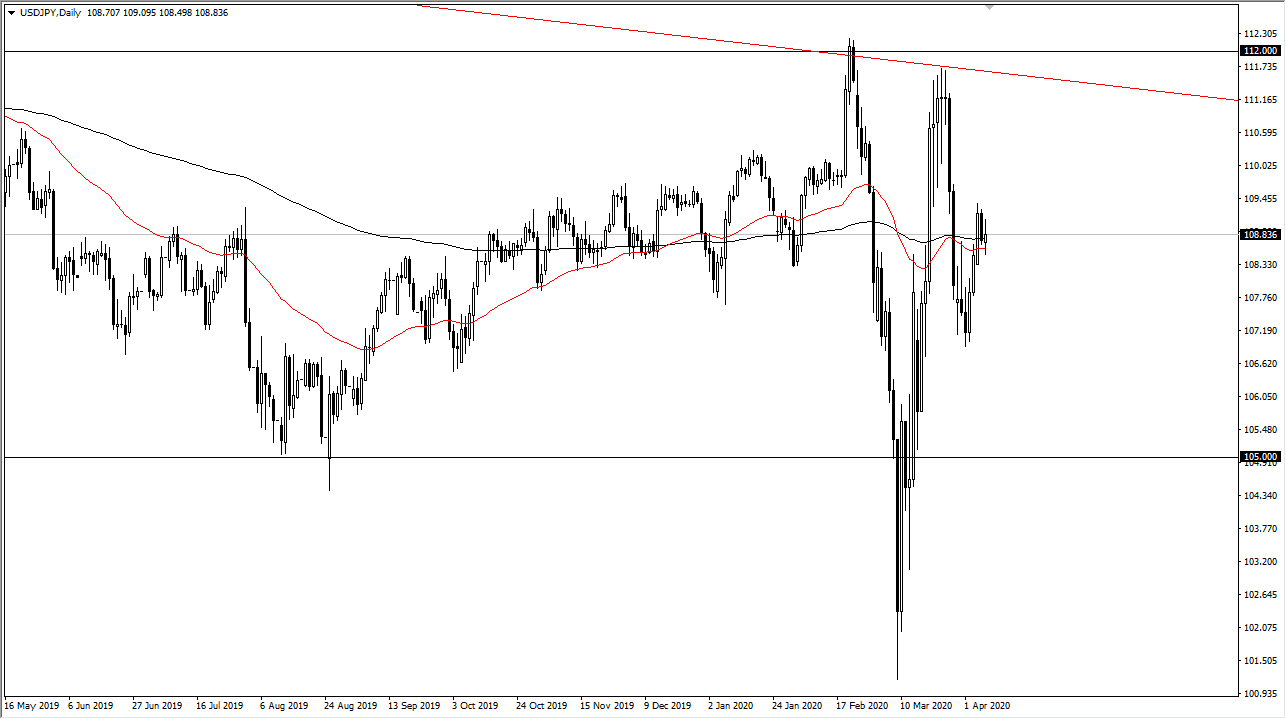

The US dollar has gone back and forth during the trading session on Wednesday, as the market simply has no direction against the Japanese yen, as we are currently trading around the 50 day EMA and the 200 day EMA the candlestick is relatively neutral, showing signs of exhaustion. At this point in time, it’s obvious that the ¥109 level is going to offer a bit of resistance, but if we can break above the ¥109.50 level, this market could very well go to the ¥111 level above.

Alternately, if the market was to break down below the choppy candlestick for the Wednesday session, then the market could go to the ¥107 level after that. That is an area that should be rather supportive, but if we were to break down below there it would lead into a lot of negativity that reaches down to the ¥105 level. I would not anticipate easy trading in this currency pair, and much like the EUR/USD pair, I essentially think that this market is going to be too difficult to put a lot of money into it. That being said though, much like the EUR/USD pair, I am looking at this as a potential proxy for strength or weakness in the Japanese yen, nothing more. That being said, it doesn’t necessarily mean that we can’t trade this market, but you need to think more of the big picture if you do in fact try to do that.

At this point, the market is trying to settle itself back down, and once it does, we could see a little bit more in the way of clarity. That being the case, the market is one that you will need to be extraordinarily cautious with, especially considering that the risk appetite of markets seems to be all over the place with the virus. As of late, the market has been difficult to deal with, and I think it’s reflected perfectly in this chart. In the short term, I’m essentially settling on the sidelines in trying to figure out what we are going to do against the Japanese yen, perhaps in other pair such as the AUD/JPY pair, EUR/JPY pair, or even the GBP/JPY pair. As far as this one is concerned, I think you’re wasting your time to get overly aggressive and it because the currencies are both considered to be “safety currency” and as a result there is a lot of noise.