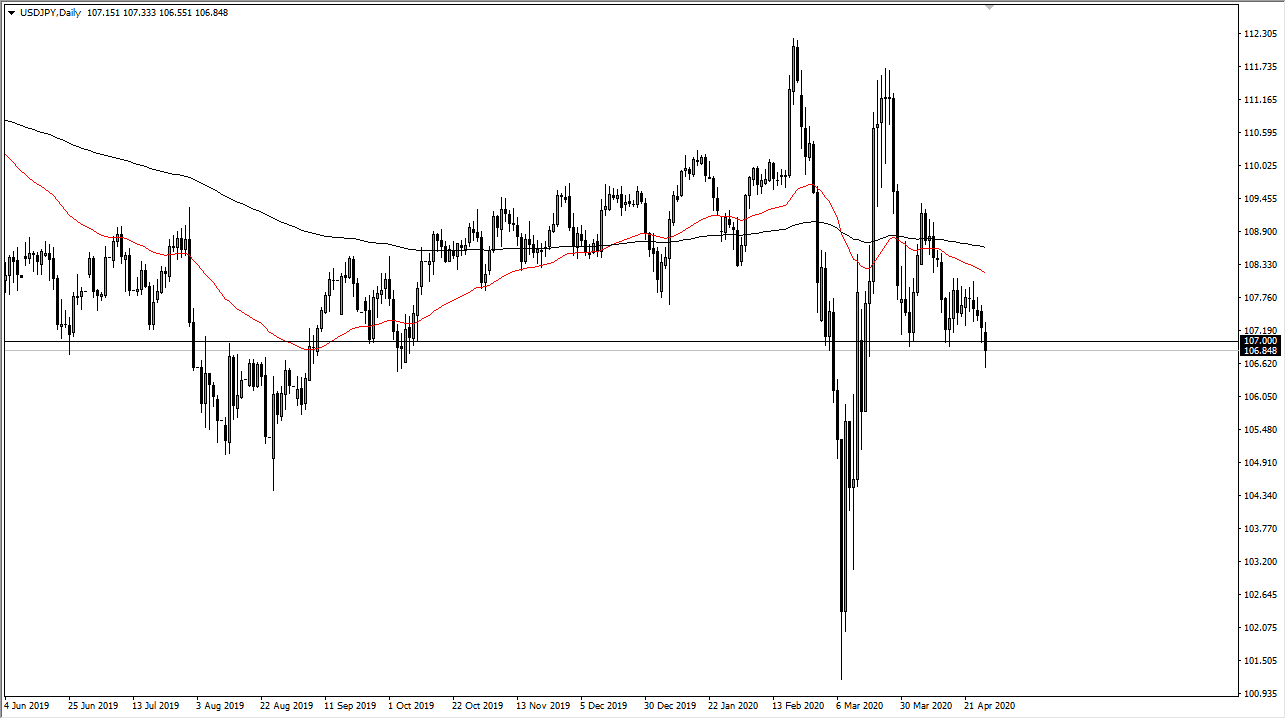

The US dollar broke down significantly during the trading session on Tuesday, slicing through the ¥107 level. This is an area that is massive support, and the fact that we breakdown through there it suggests that we have further to go in this market. Having said that, we did turn around and show signs of life though, which of course makes sense as traders would not want to be overly exposed due to the fact that the Federal Reserve could say something to throw this market into extreme volatility.

Keep in mind that this pair also has a certain amount of sensitivity to risk appetite in general, so at this point it is likely that the stock markets could throw this market around as well. The markets have gotten a bit happy, so one has to wonder whether or not we will see a market move into the Japanese yen as the market looks for safety. All things being equal, this is a market that will continue to see a lot of choppy behavior, but the fact that we break down below the ¥107 level does suggest that we could go as low as the ¥105 level, an area that shows signs of support. That being said, I would need to see this market break down below the bottom of the candlestick for the trading session on Tuesday.

On the other hand, the market was to break above the highs from the trading session on Tuesday, then the market is likely to go looking towards the ¥108 level, which will bring into picture the 50 day EMA. A move above their opens up the possibility of a move to the ¥109 level. At this point, it appears to me that the market is likely to continue to see more downward pressure than up, but at this point in time it is difficult to imagine that the market is going to be calm during the trading session on Tuesday, and I do think that the Federal Reserve statement will probably be massive in its implications. Looking at the charts now, we have a clear sell signal below the candlestick for the day. Beyond that, things get a little bit murkier, but by the end of the trading session on Wednesday, it is highly likely that we will see a bit more clarity in 24 hours going forward.