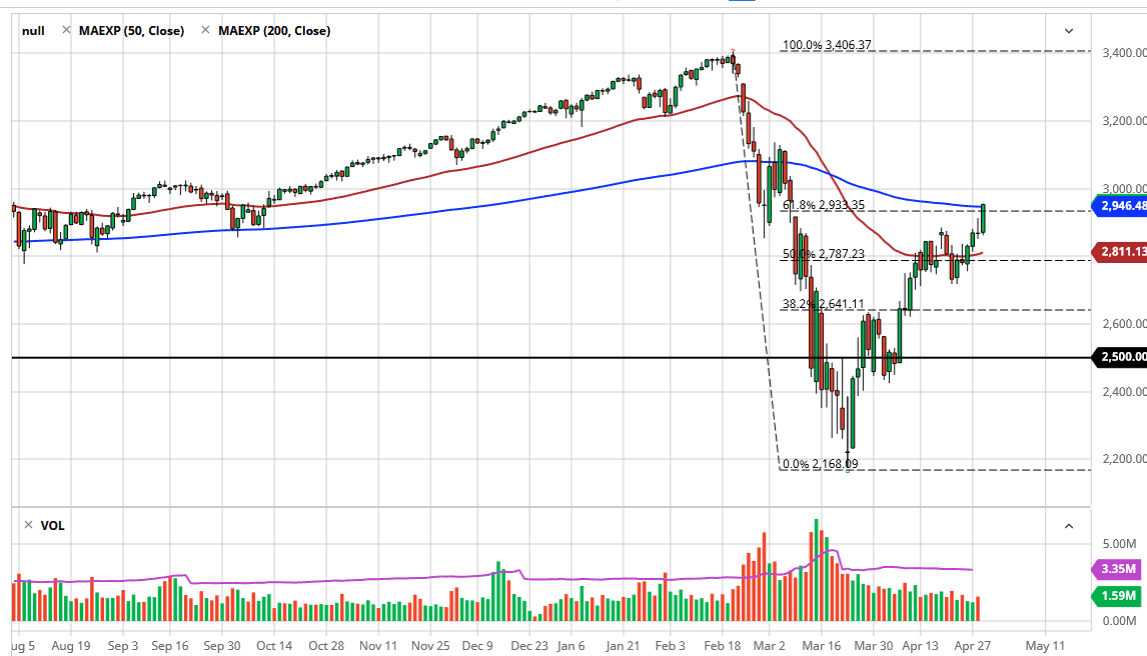

The S&P 500 closed right at the 200 day EMA and the top of the gap that I have been talking about for some time. By doing so it looks as if the 61.8% Fibonacci retracement level is also coming into play and therefore it is likely that we will see a lot of selling pressure just above. That being said though, the thing that you have to pay attention to is that we close that the top of the range. In afterhours trading, it looks as if futures traders are continuing to push this market higher, and therefore it cannot be fought anymore. Quite frankly, if this market breaks above the 3000 level I do not see much standing in the way.

I have not been trading indices because quite frankly they have become completely detached from reality, and unfortunately, I have led the logic of economies come into play. The markets have chosen to ignore massive unemployment and losses around the world and focus solely on one thing and one thing only: central banks and whether or not they are throwing money at the markets. As they are, I think it has left any doubt that the central banks support the markets far in the rearview mirror, a question that we were asking back in 2008. Now that we have this scenario going forward and the fact that the market simply ignore economic announcements at this point, you cannot fight it.

This does not mean you simply jump in and start buying at any point. You need to find some type of pullback that offers “proceed value” in a market that is moving based upon a handful of stocks. Forget what other people have told you, what happens with the economy has nothing to do with what happens on this chart. The massive meltdown that happened a few months ago had more to do with lack of liquidity in credit markets than anything else. Now that the Federal Reserve is willing to buy just about any credit it can, there is no reason to think that this is going to be an issue. Because of this, this has become a “long only” type of market. You are either buying this index, or you are sitting on the sidelines and waiting for value. Quite often bear markets have these bounces they get sold into and crushed, but I do not see any signs of that happening at this point as the buying to sell ratio in New York was tender one.