India announced an extension of the nationwide lockdown until the end of April. Like many other economies, a slowdown was gathering steam before the global Covid-19 pandemic. The World Bank predicts Indian GDP to expand between 1.5% and 2.7% for the fiscal year of 2021, which began in April. Given the persistence of the virus, as evident in rising infections in China, together with anticipated long-term modifications to existing operating models and supply chains, increase the threat of a prolonged global economic recession. The USD/INR completed a breakdown below its resistance zone, on the back of significantly softer US data, a trend favored continuing.

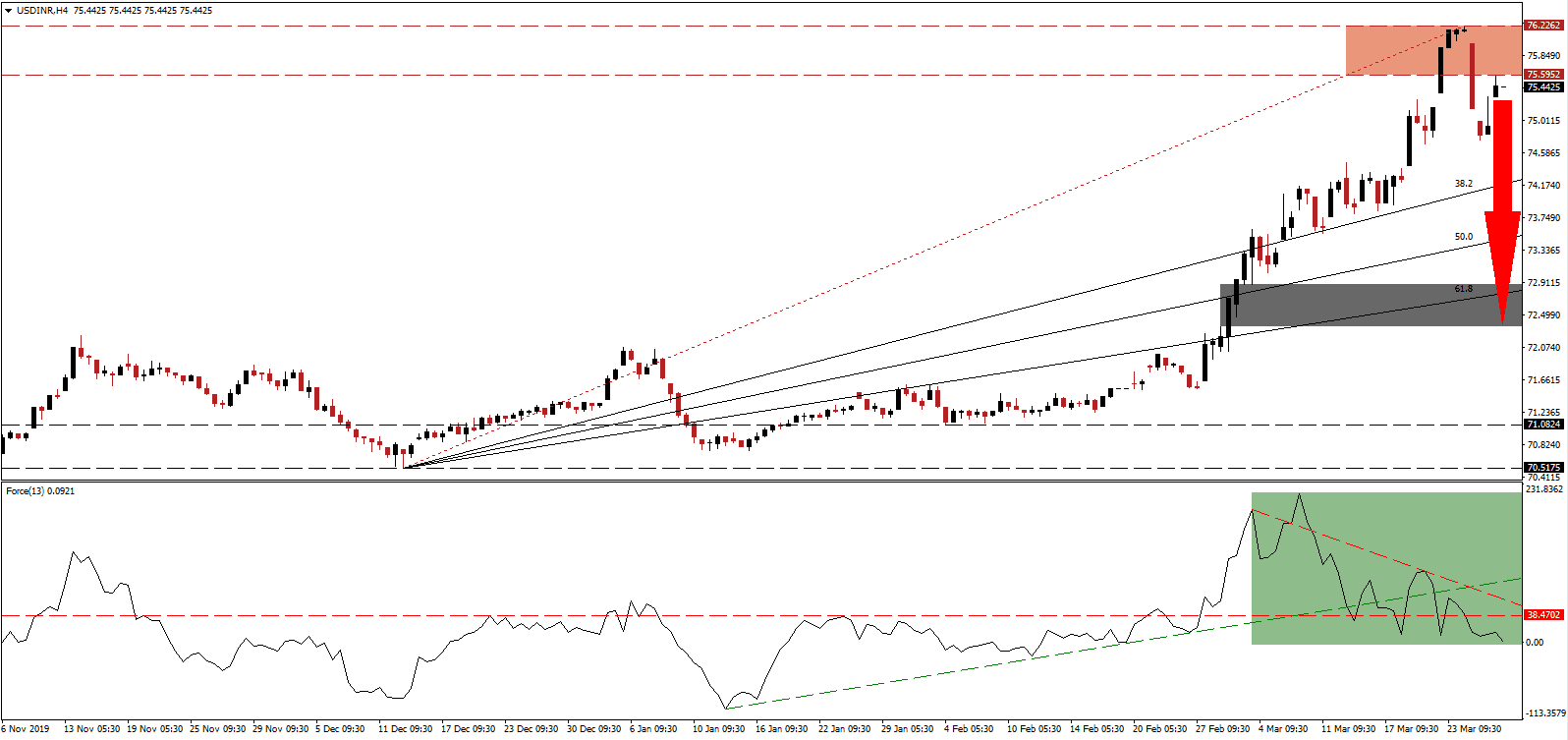

The Force Index, a next-generation technical indicator, contracted from a new 2020 peak and formed a series of lower highs and lower lows. Downside pressure increased, led by its descending resistance level, and the Force Index moved below its ascending support level. It was followed by a conversion of its horizontal support level into resistance, as marked by the green rectangle. This technical indicator is on track to cede control of the USD/INR to bears with a breakdown into negative territory. You can learn more about the Force Index here.

Following the breakdown in this currency pair below its resistance zone located between 75.5952 and 76.2262, as marked by the red rectangle, news of the lockdown extension pushed the USD/INR back into the bottom range of it. India announced a $22.6 billion stimulus to provide direct cash transfers and food security measures. A second $13 billion stimulus to support small and medium-sized businesses, employing over 500 million workers, is rumored. Calls to deliver a total relief package worth 10% of the $2.9 trillion-economy are on the rise.

One essential level to monitor is the intra-day low of 74.7583, the base of the current breakdown. A sustained move lower is likely to initiate the next wave of sell orders, delivering the necessary downside volume to push the USD/INR into its ascending 38.2 Fibonacci Retracement Fan Support Level. A breakdown extension, fueled by ongoing economic disappointments out of the US, is expected to take price action into its short-term support zone located between 72.3502 and 72.8968, as marled by the grey rectangle.

USD/INR Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 75.4500

Take Profit @ 72.3500

Stop Loss @ 76.2500

Downside Potential: 31,000 pips

Upside Risk: 8,000 pips

Risk/Reward Ratio: 3.88

Should the Force Index reclaim its ascending support level, the USD/INR is anticipated to drift to fresh 2020 highs. Any breakout from current levels appears unsustainable, and will not accurately reflect fundamental conditions. The next resistance zone is located between 77.1307 and 77.6950. Forex traders should cautiously consider taking advantage of a temporary price spike with new short orders.

USD/INR Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 76.6500

Take Profit @ 77.6500

Stop Loss @ 76.2500

Upside Potential: 10,000 pips

Downside Risk: 4,000 pips

Risk/Reward Ratio: 2.50