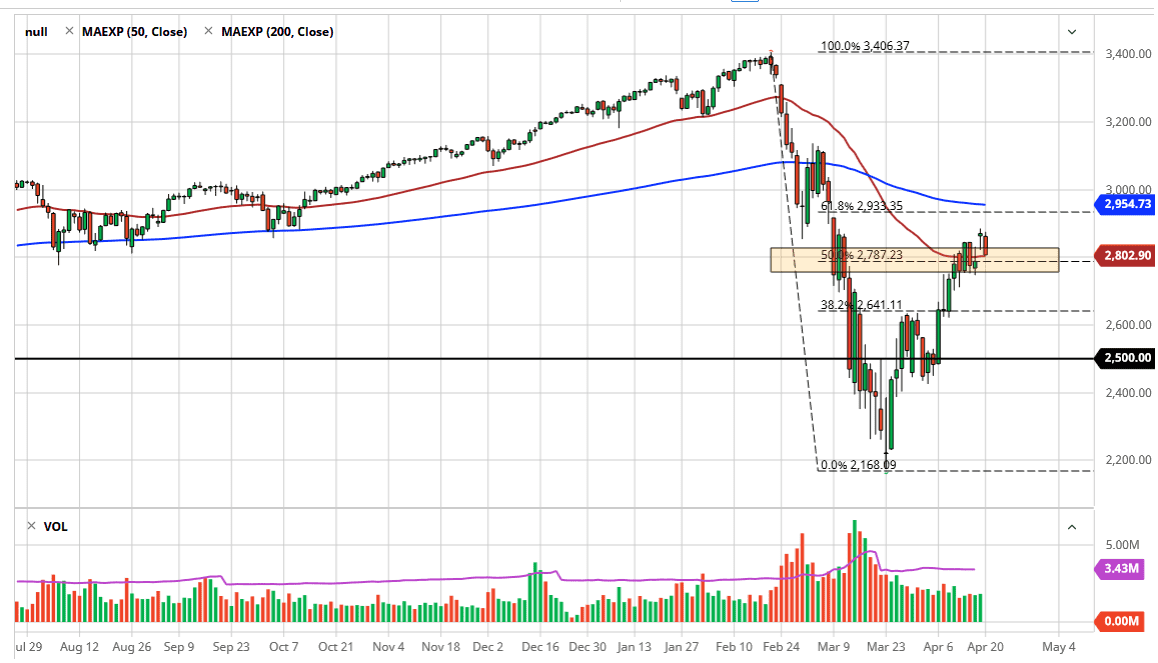

The S&P 500 has ended up forming a rather negative candlestick for the trading session on Monday as the week opened up rather soft. Once interesting is that we have yet to fill the gap that happened on Friday, so that’s the question here: “Will we fill the gap and bounce, or something more ominous?” The main reason I asked this is that typically gap gets filled and they do offer support in situations like this, but in this scenario, things are quite a bit different. For example, we are dealing with the idea of the economy being shut off. If stock markets actually reflected economic reality, it’s very likely the S&P 500 would have never bounced. Nonetheless, I eventually the truth comes in and has its part to play.

The gap higher on the Friday session has now been deemed a “hanging man”, which of course is a very negative candlestick. Now that we have broken below that, the question will be whether or not the gap holds. If it does not, and for that matter if we break down below the 2750 level, it’s likely that we will see a significant break down towards the 2640 handle. When you look at this chart, you can see that there is a massive gap above, so it’s not as if we can’t grind higher and then turned around, just that the action over the last couple of days has been rather noisy.

What’s most bearish about the candlestick is the fact that it closed towards the lows of the session, sitting right at the 50 day EMA. That of course is a very negative looking candle and suggests that we should have some type of continuation based upon how low the market was okay with closing. In fact, at the 3 o’clock hour we did not see institutional investors come in to pick up the market, something that of course is not a very good look. That being said, we do need to keep in mind that there is always the alternate scenario which is to rally. The 200 day EMA will make a nice target for those who are bullish, but at that point I think we see even more resistance based upon the gap and the 200 day EMA. In other words, I think the upward momentum is probably somewhat limited in the time being, and I think it’s only a matter of time before we rollover.