The US dollar has been relatively quiet against the Indian Rupee during the trading session on Monday but that’s not a huge surprise considering that a lot of the world’s largest banks were away from trading terminals when it comes to the currency markets. It was Easter Monday, and although it certainly doesn’t affect Indian banks, it does affect European Union banks and therefore a massive amount of liquidity.

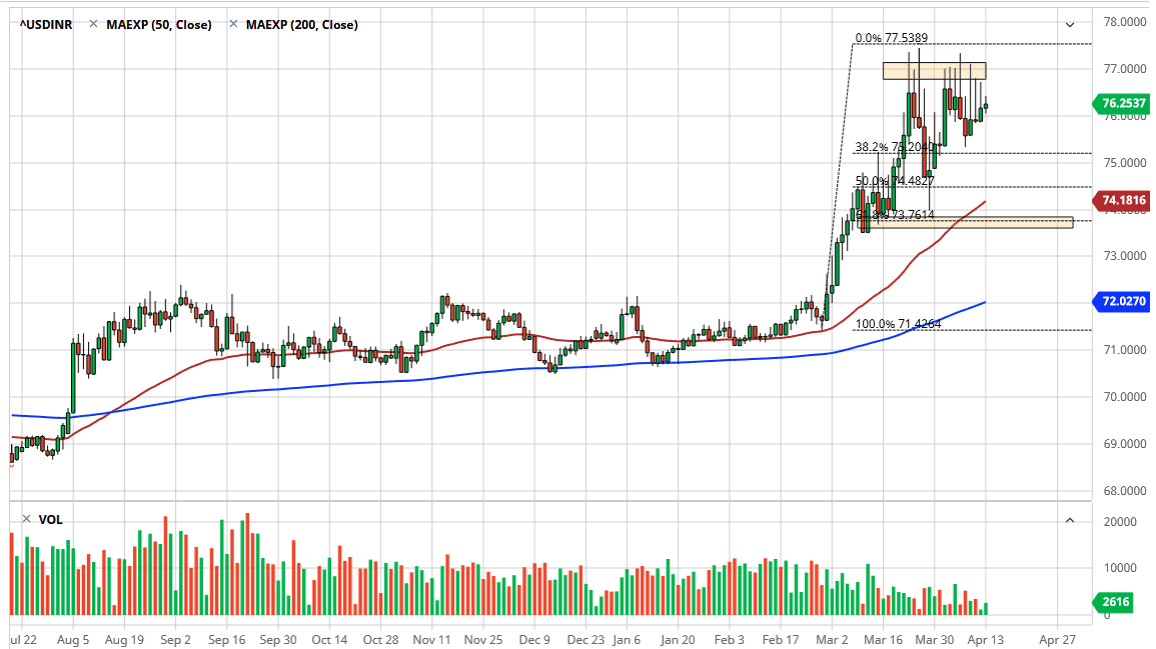

That being said, when I look at this chart the first thing that comes to light is that it’s obviously resisted just above at the 77 Rupee level. I believe that closing above 77 Rupee is going to be the main hurdle that the US dollar needs to get beyond in order to continue going higher. Remember, India’s one of the world’s great emerging markets, so this is an excellent proxy for EM currencies in general. At this point, the US dollar has been stubbornly resilient, even though we have seen several shooting stars that dig into the 77 Rupee level, normally a sign that you are getting ready to rollover. However, the greenback has held its own, despite the fact that it had been extraordinarily overdone recently.

To the downside I see the 50 day EMA, currently trading at the 74.18 Rupee level, as a potential support level that people will be paid attention to in a dynamic sense. It is worth noting that the market pulled back to the 74 Rupee level earlier, which was essentially the 61.8% Fibonacci retracement level. All things being equal, the quiet candle suggests that the market is simply going to hang out in this area, and therefore it’s worth paying attention to. I think that there will be plenty of value hunters out there and they will take advantage of the breakout if and when it happens. A break above the 77 Rupee level on a daily close could open up the door to a move towards 80 Rupee, which is the next major psychologically significant figure. That being said, I would not be concerned about the overall uptrend until we get a break down below the 61.8% fib, closer to the 74 Rupee handle. Until then I believe that buying on the dips should continue to work, especially if we get any type of negative news out of India involving the coronavirus figures as that country continues to be locked down.