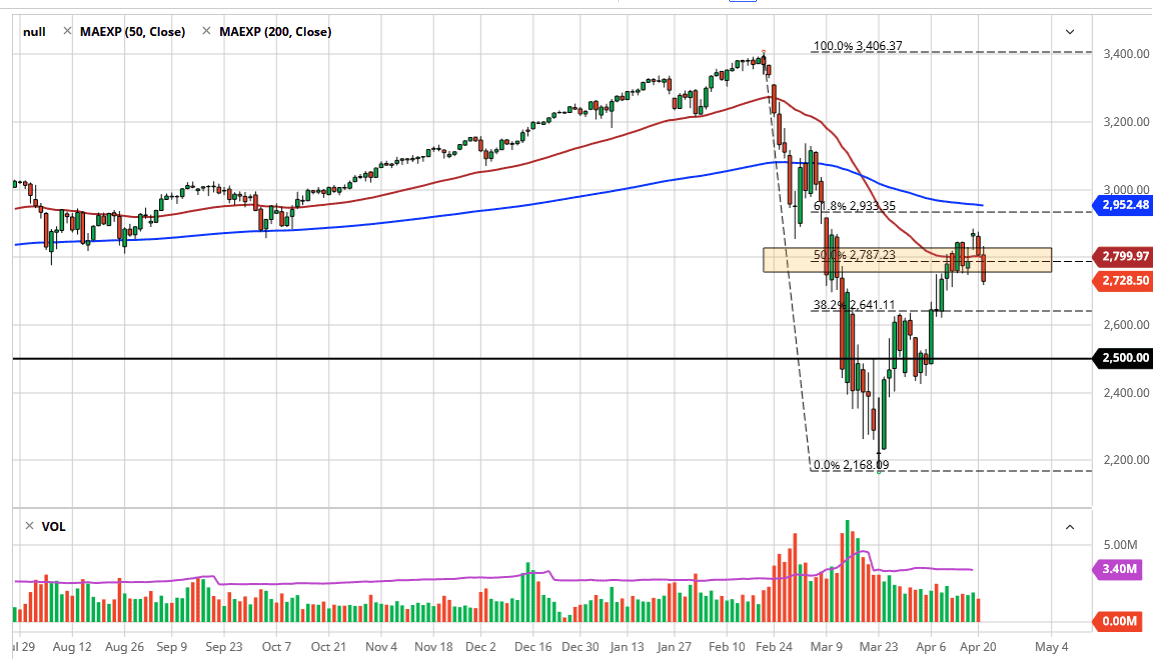

The S&P 500 has had a rough session on Tuesday, as the 50 day EMA continues to offer significant resistance right at the psychologically important 2800 handle. The fact that we pulled back so stringently from this level only as an exclamation point to the 50% Fibonacci retracement level as well. Looking at this chart, I believe that we are ready to pull back a bit and it is difficult to get overly excited about buying. I think that the next support level is likely where we are going, and that means a move to the 2640 handle.

We are in the midst of earnings season and that probably will not do much in the way of favors when it comes to the S&P 500. The global economy is falling apart and of course the S&P 500 is going to continue to see negativity based upon that. Quite frankly, it looks as if the market has gotten far ahead of itself with this little rally, which pulled back 50% of the massive selloff. In other words, this is a garden-variety retracement and it could lead to more selling. The 2500 level underneath would be an area that I suspect a lot of traders would be paying close attention to, and that could be the beginning of a serious bite by the bullish traders out there.

The candlestick of course is extremely negative looking, and the fact that we did try to rally initially during the trading session and then broke down suggests that we are going to see more selling pressure sooner rather than later. I think short-term rallies are probably a nice opportunity to get short of a market that clearly had gotten so far ahead of itself that it is now overvalued. In fact, the PE ratio is roughly the same as it was when we are at the top due to the earnings being brought down so drastically. In other words, it still as expensive as it was back in February, something that the price chart does not suggest quite so easily. The gap at the 61.8% Fibonacci retracement level also features the 200 day EMA, which is an area that could be a target if for some reason we start rallying, but a break above that would take something extraordinarily special. Look for exhaustion, and then take advantage of it as it is the best way to trade stock markets at this point, not just here but worldwide.