After a growing number of countries believe they have either reached the peak of the global Covid-19 pandemic or are very close to it, markets are now digesting news about various measures to reopen economies. Where most politicians and policymakers favor a U-shaped recovery, isolated pockets of caution are emerging. One of the most dominant threats remains a rush to lift restrictions, which can lead to a new wave of infections heading into the summer months. More data suggests a more profound economic recession, and recovery prospects are weaker than financial markets presently price into models. The threat and likelihood of a return of risk-off sentiment support a breakout extension in silver, which lags the momentum in gold.

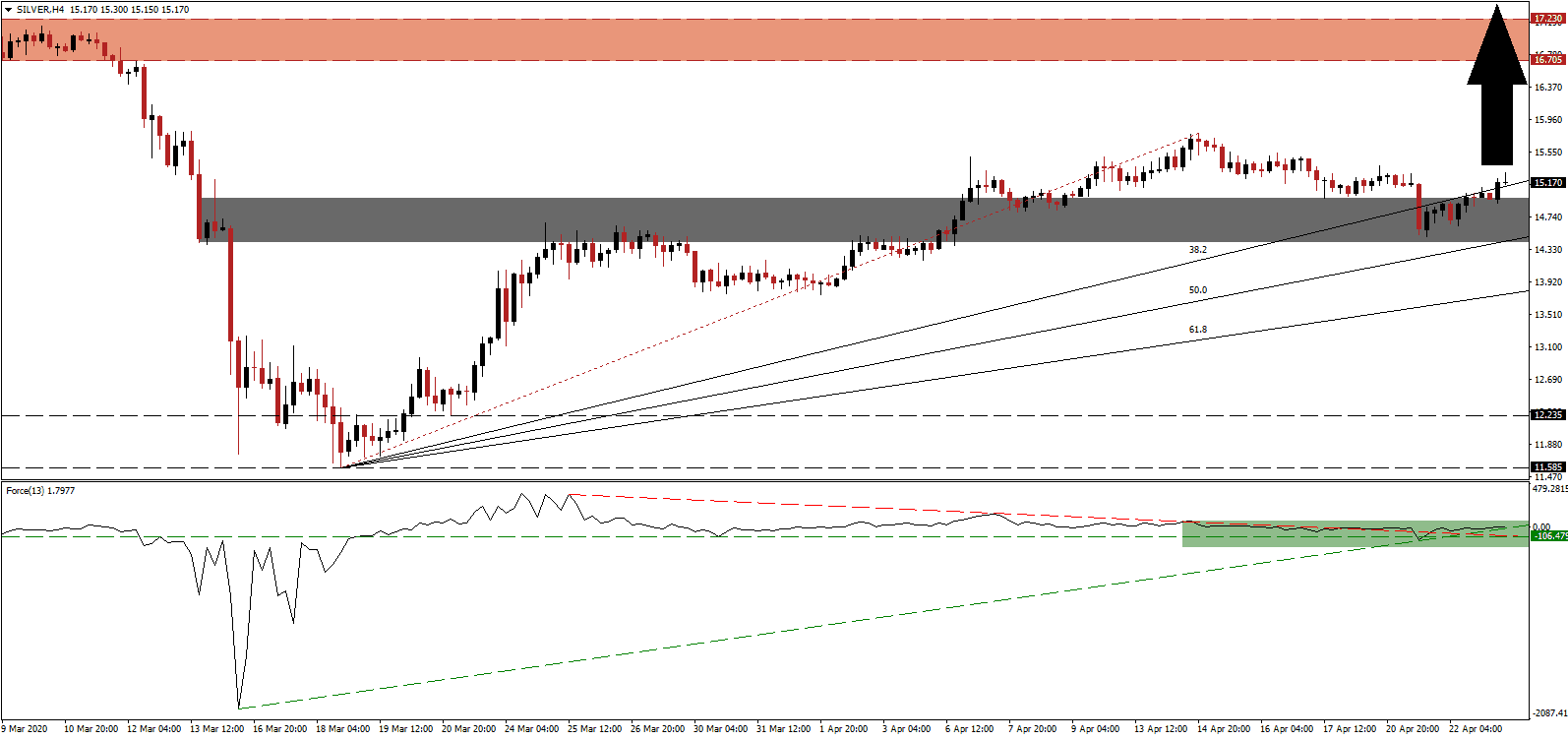

The Force Index, a next-generation technical indicator, points towards moderately bullish momentum. After the bounce off of its ascending support level, the Force Index reclaimed its horizontal support level, as marked by the green rectangle. It also resulted in a breakout above its descending resistance level into positive territory, with the ascending support level favored to guide this technical indicator farther to the upside. Bulls remain in control of silver, and bullish momentum is gradually accumulating.

Price action reversed the initial breakout above its short-term resistance zone, verifying its conversion into a substantial support level. This zone is located between 14.415 and 14.975, as marked by the grey rectangle. The top of the breakout additionally marks the end-point of the redrawn Fibonacci Retracement Fan sequence, which enforces the dominant bullish chart pattern. Forex traders are recommended to monitor the intra-day high of 15.790, the present peak of the breakout sequence. A sustained push higher is anticipated to catapult silver higher.

Preliminary PMI data for April out of France and Germany confirmed a significantly more massive collapse in economic activity. The attention for the remainder of today’s session lies with US initial jobless claims and PMI reports. Regional data indicate the same pattern evident across the Eurozone, positioning this precious metal for more gains. Silver is expected to advance into its resistance zone located between 16.705 and 17.230, as identified by the red rectangle. More upside is possible, supported by ongoing fundamental developments.

Silver Technical Trading Set-Up - Breakout Extension Scenario

Long Entry @ 15.200

Take Profit @ 17.250

Stop Loss @ 14.600

Upside Potential: 2,050 pips

Downside Risk: 600 pips

Risk/Reward Ratio: 3.42

In case the Force Index collapses below its descending resistance level into negative territory, silver is likely to face a short-term sell-off. The downside potential remains limited to its ascending 61.8 Fibonacci Retracement Fan Support Level, due to persistent negative global economic progress. Traders are advised to buy the dips moving forward, with this safe-haven asset ideally positioned to extend its advance to new 2020 highs.

Silver Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 14.250

Take Profit @ 13.850

Stop Loss @ 14.450

Downside Potential: 400 pips

Upside Risk: 200 pips

Risk/Reward Ratio: 2.00