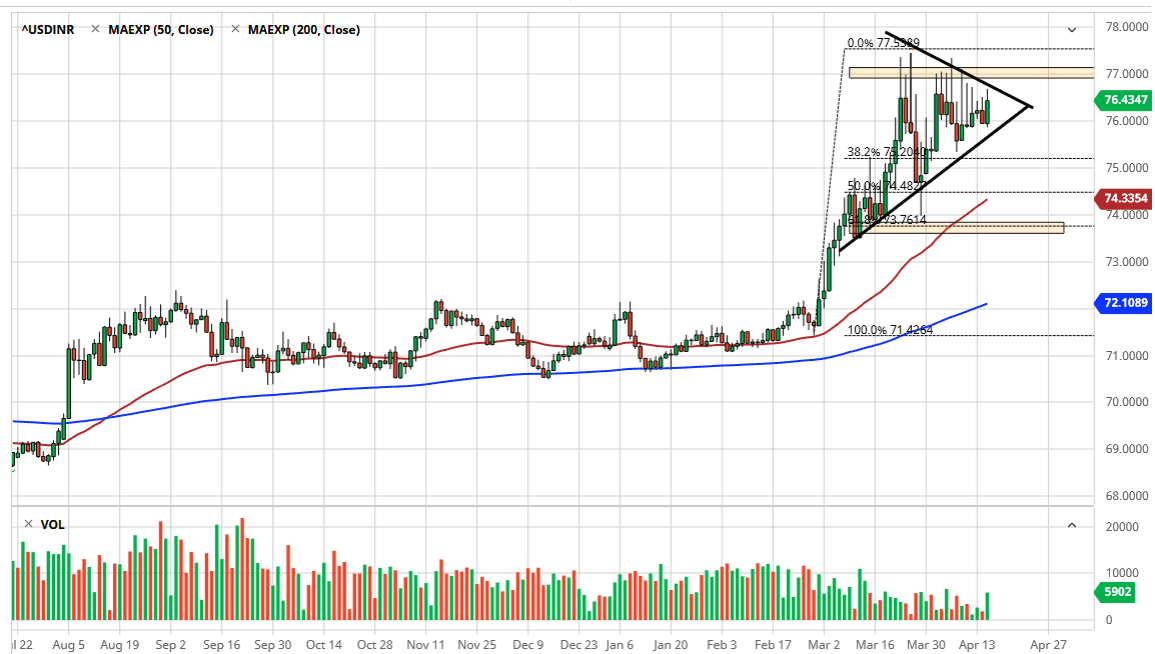

The US dollar has rallied against the Indian Rupee during the trading session on Wednesday, but unlike the previous candles over the last couple of weeks, the wick is much shorter. What does this tell us? It shows that people are much more comfortable hanging onto the greenback at the end of the session on Wednesday than they were several other days before. Granted, this in and of itself isn’t necessarily a signal to start buying but it does give you an idea as to where the market might be “leaning.”

I see the 77 Rupee level above as an area that will probably have a lot of resistance, but if we were to break above that level it opens up the door towards the 78 Rupee, and then perhaps even the 80 Rupee level over the longer term. Granted, the USD/INR pair tends to be rather choppy, but it does trend for ages. Furthermore, we are forming some type of wedge at this point, and therefore it’s likely that we will see some type of pressure buildup and then an explosive move. Right now, although there has been a ton of wicks above, it certainly looks as if the selling pressure is starting to crack a bit.

To the downside, if we were to break down below the bottom of the wedge then it’s likely that we could go down towards the 75 Rupee level where we will probably start to come into contact with the 50 day EMA, which of course is an indicator that will attract a lot of attention by traders as we are in a strong uptrend. Furthermore, you have to keep in mind that there is a lot of global fear out there and India is essentially locked down and entering its first recession in over 40 years. While the United States is going to be in a recession as well, the greenback tends to be more of a safety currency and of course there is high demand for the US treasury market right now, which continues to make lower yields. As long as that’s the case, it means that there are a lot of buyers out there when it comes to US bonds. All things being equal, I think that short-term pullbacks probably offer buying opportunities in this market, but as far as a big move is concerned, we need to break out of this wedge at the very least.