US President Trump aims to maintain voter trust in the economy post-Covid-19. Several states on both coasts are debating plans on partially reopening their economies before the federal government acts. Trump wrongly believes that he has the sole authority to deliver such an order. Dr. Anthony Fauci, the Director of the National Institute of Allergy and Infectious Diseases since 1984 and the country's premier infectious disease expert, notes a partial resumption of economic activities is possible in May in select states. He cautions safe individual voting on November 3rd cannot be guaranteed. The USD/CHF is under renewed breakdown pressures inside of its short-term resistance zone.

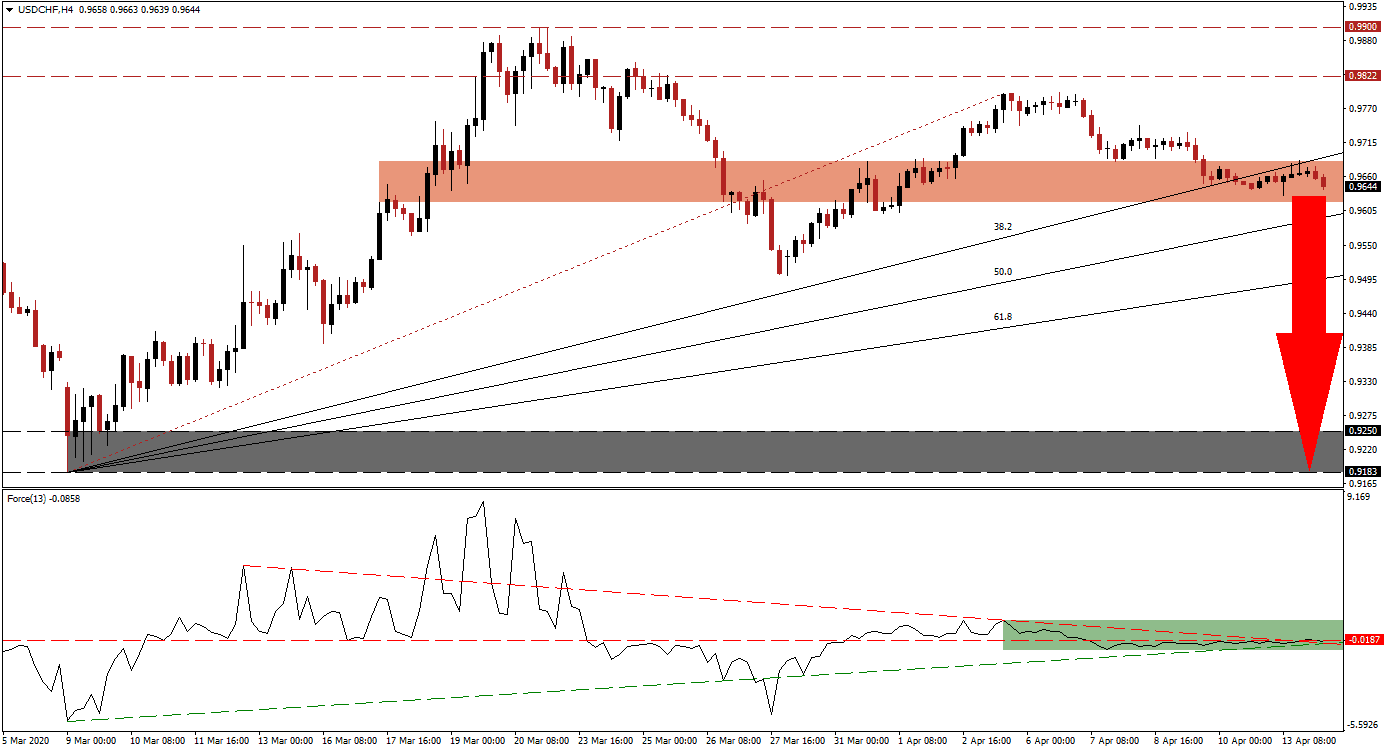

The Force Index, a next-generation technical indicator, shows the absence of bullish momentum. After the ascending support level and descending resistance level crossed, bearish pressure expanded. The Force Index contracted below the horizontal resistance level, as marked by the green rectangle. This technical indicator ceded control of the USD/CHF to bears following its contraction into negative territory, from where more downside is likely. You can read more about the Force Index here.

After reversing the breakout above its short-term resistance zone located between 0.9618 and 0.9684, as identified by the red rectangle, fundamental circumstances further deteriorated, led by the collapse in the labor market. US Treasury Secretary Steven Mnuchin and White House economic adviser Larry Kudlow follow the president’s path of ignoring health care experts with a focus on returning to full economic activity, crucial to Trump’s re-election. A third-quarter recession may be too much for his presidency to overcome if history is a guide. Given the uncertain outlook, the safe-haven appeal of the Swiss Franc is adding a bearish catalyst to the USD/CHF.

One essential level to monitor is the ascending 50.0 Fibonacci Retracement Fan Support Level, narrowing the gap to the bottom range of the short-term resistance zone. A breakdown below this level is favored to spark a profit-taking sell-off, providing the necessary volume for an extended correction in the USD/CHF. It will clear the path for price action to accelerate into its support zone located between 0.9183 and 0.9250, as marked by the grey rectangle. You can learn more about the Fibonacci Retracement Fan here.

USD/CHF Technical Trading Set-Up - Profit-Taking Scenario

- Short Entry @ 0.9645

- Take Profit @ 0.9185

- Stop Loss @ 0.9745

- Downside Potential: 460 pips

- Upside Risk: 100 pips

- Risk/Reward Ratio: 4.60

A spike in the Force Index, assisted by the ascending support level, could pressure the USD/CHF higher. Forex traders are advised to consider a breakout from current levels as an outstanding selling opportunity, on the back of a worsening fundamental outlook for the US economy. The upside remains limited to its long-term resistance zone located between 0.9822 and 0.9900.

USD/CHF Technical Trading Set-Up - Limited Breakout Scenario

- Long Entry @ 0.9785

- Take Profit @ 0.9885

- Stop Loss @ 0.9745

- Upside Potential: 100 pips

- Downside Risk: 40 pips

- Risk/Reward Ratio: 2.50