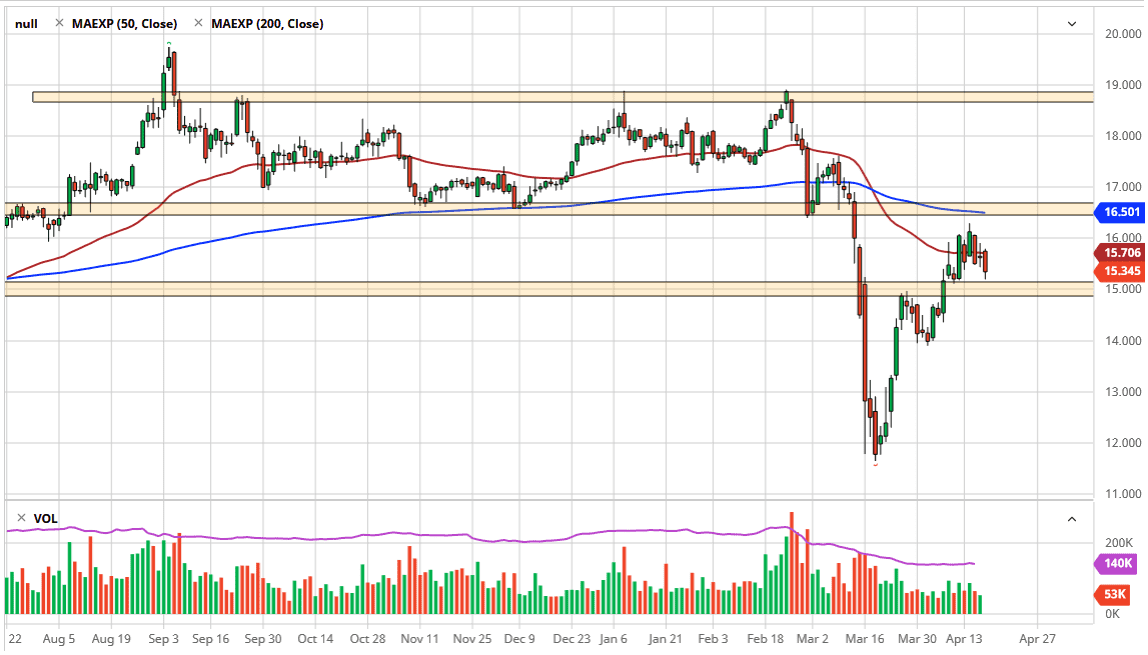

The silver markets fell during the trading session on Friday, reaching towards the $15 level, an area that I think is crucial, as it has previously been resistance, and now should be massive support. Keep in mind that the bullish flag underneath should continue to offer support, and it does suggest that we could go as high as the $17.50 level, but quite frankly it doesn’t look like the silver market is ready to do that right now. The market has had a rough Friday session, although it stayed within the consolidation area that we had been in previously. Because of this, I think there is a little bit of hope for silver to hang on, but for me it’s clear that silver is going to underperform gold.

If we do break down below the $15 level, then I think there is a significant amount of support at both the $14.50 level and then the $14 level underneath. I do think that the market probably bounces a bit, so therefore I’m looking for short-term buying opportunity. All things being equal though, I am long of silver at all times. I buy physical silver all the time and add to my position on dips. That being said, as far as leverage is concerned, I am very cautious because the silver market does tend to be very noisy.

I think that the biggest problem silver is going to have is the fact that there is a serious lack of industrial demand. Yes, it does have the same precious metal component that gold does, but it is much less of the driving force that it is in the gold market, because the industrial use case for gold is much more limited than it is with silver. Commodity markets in general have been hurt, especially when it comes down to industrial type of metals. Gold would be a bit different, but it also has a lot of bullish factors involved in the move, and therefore it makes quite a bit of sense that the divergence between gold and silver continues. In fact, when my favorite trades lately has been to buy gold and sell silver through ETF markets as I am in the United States. If I had the CFD markets available, then I would do it through that vehicle. Trading the spread makes quite a bit of sense here, because we continue to see so much more relative strength in gold longer term.