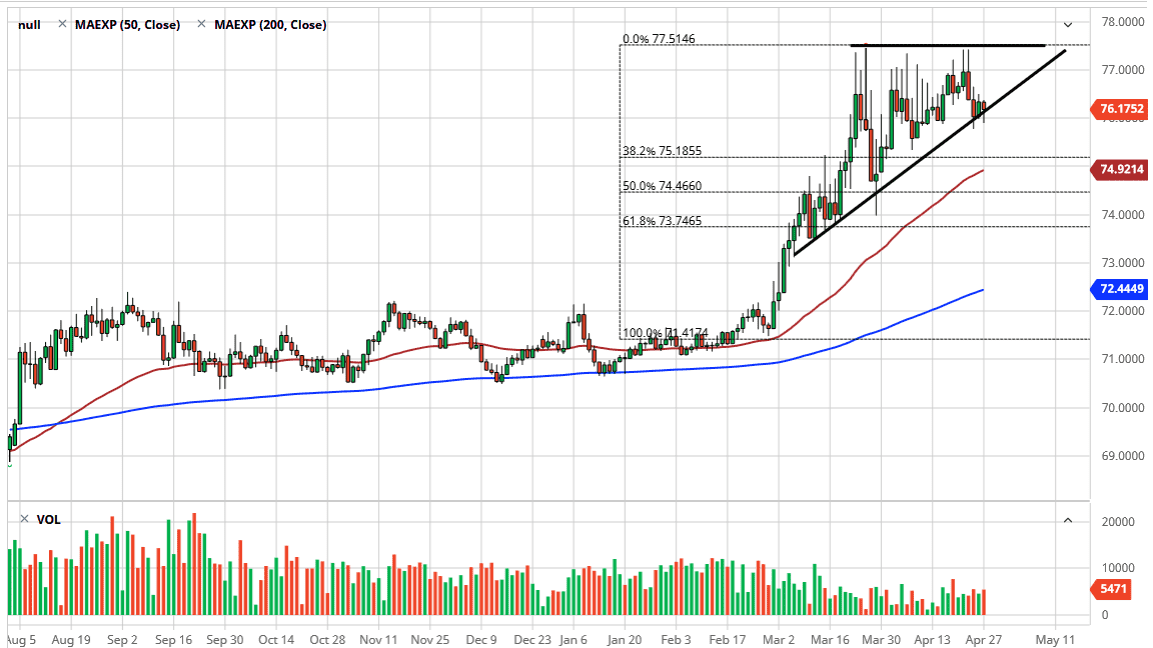

The Indian rupee is likely to find a bit of pressure when facing the greenback during the trading session on Tuesday as the Monday session had seen the USD/INR break down below the ₹75 level momentarily, before turning around to form a hammer. Furthermore, the hammer formed right on an uptrend line, continuing the overall bullish pressure that we have seen. The question now is whether or not there is a lack of momentum or if it is simply a bit of consolidation.

At this point, the market does look like it is ready to turn around and go looking towards the ₹77 level, an area that begins significant resistance to the ₹77.50 level. Once we can clear that level, the market is likely to go much higher, as it would be a very bullish sign. Because of this, if the market were to break above there then you need to start looking at the ascending triangle for some type of measured move. You could be looking at a move to the ₹82 level over the longer term, but clearly the ₹80 level would be an area where people would be looking for some type of resistance based upon the psychology of the large, round, psychologically significant figure.

As always, you need to keep the alternate scenario in the back of your mind. If the market were to break down below the ₹76 level on a daily close, then it is likely that the market goes looking towards the ₹75 level underneath, which is not only a psychologically important figure but it is also where we will find the 50 day EMA as it is racing towards that level. That is an area that should offer support as well, so it is not until we break down below there that I would be concerned. At this point, I do believe that pullbacks offer value, especially as although the stock markets have done a little bit of risk on behavior, the reality is that a lot of the issues that have been out there for the emerging markets continue to be a major problem. Furthermore, the fact that we have formed a hammer suggests that there is plenty of buying pressure underneath. It looks as if the market is simply going to try to build up enough momentum to finally go higher. At this point, I do not have any interest in shorting this market quite yet.