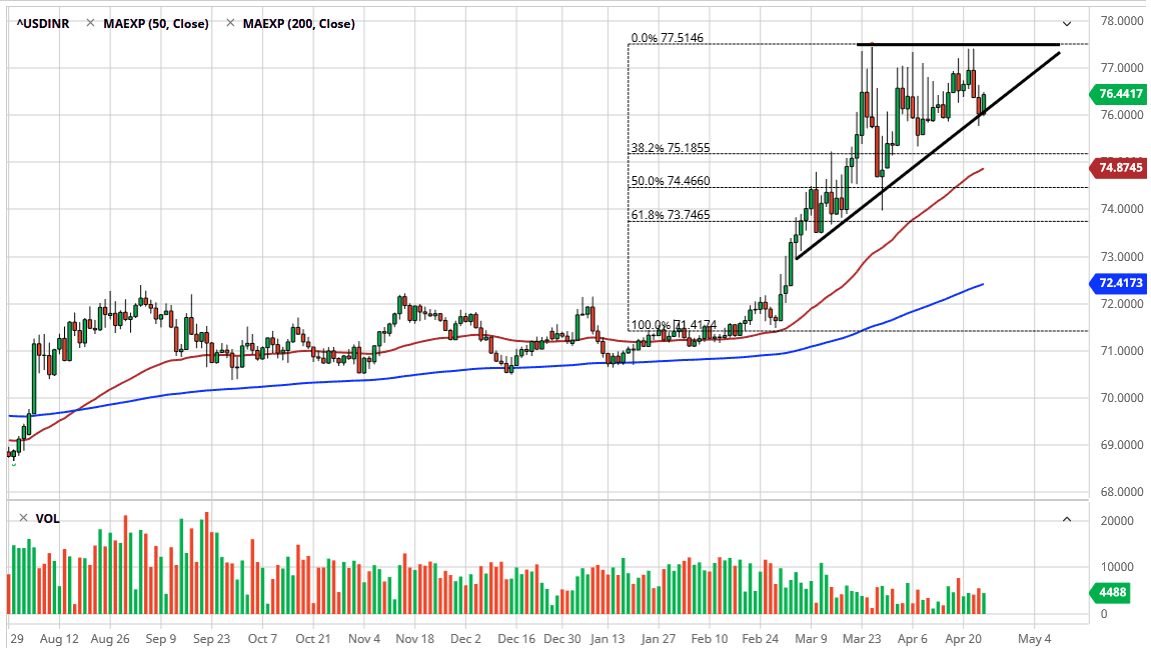

The US dollar has rallied a bit during the trading session on Friday to close out the week, as we touched the uptrend line and of course the ₹76 level. Ultimately, this is a market that has been grinding away to the upside and now that we have pulled back, a certain amount of the value of this trade comes back into play. After all, the US dollar is much more favored than the Indian rupee as you can see, over the last several weeks.

To the upside, the ₹77.50 level offers significant resistance, which we have pulled back from several times. The resiliency of the US dollar should be acknowledged on this chart, and therefore I think it is likely to continue to reach towards that area and it does show a real bit of tenacity as we haven’t been able to break above that area but we obviously haven’t given up there either. Underneath, there is an uptrend line that should continue to support this market, as well as the 50 day EMA which is approaching the ₹75 level.

This is why I believe that the market is going to find plenty of support sooner rather than later. Beyond that, you should also pay attention to the fact that India is going to continue to suffer the effects of the coronavirus for quite some time and is under significant lockdown. The United States is currently starting to see the economy try to open back up in the next few days, so it makes quite a bit of sense that we should see the US dollar rally on that front as well. Beyond that, as the global supply chain is falling apart, there seems to be more demand for US Treasuries. This naturally drives up the demand for the US dollar. At this point, it is difficult to imagine the people were looking to buy into the emerging market economies, and that of course includes India. India is entering its first recession in over 40 years, and that is something that certainly cannot be overlooked as well. Buying dips and waiting for the massive breakout is how I am playing this market, expecting a move to the ₹80 level before it is all said and done. I have no interest in shorting this market anytime soon but would reevaluate the entire situation if we closed on a daily candlestick underneath the ₹75 level.