US initial jobless claims continue to mount, with next week’s data likely to surpass 30 million job losses over two months due to the global Covid-19 pandemic. PMI data and regional economic reports suggest a depressionary environment. The housing market, creating the essential wealth effect that powers debt-induced consumer spending on which the US economy is built on, is in more dire shape than before the 2008 global financial crisis. Dealing an additional blow to confidence was news that remdesevir, developed by US-based Gilead Sciences, failed to provide a cure for the virus. The USD/CHF is experiencing a bullish momentum loss, favored to initiate a profit-taking sell-off.

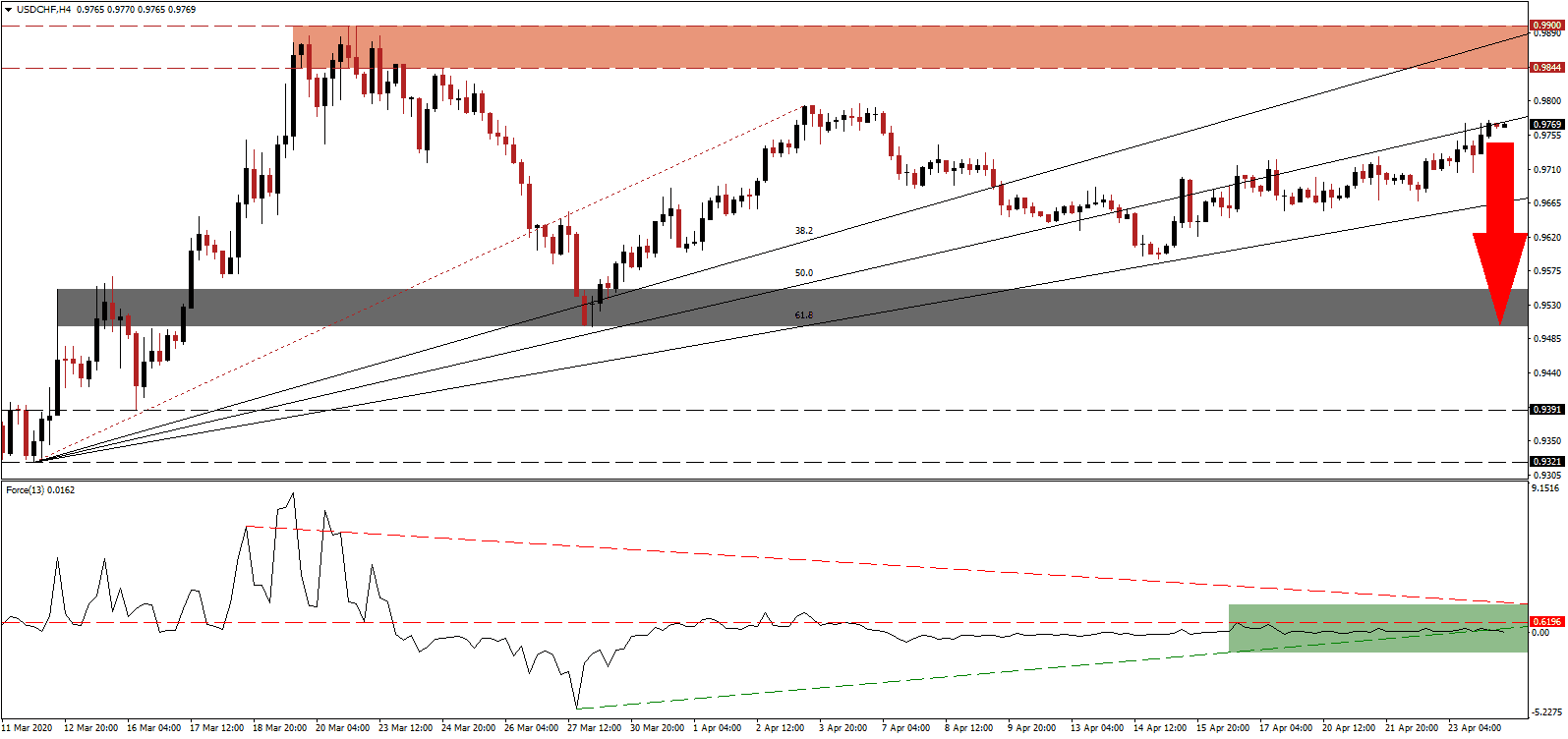

The Force Index, a next-generation technical indicator, points towards the ongoing demise in momentum since the conversion of its horizontal support level into resistance. With the descending resistance level enforcing breakdown pressures, the Force Index corrected below its ascending support level, as marked by the green rectangle. A collapse in this technical indicator into negative territory will grant bears full control of the USD/CHF, driving price action into a more massive corrective phase.

Optimism fueled a reversal in this currency pair, after bouncing off of its ascending 61.8 Fibonacci Retracement Fan Support Level. While the 38.2 Fibonacci Retracement Fan Resistance Level entered its resistance zone, located between 0.9844 and 0.9900, as marked by the red rectangle, bearish momentum is rising slowly. The USD/CHF is now facing rejection by its 50.0 Fibonacci Retracement Fan Resistance Level. Today’s durable goods orders out of the US are expected to offer a fundamental catalyst, which may spark the pending sell-off in this currency pair.

Switzerland administered an efficient financial rescue package for small to medium-sized businesses, forming the backbone of its economy and labor market. The US copied this approach, but the majority of funds went to large, publicly listed companies, forcing the government to replenish the depleted fund. With elevated risks dominant across the spectrum, the USD/CHF is well-positioned to correct into its short-term support zone. This zone awaits price action between 0.9501 and 0.9550, as identified by the grey rectangle. A breakdown extension is possible, but a new catalyst is required.

USD/CHF Technical Trading Set-Up - Profit-Taking Scenario

Short Entry @ 0.9770

Take Profit @ 0.9500

Stop Loss @ 0.9850

Downside Potential: 270 pips

Upside Risk: 80 pips

Risk/Reward Ratio: 3.38

Should the Force Index push through its descending resistance level, the USD/CHF is anticipated to extend its current advance. It will position price action for a more massive collapse in the future, and Forex traders are recommended to consider a breakout from current levels as a selling opportunity. The next resistance zone is located between 0.9969 and 1.0000, with parity presenting an essential psychological resistance level.

USD/CHF Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 0.9920

Take Profit @ 1.0000

Stop Loss @ 0.9880

Upside Potential: 80 pips

Downside Risk: 40 pips

Risk/Reward Ratio: 2.00