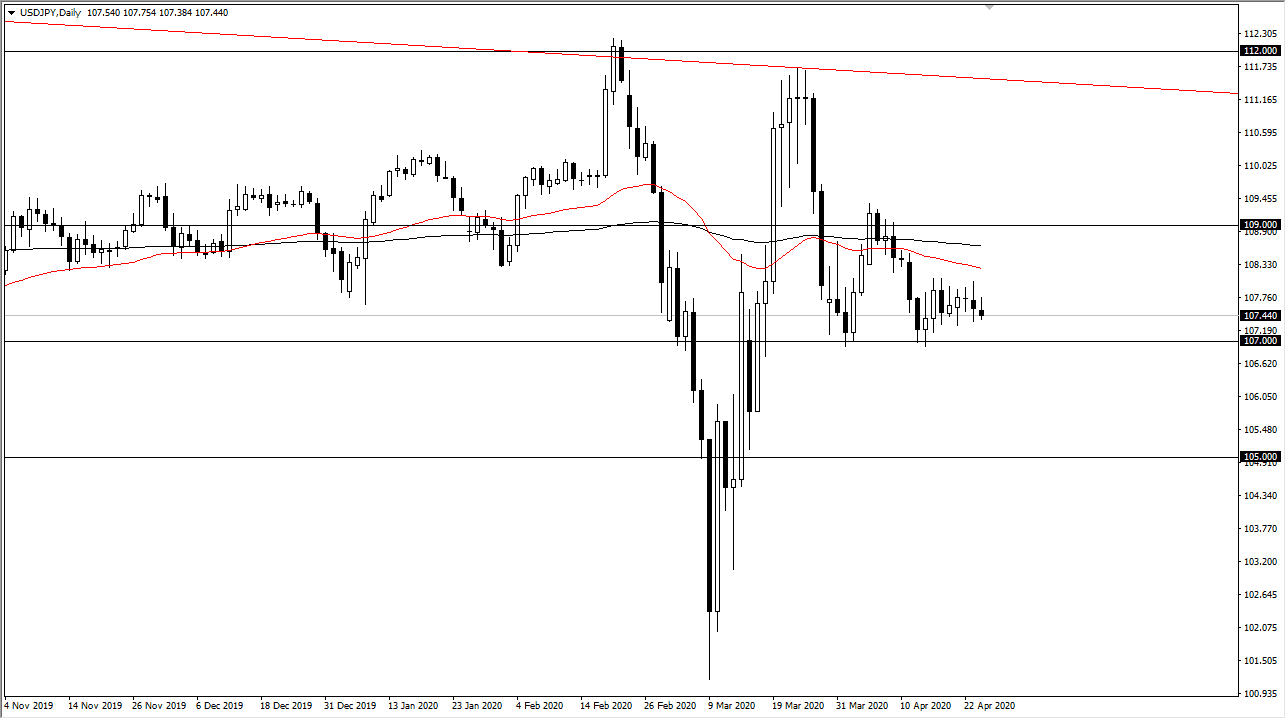

The US dollar initially tried to rally during the trading session on Friday but gave back quite a bit of the gains to form a bit of a shooting star. Ultimately this is a market that is overly sensitive to economic risk, and right now it seems as if the economic risk is firmly skewed to the downside. The ¥107 level underneath is supportive, and I think that if we break down below the level it is likely that the market will continue to go down towards the ¥105 level. At this point, the market would probably accelerate to the downside.

I suspect that if we do rally like that, we will see a significant amount of momentum pick up as it would be a significant break of an area that has obviously been important to the markets as of late. That probably coincides with some type of selloff in the stock markets, as the Japanese yen tends to gain strength when the stock market falls. On the other hand, this market tends to rally at the stock market takes out to the upside. I would say there is been a bit of divergence as of late though, at least until the last week or so as both have gone sideways and done almost nothing.

To the upside, the ¥109 level is massive resistance, and the top of a larger consolidation area. Volatility is being sucked right out of this market, as the shorter-term range is tightening up to the ¥107 level on the bottom and the ¥108 level on the top. All things being equal though, I think that the consolidation area of 200 pips gives you an opportunity to protect that move out on a breakout. In other words, the 200 PIP move to the downside or the 200 PIP move to the upside if we get that move. In the short term, it is a difficult market to trade, so therefore it is likely that the chart is going to be best used as an indicator about Japanese yen strength or weakness, and perhaps can be used as a secondary indicator for the other yen related pairs such as the AUD/JPY pair, EUR/JPY pair, GBP/JPY pair, and so on. After all, a currency is measured against the USD for overall strength as it is the world’s reserve currency. At this point, this market is one that it’s difficult to trade because it simply isn’t going anywhere.