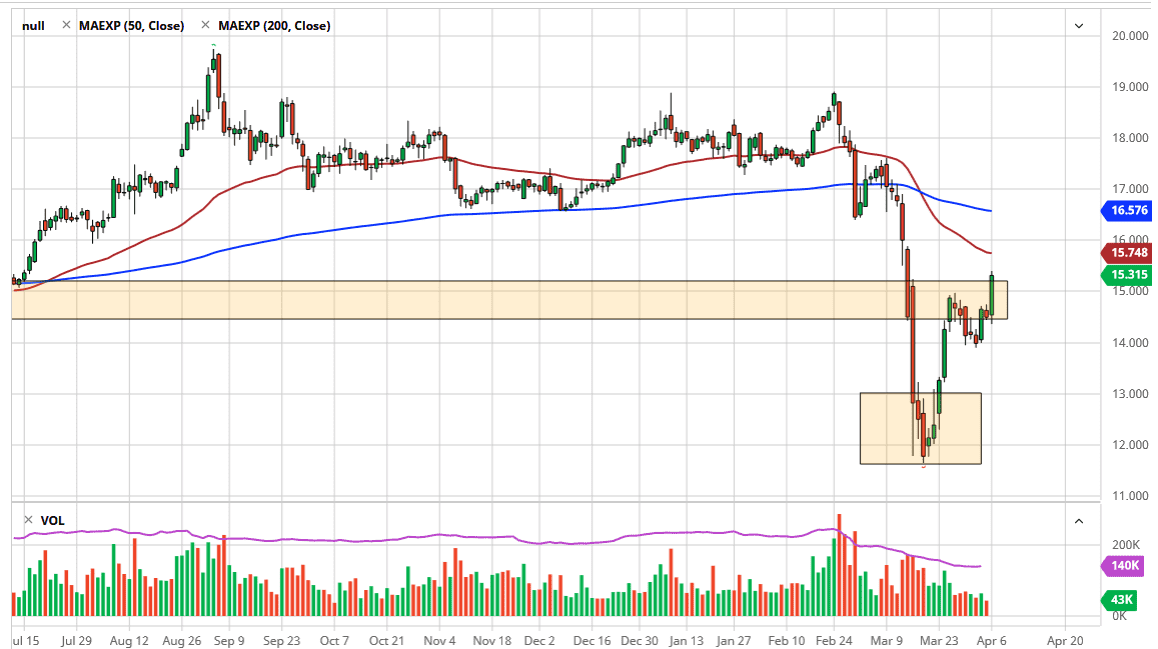

Silver markets have rallied significantly during the trading session on Monday, clearing above the $15.00 level, and perhaps even more importantly the 15 point to zero dollars level. This is a major breakout and signifies that silver is ready to go much higher. This coincides quite nicely with the stock markets which have rallied based upon a slowing of the coronavirus death rate. There is a bullish flag underneath and that’s a very bullish sign as well.

Based upon the bullish flag, it looks as if the market is trying to go towards the $17.50 level. Short-term pullback should continue to find plenty of buyers as the breakout is something that just about everybody in the world will have seen. The $15 level course could offer a significant amount of support, but so should the bullish flag. In other words, the “floor” of the market has been shifted to the outside at the $14 handle. Ultimately, this is a market that should continue to find buyers if there is more of a “risk on” feel, and as long as that’s the case, this is a very good opportunity to get involved in a market that has been beaten down.

That being said, if there is suddenly a runaway from precious metals, you should get out of the silver markets rather rapidly, because they are the first metal that gets sold under most circumstances. There has been the so-called “peers trade” going on, with people buying gold in shorting silver, which works out quite well, but you need to be cautious as to the position sizing if you do in fact choose to go that route. Ultimately, it looks as if we are getting ready to reach towards the 50 day EMA which is closer to the $15.75 level, but when frankly I think that it’s only going to be a minor bump along the road. I like buying short-term pullbacks, but with small bits and pieces instead of trying to get overly levered. For what it’s worth, I have been buying physical silver down here but without any leverage it’s not necessarily a huge gain. The road higher is probably going to be very noisy, but it certainly looks as if the market made up its mind on Monday that it’s ready to continue going to the upside. With that in mind, I am bullish, as gold also broke out during the day.