India could enter its first annualized recession in forty years, due to the extended lockdown measures in response to the global Covid-19 pandemic. 1980 featured the last contraction when GDP fell by 5.2%. On Monday, India took steps to ease restrictions partially. Public fear is anticipated to remain elevated even after lockdown measures are removed. Before the outbreak of the virus, India was forecast to grow by 6.0% in 2020, surpassing China’s rate of expansion. Short-term breakdown pressures in the USD/INR materialized, driven by ongoing US weakness, which is mispriced across the financial spectrum.

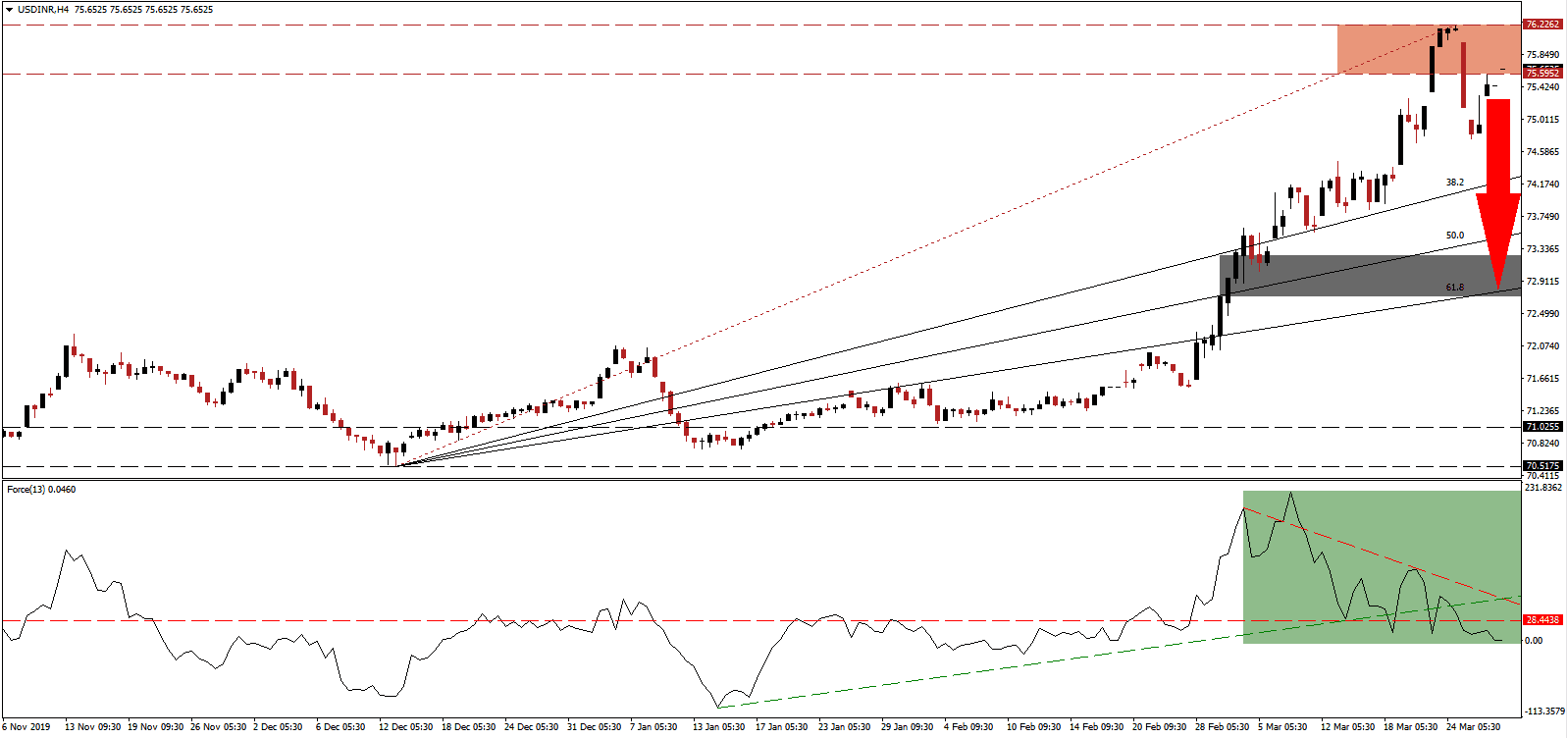

The Force Index, a next-generation technical indicator, confirms the collapse in bullish momentum after converting its horizontal support level into resistance. Increasing downside pressures is the breakdown in the Force Index below its ascending support level, now serving as resistance, as marked by the green rectangle. The descending resistance level is further pressuring this technical indicator lower. Bears are on the verge of regaining control of the USD/INR with a crossover below the 0 center-line.

After price action corrected below its resistance zone located between 75.5952 and 76.2262, as marked by the red rectangle, a reversal elevated the USD/INR back inside of it. The recovery failed to force a momentum change, and a renewed breakdown is expected. India unveiled a $22.6 billion stimulus, a fraction as compared to developed countries. A measured approach is favored, as the government resists following the mistakes of extended bailout across the economy. It adds a long-term bullish catalyst to the Indian Rupee and a bearish development for this currency pair.

By the end of April, the US is on track to report job losses above 30 million over two months. It represents over 40% more losses than total job creations since 2009. Markets underestimate the long-term negative impact on the US economy while continuing to call for an equally powerful reversal. This currency pair is well-positioned to accelerate down into is ascending 38.2 Fibonacci Retracement Fan Support Level. The pending corrective phase in the USD/INR may extend into its short-term support zone located between 72.7114 and 73.2406, as identified by the grey rectangle, and enforced by the 61.8 Fibonacci Retracement Fan Support Level.

USD/INR Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 75.6500

Take Profit @ 72.9500

Stop Loss @ 76.4500

Downside Potential: 27,000 pips

Upside Risk: 8,000 pips

Risk/Reward Ratio: 3.38

A breakout in the Force Index above its ascending support level may pressure the USD/INR farther to the upside. Long-term issues remain for the Indian economy, which is trumped by mounting problems in the US. Volatility is favored to increase, as more US data points towards a worse case than presently priced. The next resistance zone is located between 77.4509 and 77.9308. Forex traders should consider this an excellent short-selling opportunity.

USD/INR Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 76.7500

Take Profit @ 77.9000

Stop Loss @ 76.2500

Upside Potential: 11,500 pips

Downside Risk: 5,000 pips

Risk/Reward Ratio: 2.30