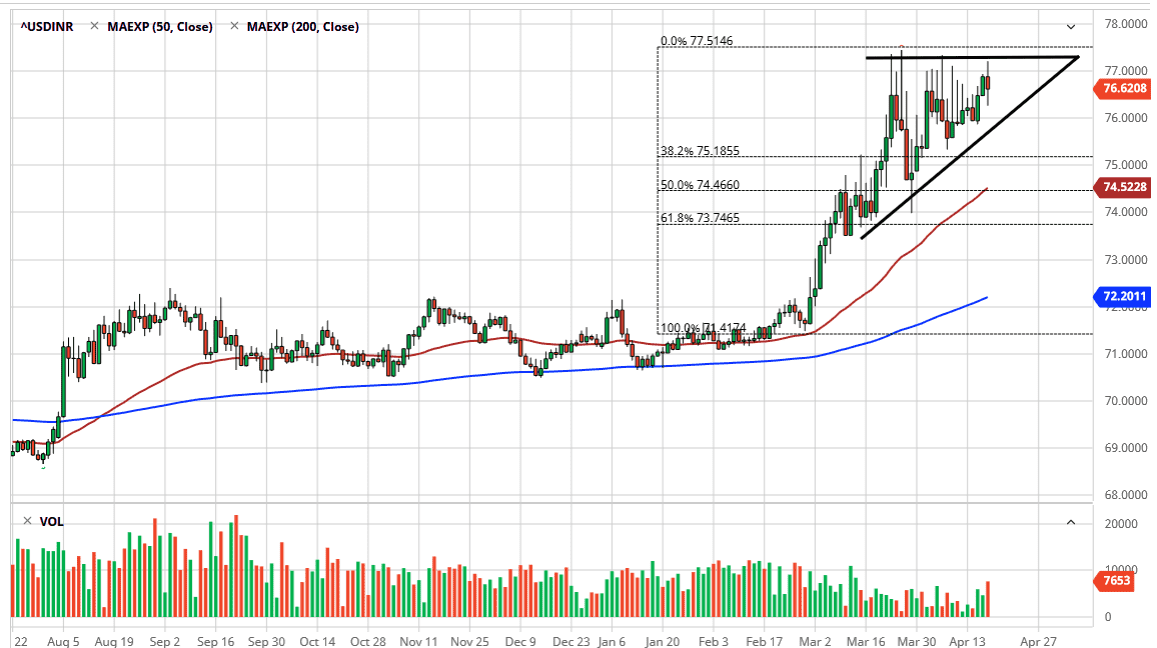

The US dollar has gone back and forth in a rather volatile session on Friday against the Indian rupee, as well as many other currencies. Just as we had seen a little bit of softness in the greenback against some of the more developed economies, it also lost a little bit against the Indian rupee, which of course is very bullish for risk. However, when you step back and look at the chart you can see that we are starting to form a distinct pattern, which is very bullish for the US dollar.

If you’ve been watching me here at Daily Forex, you know that I am bullish of the US dollar and I do think that emerging market currencies are in a lot of trouble. The ₹77 level above continues to cause issues from what I can see and therefore I think that we have been building up pressure to finally make that break out and continue going higher. It does make sense that we have been crawling along, due to the fact that we have seen a lot of bullish pressure initially and had gotten a little bit ahead of ourselves. Now we have consolidated a bit and a pattern is starting to clearly show itself.

When I look at this, and if you have been watching, you know that I have been talking about the ₹77 level with a lot of interest. We continue to see the US dollar pulled back to that area but something that’s important to pay attention to is the fact that over the last several days, the US dollar has been able to keep quite a bit more of the gains than it had been doing previously. If that’s the case, it shows that the buyers are starting to chip away at that massive resistance. While I can’t necessarily call it an ascending triangle, it is something like that. That makes sense, because most of these emerging market currencies are pretty noisy. It’s rare that you get a perfect pattern, but this says the same thing: every time the US dollar pulls back, buyer step in to pick it up. India is still under extreme lockdown, and it looks very likely that India recovering from the coronavirus pandemic is going to take quite some time. India is going to enter its first recession in almost 40 years, which of course doesn’t help the scenario either. Emerging market debt, denominated in US dollars, will be the next major thing we are all talking about.