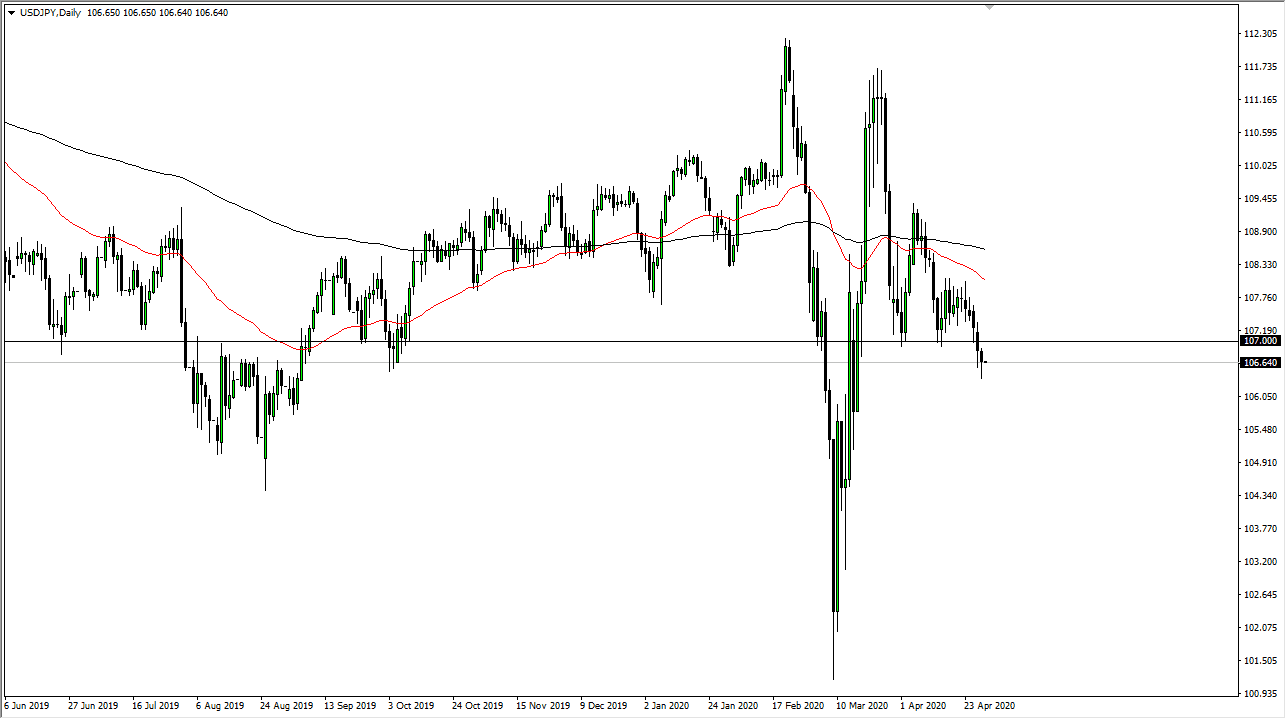

The US dollar fell during the trading session on Wednesday, but as you can see struggles to maintain any type of serious trend. At this point, the market looks as if it could bounce to reach towards the ¥107 level, an area that had been massive support in the past, and it should now be resistance. Any sign of failure in that general vicinity, would be an opportunity to start selling. At this point, if we break above that level on a daily close, then the market may go even higher. The market has recently just broken out of at 200 point range, so it does at least suggest that we could go down to the ¥105 level.

The US dollar of course got hit by Jerome Powell suggesting that the Federal Reserve is going to keep as much liquidity in the markets as necessary, and therefore it is likely that the US dollar will continue to struggle a bit. Having said that though, the Japanese yen is considered to be a safety currency so we could get a little bit of back-and-forth depending on how people react to the possibility of stimulus forever. This could be good for stock markets and that could push this pair back up to the upside, but I believe that would more than likely be temporary. On the other hand, if we break down below the bottom of the candlestick, then it is likely that the market will eventually go to that aforementioned ¥105 level, but it may take some time to get there.

That being said, expect a lot of choppy behavior and of course indecisive trading. With that being the case, you probably need to fade rallies on short-term charts more than anything else. The market continues to see a bit of a slump, and it is worth noting that the ¥107 level did offer quite a bit of support for quite some time, so being below there of course is something that you need to pay attention to. A breakdown below the bottom of the candlestick for the trading session on Wednesday is a very negative sign as it is somewhat like a hammer, so that being said I would probably be much more aggressive on that move than fading some type of rally as it would show so much in the way of extreme negativity that would need to be paid attention to.