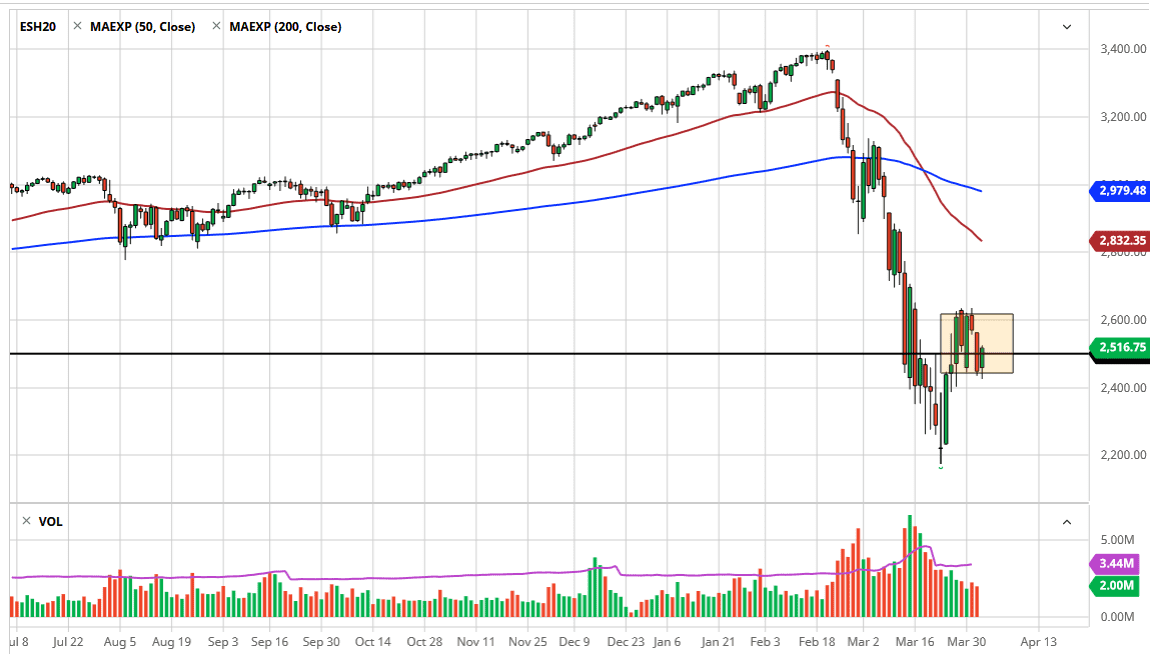

The S&P 500 had a wild session during the day on Thursday, as it initially looked like we were going to fall apart after the initial jobless claims in the United States were over 6 million. However, Wall Street shrugged it off almost immediately and started going higher at that point. However, we are still very much within the consolidation area that we had been in previously, so it’s a bit difficult to read too much into this other than the market is simply sitting around and waiting for what it’s going to be influenced to do next.

At this point, it’s all about the coronavirus and the economic figures don’t really matter. We already know that things are going to be horrific and although I get a lot of questions like “Why would the markets not sell off drastically with these numbers?” It’s obvious that the markets are simply waiting for direction, and at this point I think that people already know things are going to be horrible. The question is whether or not they can be better? The jobs number surprising to the upside could cause a bit of a bullish move to the upside, but if we get an even more disturbing figure, pay attention to the way that the S&P 500 reacts.

The reason I say this is that the markets will quite often stop reacting before a trend change. In the past, massive selloff said that then were followed by a bad announcement that doesn’t break the market down even further suggests that the trend is probably starting to change. I think it’s early to suggest that, but clearly, we could see that situation coming rather soon. Pay attention to the jobs figure, and how we close. I would not be trading this market during the day, but I think there’s probably more of a risk to the upside right now than the down. A break down below the 2400 level would open up the door to the 2200 level next. On the other hand, if we were to break above 2650, that opens up a move towards the 2750 level, 2850 level, and so on. In the short term, it looks like we are still stuck in the same consolidation area that we had been in previously with the 2500 level being a bit of a magnet for price and essentially “fair value.”