The S&P 500 has had a bad trading session during the day on Wednesday, as we continue to see a lot of concerns out there when it comes to the global growth situation, which is only going to slow down from here. After all, there are a lot of concerns when it comes to the idea of the coronavirus slowing everything down, so I do believe that it’s only a matter of time before the markets fall even further because quite frankly there’s no real end in sight when it comes to the lockdown. I believe at this point a lot of stock traders are starting to come to grips with the idea that the stop in economic momentum is going to last longer than originally anticipated.

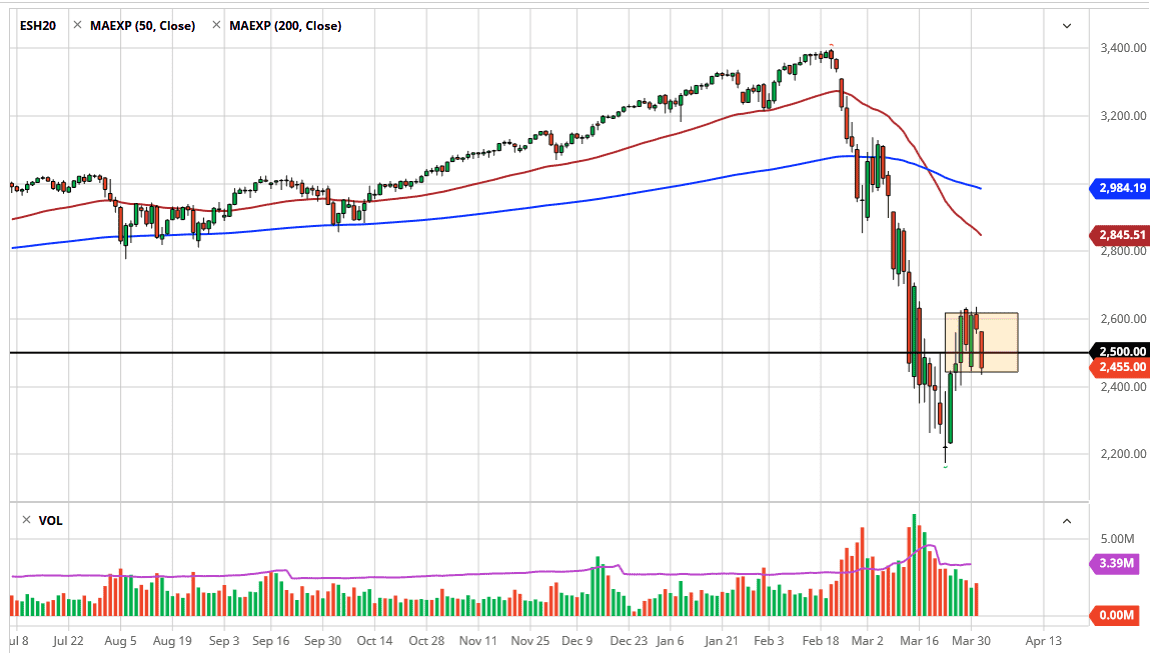

As you can see on the chart, I have a consolidation area marked out and I think that we probably would fade any rallies towards the top of it. Furthermore, we have the jobs number coming out on Friday which most people think will be horrific. I believe between now and then it’s very unlikely that we get a major move, and therefore I think that you are probably looking at a market that is likely to be without any real direction. That being said, this is the futures chart and I believe that we will probably see a lot of negativity in Asia and Europe heading into New York.

If we turn around a break above the 2650 level somehow, then the market is likely to go towards the 2750 handle, perhaps even the 2850 level after that. I think in the meantime though, this is a market that is going to be very choppy and erratic and most certainly favor the downside in general. It will be interesting to see how this plays out but given enough time it is very likely to try to go towards the bottom and test to see whether or not it holds. If it does, then we could be on the path to turn things around and finally rallying again. If it does not, that could open up the door to the 2000 level rather quickly as it is the next large, round, psychologically significant figure and an area that is historically important. Because of this, the market is going to be very dangerous and you should keep your position size relatively small as sudden movements and announcements will be a real danger.