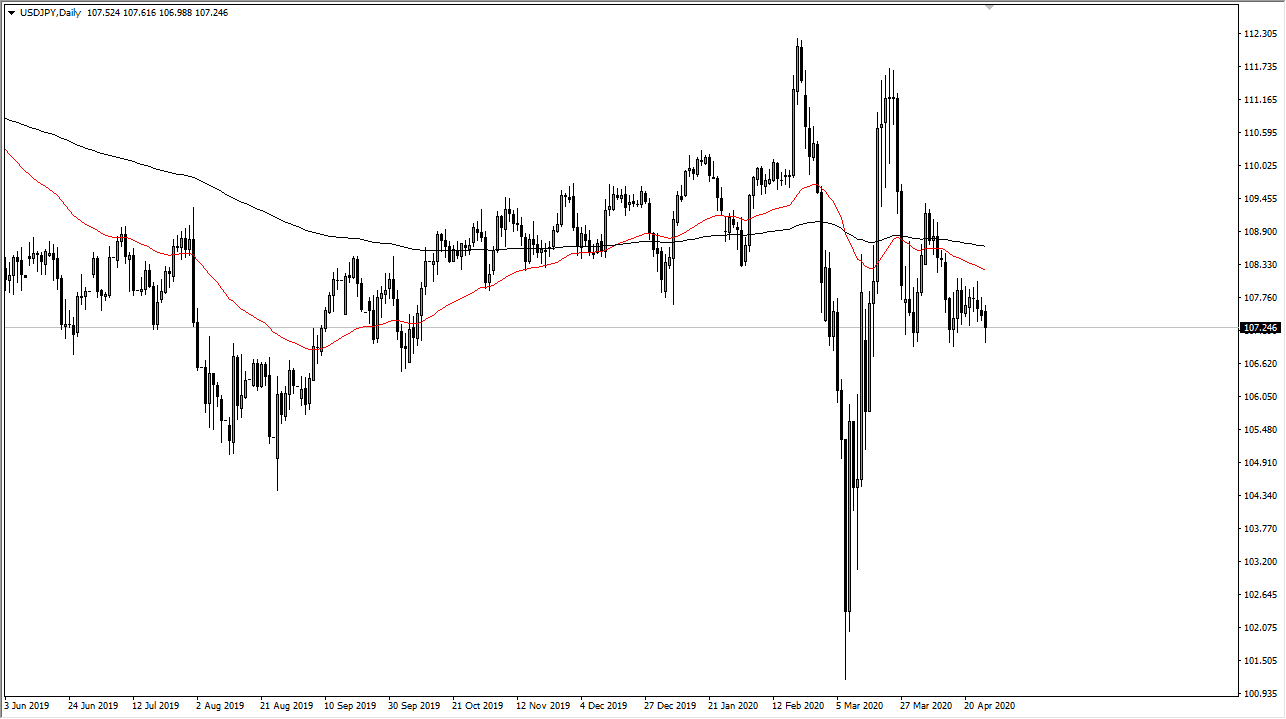

The US dollar fell during the trading session on Monday to reach down towards the ¥107 level but found buyers to save it yet again as we have a couple of times previously. In fact, we actually touched the ¥107 level before turning around early in the US session. With stocks doing relatively well during most of the day on Monday, this had people selling the Japanese yen and going into riskier assets, something that tends to lift this market a bit. However, if you look out to hire time frames you can see that this market may rollover.

The US dollar bounced as high as ¥107.25 or so, as it started out just below the ¥108 level. The candlestick is not quite a hammer, but it does look as if it is going to continue to recognize the ¥107 level as something important. That brings up the next trade, simply selling this pair on a significant break below the ¥107 level. Quite frankly, with a small stop loss you can aim for 200 pips to the downside based upon the structure of the market, making it a nice trade set up.

If that happens, there will be a bit of a “trapdoor opening” in fact, as we have seen so much in the way of buying pressure in this area over the longer term. Having said that, if we do rally from here, I anticipate that the ¥108 level will offer a bit of resistance as well. Overall, I look at this as two consolidation areas, a small one between the ¥107 level on the bottom and the ¥108 level on the top. That is inside the bigger range between ¥107 and ¥109 above there. What is even more telling is the fact that the most recent highs have been getting steadily lower.

At this point, I do not necessarily have an argument for buying this pair, because if the US dollar suddenly takes off in strength, I prefer to short other pairs like the GBP/USD instead of trying to fight the Japanese yen as it will be a safety trade, something that both of these currencies are related to. I would be even more interested in shorting the AUD/USD on signs of exhaustion if the US dollar rallies as well. Nonetheless, for me the most important part on this chart is going to be the area right around ¥107.